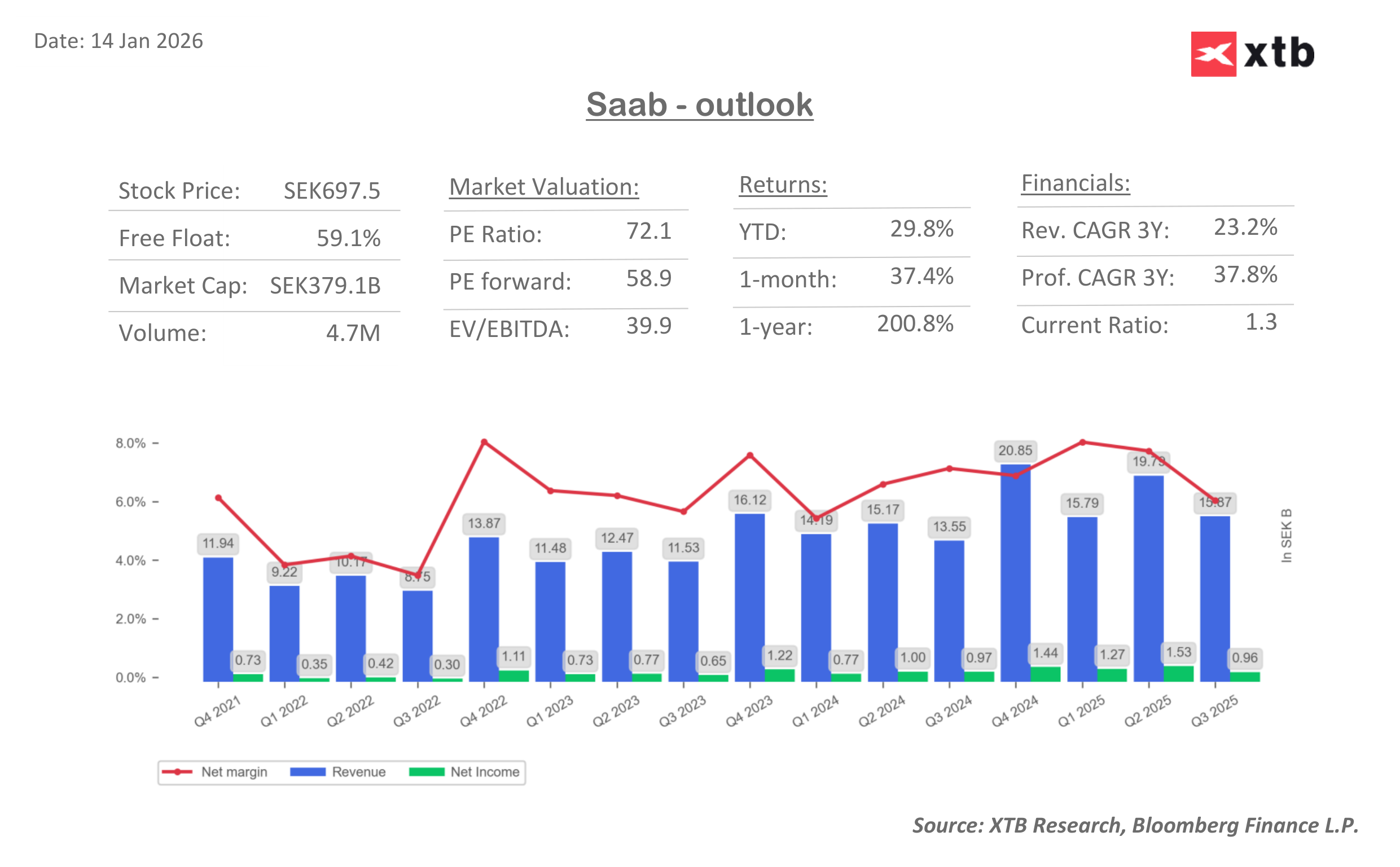

Shares of Swedish defense contractor Saab AB (SAABB.SE) are moving higher and are trading close to an all-time high of around SEK 700 per share. The biggest concern for bulls at this stage is valuation: after a strong re-rating, Saab is increasingly priced more like a high-growth technology name than a traditional defense company.

Saab generates roughly 40% of its revenue in Sweden, and demand for its products could accelerate across the Nordic region as countries prioritize shorter, more secure supply chains and respond to rising strategic risks - both from Russia and from uncertainty around relying on U.S. equipment amid potential conflicts of interest in the Arctic under the current Donald Trump administration.

At the same time, Saab’s aeronautics segment - around one-quarter of the business continues to face margin pressure: the company’s aircraft compete against strong foreign rivals, a broad lineup of fifth-generation fighters, and a likely gradual shift of major defense spending toward drone capabilities.

SAAB shares (D1 timeframe)

Source: xStation5

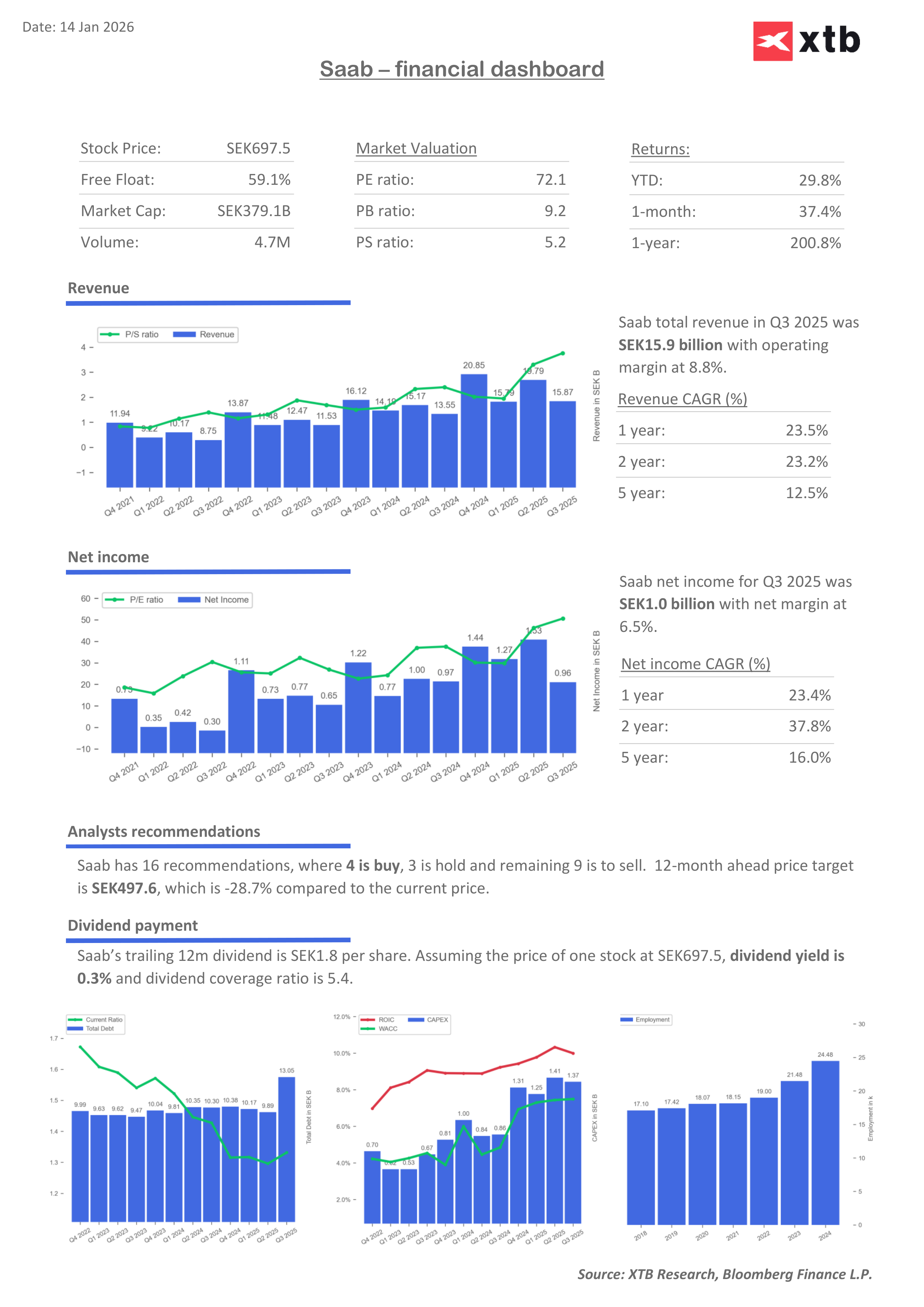

Saab’s valuation has climbed sharply, while net profit—although clearly higher (in Q1 and Q2 2025 it was up roughly 50% y/y, but flattened in Q3)—has not increased in line with the share price. This suggests investors are pricing in future expansion more aggressively, raising the risk that the stock becomes overstretched. The price-to-book ratio is now close to 10, while price-to-sales is above 5. ROIC still exceeds WACC, but costs have also risen alongside a rapid increase in headcount, and leverage has increased as well. The most obvious risk for Saab shares is a potential ceasefire and peace deal in Ukraine, which could reduce long-term growth expectations for the defense sector and cool capital inflows—even if defense investment remains structurally elevated. Importantly, Saab’s net margin has been declining since Q1 2025 and is not meaningfully above its historical average.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

US Open: Indexes Stop on PPI, Banks in the Shadow of Data

MIDDAY WRAP: Mixed sentiment in Europe, declines on U.S. indices

Wells Fargo: Q4 was disappointing, but the forecasts for 2026 spark the imagination 💡🏛️

Will the U.S. Supreme Court decision shake Wall Street? 🗽 These stocks could benefit

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.