-

Revenue Shift Confirmed: Q1 miss was offset by a $10–$11B Q2 revenue guide, signaling a timing deferral and strong sequential growth.

-

Margin Headwinds Persist: Q2 EPS guidance came in low, confirming investor concerns about profitability and margin pressure.

-

FY Outlook Raised: SMCI increased its full-year guidance to $36B, underscoring confidence in long-term AI execution.

-

Revenue Shift Confirmed: Q1 miss was offset by a $10–$11B Q2 revenue guide, signaling a timing deferral and strong sequential growth.

-

Margin Headwinds Persist: Q2 EPS guidance came in low, confirming investor concerns about profitability and margin pressure.

-

FY Outlook Raised: SMCI increased its full-year guidance to $36B, underscoring confidence in long-term AI execution.

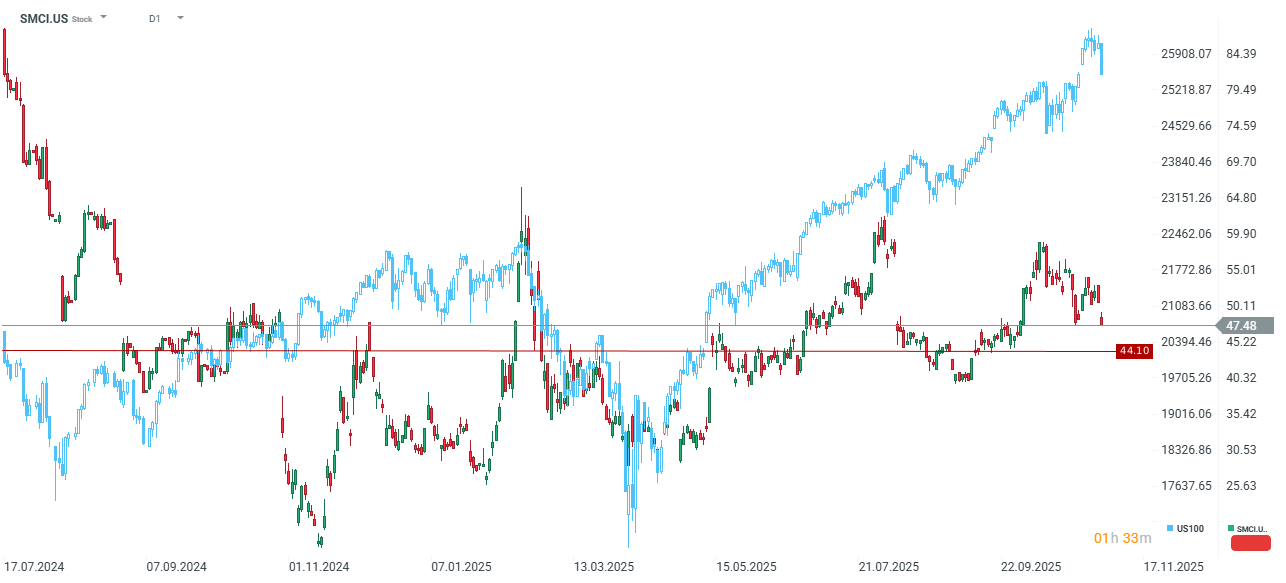

Super Micro Computer (SMCI) reported significantly disappointing results for Q1 FY2026, though forward guidance points to a robust recovery and sequential growth surge.

Key Q1 FY2026 Misses

-

Revenue came in at $5.02 billion, falling short of the $6.09 billion consensus, representing a 17.5% miss.

-

Adjusted Earnings Per Share (EPS) was $0.35, a 14.6% disappointment against the expected $0.41.

-

The Adjusted Gross Margin was 9.5%, narrowly missing the 9.63% expectation.

Forward Guidance Signals Volatility and Margin Pressure

-

Q2 Revenue guidance was set between $10 and $11 billion, significantly exceeding the consensus of $8.05 billion and implying a substantial 24% to 37% sequential increase.

-

However, Q2 EPS guidance of $0.46–$0.54 fell well below the $0.62 consensus, suggesting continued margin compression despite the revenue acceleration.

-

SMCI raised its full-year FY2025 revenue guidance to at least $36 billion, up from the previous at least $33 billion.

Analysis: Timing Shift Over Fundamental Disappointment

-

The company's poor Q1 performance was attributed to a clear revenue deferral into Q2, caused by customers awaiting "design win upgrades" related to new NVIDIA and AMD chip generations.

-

This backlog suggests the Q1 result is primarily a timing issue rather than a fundamental demand deterioration. The Q2 revenue forecast, implying a potential 100% sequential jump, reinforces this view.

-

Crucially, the company's decision to increase its ambitious full-year target to $36 billion underpins management's confidence in execution, even as the lower-than-expected Q2 EPS guidance highlights ongoing concerns about profitability and margins.

-

The 8% drop in after-hours trading reflects typical market asymmetry, where investors prioritize the quarterly miss over the optimistic long-term revenue forecast, while also reacting to the weak profitability outlook.

🚀 AMD Confirms AI Thesis with Strong Results and Confident Guidance

Daily Summary - Global Sell-Off: Stocks and Crypto Down

Arista Networks Q3 Preview — What can we expect?

US OPEN: Downward Pressure on U.S. Markets Amid Government Shutdown

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.