Investors' attention during this week's first market session was primarily focused on the equity market, which reacted directly to updates on liquidity uncertainty in the banking market. The mood from the US equity market spilled over into other directions, including currencies and Emerging Markets, which also recorded massive volatility. Particularly interesting appear to be the cases of currency pairs linked to the Hungarian forint and the Mexican peso, which recorded massive declines due to sharp movements in the EM credit default swap market, which rocketed to levels not seen since November 2022.

Source: Bloomberg

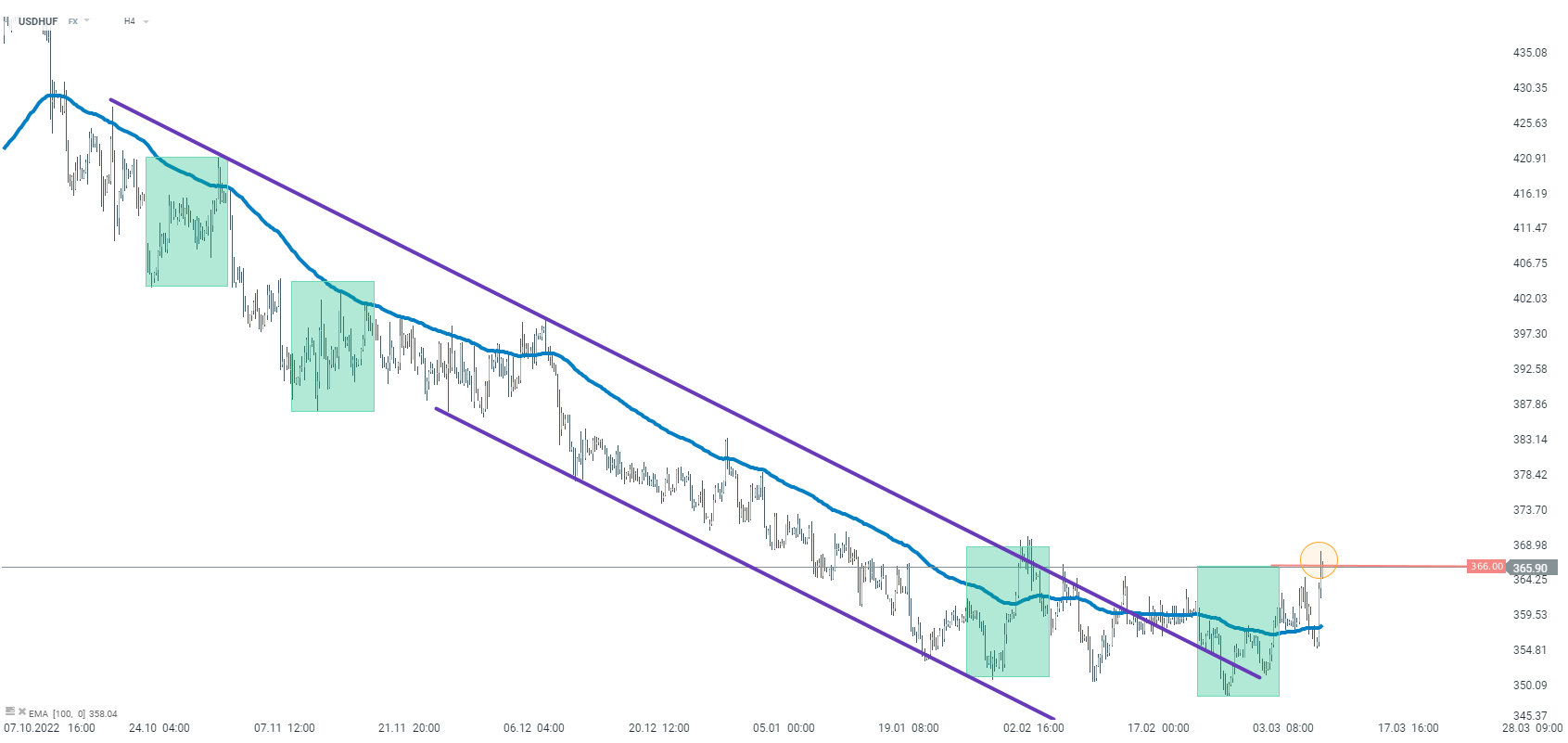

The downward trend on the USDHUF has clearly slowed recently. The price has managed to break out above the downtrend channel and has also crossed and is holding above the EMA100 average. The last obstacle to be overcome remained the upper limit of the 1:1 system at 366.00, which is currently being tested. If it is crossed according to the Overbalance methodology, the long-term trend could change. Source: xStation5

The downward trend on the USDHUF has clearly slowed recently. The price has managed to break out above the downtrend channel and has also crossed and is holding above the EMA100 average. The last obstacle to be overcome remained the upper limit of the 1:1 system at 366.00, which is currently being tested. If it is crossed according to the Overbalance methodology, the long-term trend could change. Source: xStation5

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.