- Stable business model: Recurring subscription revenues provide financial predictability.

- Resilience to market fluctuations: The company maintains profitability and generates cash even in difficult conditions.

- Safe haven for investors: The defensive nature of the business attracts capital during uncertain periods.

- Stable business model: Recurring subscription revenues provide financial predictability.

- Resilience to market fluctuations: The company maintains profitability and generates cash even in difficult conditions.

- Safe haven for investors: The defensive nature of the business attracts capital during uncertain periods.

Comcast: A Safe Haven in a Volatile Media World

When markets panic, investors look for safe havens. Comcast Corp is one such company. The U.S. media and telecommunications giant stands out with stable subscription revenues, solid cable infrastructure, and a growing streaming segment. It is a defensive stock that can attract capital like a magnet during periods of market chaos.

Company Profile – Comcast Corporation

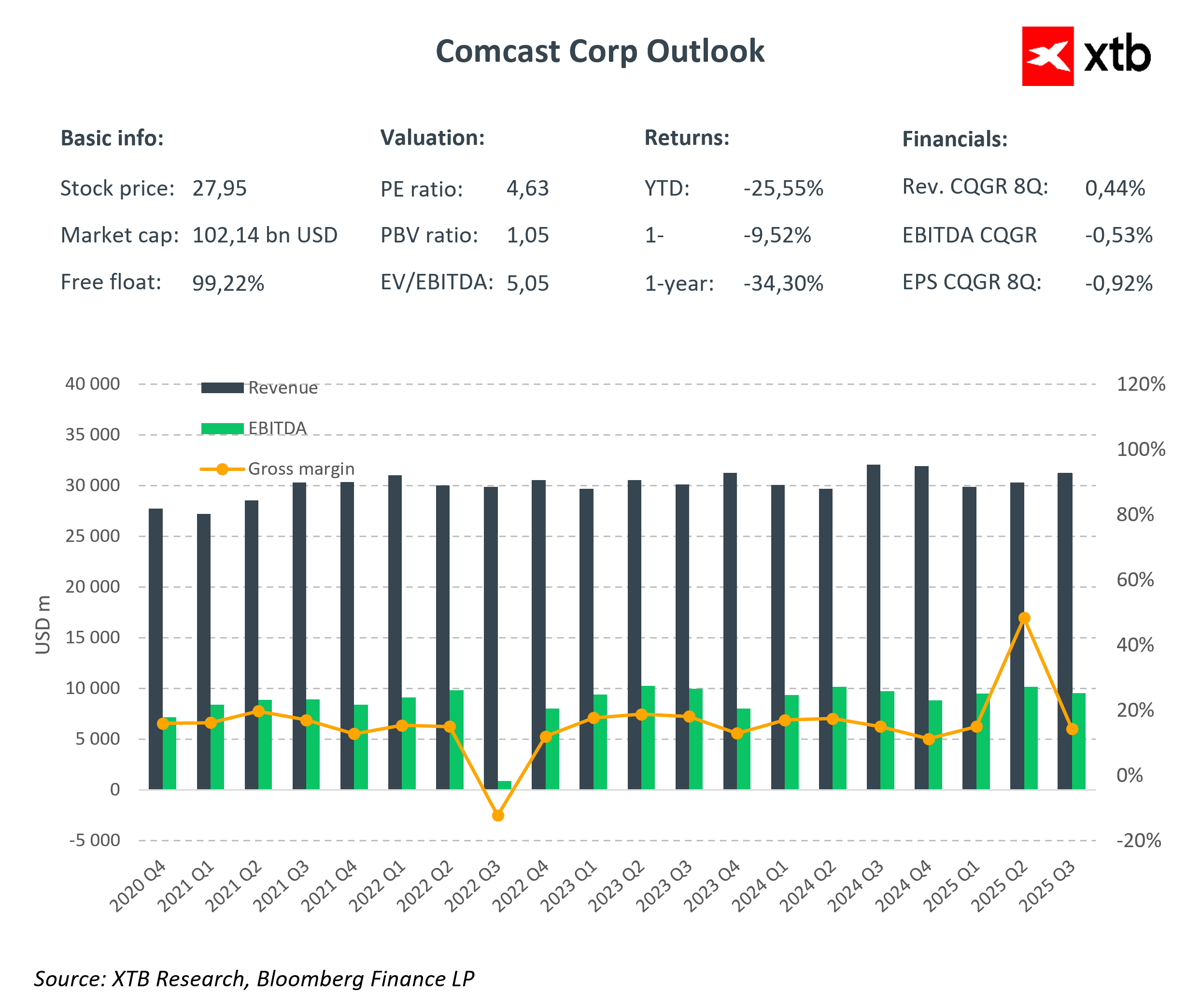

Comcast Corporation is a global leader in the media and telecommunications sector, offering broadband Internet, television services, and media content through its Comcast Cable and NBCUniversal segments. Currently, the company is significantly undervalued relative to its historical valuation and the industry. In times of market panic and rising uncertainty, investors seek companies with stable, defensive fundamentals, and Comcast fits this role perfectly.

Comcast’s Defensive Nature

Comcast’s business model is based on stable, recurring subscription revenues from broadband and television services, which are largely resilient to economic slowdowns. Comcast Cable, generating over 60% of total revenues, ensures a steady inflow from millions of customers. It is a true “safe haven” in volatile market conditions.

The NBCUniversal segment, though more cyclical, provides strong support in media and entertainment, benefiting from growing demand for content and the expansion of streaming platforms such as Peacock. Overall, Comcast maintains a dominant position in the U.S. broadband market. This advantage translates into predictable revenues and business resilience, making the company attractive to investors seeking stability in uncertain times.

Comcast Financial Performance

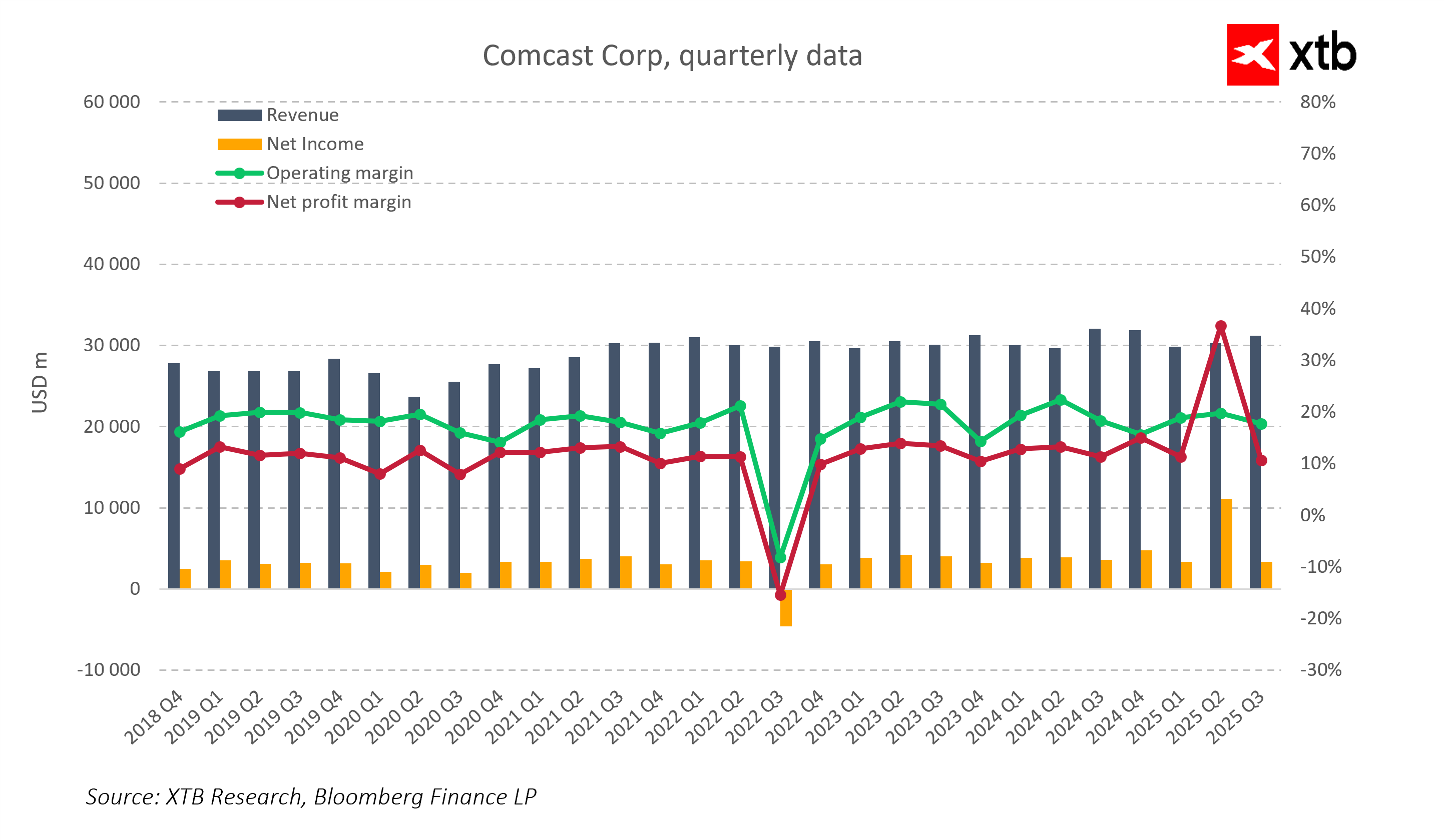

Comcast is a genuine leader in the media and telecommunications sector, consistently demonstrating that its business model is stable, market-resilient, and focused on long-term growth. The company maintains quarterly revenues of approximately $31 billion, immediately highlighting the strength of its business base and the predictability of its cash flows. Even when temporary fluctuations occur due to seasonal effects or exceptional events, such as the 2024 Olympic Games, Comcast quickly returns to a growth trajectory, confirming the resilience of its business model.

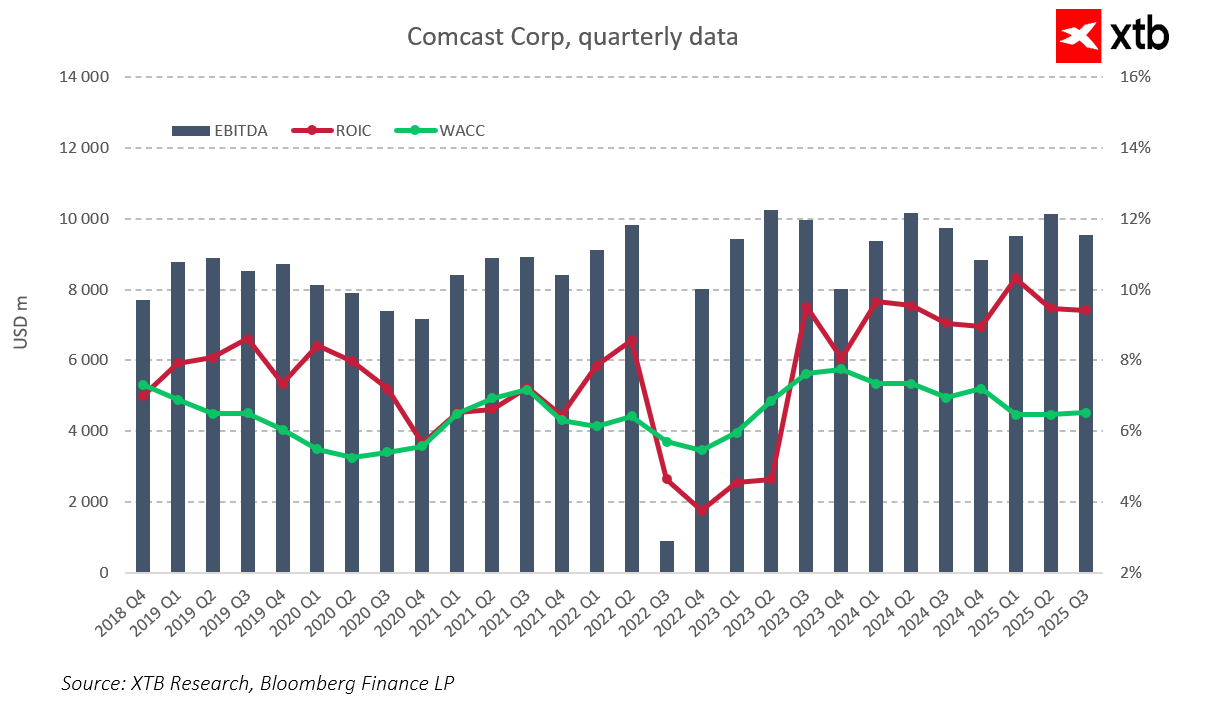

EBITDA remains in the $9–10 billion range, reflecting effective cost management and high operational resilience. A 3.7% decline in EBITDA in Q3 2025 was primarily due to strategic investments in the network, price structure simplification, and new service development. This is not a sign of weakness but a deliberate strengthening of competitive advantage and service quality. Comcast is unafraid to invest in the future, even if it temporarily affects quarterly metrics.

Margins remain solid and stable. High gross margins, along with maintained operating and net margins, demonstrate the company’s ability to preserve profitability even in challenging market conditions. This further proves that Comcast’s business model is designed to create long-term shareholder value.

Net income growth in Q2 2025 confirms the company’s flexibility and resilience. Despite pressure on broadband revenues and minor subscriber losses, Comcast generates real cash and maintains financial stability. Free cash flow increased by 45% year-over-year to $4.9 billion, providing a solid financial buffer and supporting a shareholder return program of $2.8 billion.

An even more telling metric is ROIC, which consistently exceeds the WACC. This shows that Comcast not only generates profits but does so efficiently, creating real value for investors. These results clearly confirm the company’s defensive nature. In times of uncertainty, investors can rely on solid fundamentals, predictable cash flows, and business resilience to market fluctuations.

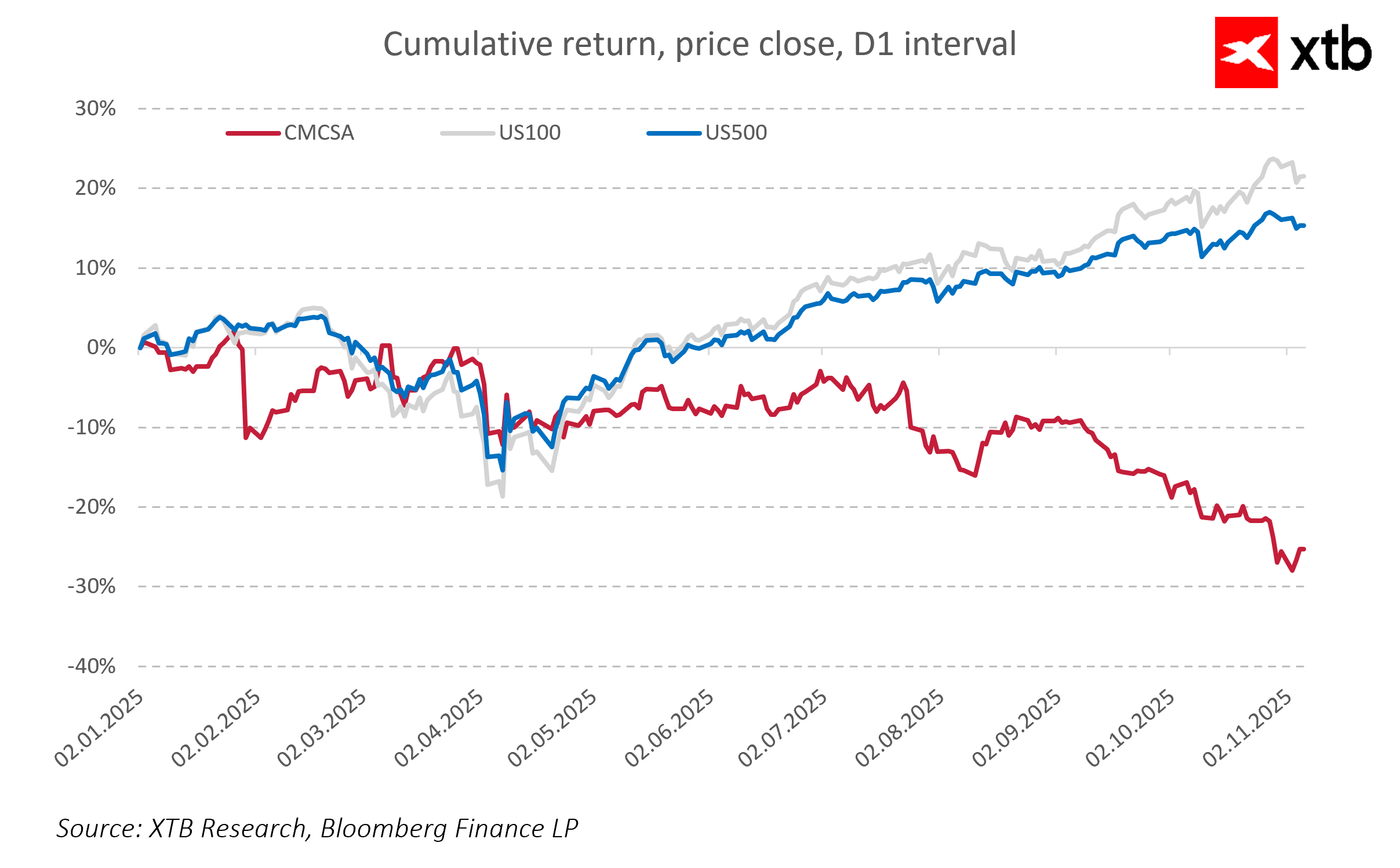

Compared to market valuations, Comcast looks very attractive. Low P/E and EV/EBITDA ratios indicate that, despite strong performance, the market still undervalues the company’s full potential. The stock’s decline this year, approaching a 52-week low, may actually present an investment opportunity, especially for those seeking a defensive, stable, and growth-oriented company.

Additionally, Comcast continues to increase investments in network development and innovative solutions, maintaining a competitive edge in broadband and TV services. The growing significance of wireless services, which added over 400,000 lines in the last quarter, demonstrates the company’s ability to respond dynamically to changing customer preferences.

Comcast combines all the features of a defensive company valued by investors during uncertain times. Revenue stability, operational resilience, cash generation ability, strategic investments in the future, and attractive valuation relative to business quality make it a genuine investment opportunity. During market panics, the company can attract capital, and over the long term, it offers solid growth prospects and security for shareholders.

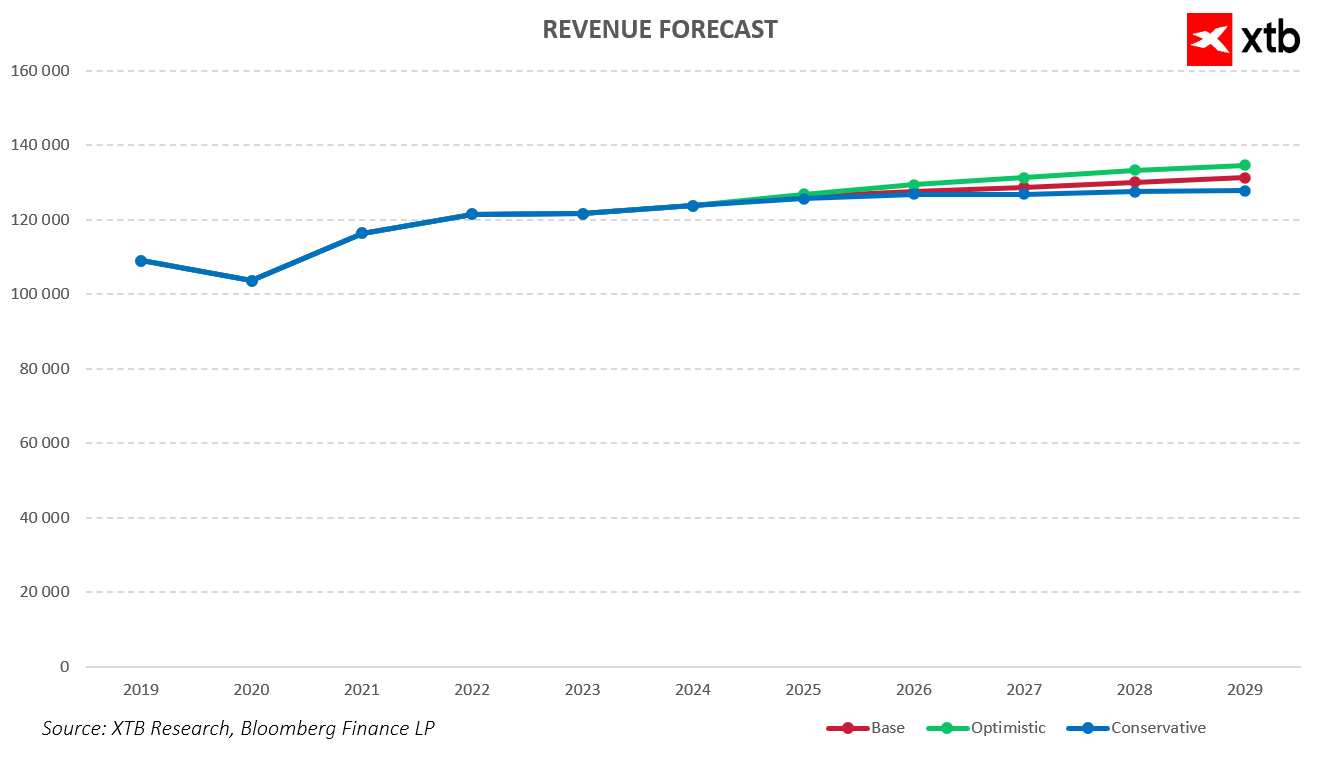

Revenue Forecast

For years, Comcast has proven that its business model is stable and resilient to market fluctuations, and revenue forecasts for the coming years only reinforce this strong position. Even in a volatile environment, the company maintains the ability to generate solid revenues, and scenarios indicate that the future may bring further shareholder value growth. Revenues grow systematically, reflecting predictable cash flows and the company’s ability to adapt to varying market conditions.

-

In the base scenario, Comcast revenues grow moderately, reaching $126.2 billion in 2025 and $131.3 billion in 2029. Such stable growth highlights the strength of the business fundamentals and the ability to maintain predictable inflows, typical of defensive companies.

-

The optimistic scenario assumes faster revenue growth, reaching $126.8 billion in 2025 and $134.6 billion in 2029. This scenario illustrates the company’s potential for accelerated development, especially in wireless services and new media content, which could drive growth beyond analysts’ expectations. In this view, Comcast not only maintains a competitive advantage but also demonstrates its ability to seize market opportunities in dynamic conditions.

-

The conservative scenario presents a more cautious perspective, assuming slower revenue growth from $125.6 billion in 2025 to $127.8 billion in 2029. Even at this slower pace, the company maintains stability and the ability to generate predictable inflows, attracting investors seeking safe, defensive investments.

Regardless of the scenario, revenue forecasts indicate that Comcast remains a stable and predictable company capable of maintaining solid business fundamentals and capitalizing on growth opportunities in various market conditions. This makes the company attractive both to investors seeking security and to those focused on long-term value growth.

Valuation Perspective

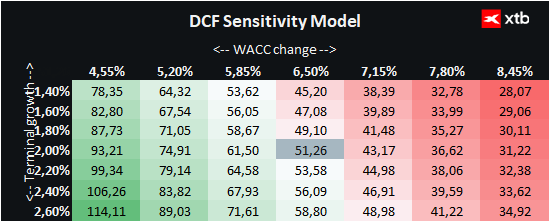

We present a DCF-based valuation of Comcast for informational purposes only; it should not be considered an investment recommendation or precise valuation.

The valuation is based on the base-case revenue and financial performance forecast. A constant WACC of 6.5% was assumed throughout the forecast period. Terminal value was estimated using a conservative 2% growth rate. Other financial parameters were averaged from the last five years to provide a realistic view of the company’s financial situation.

Based on this, Comcast’s fair value per share is approximately $51.26, implying potential upside of 83% compared to the current market price of $27.95. The valuation takes into account various risks, including changing market conditions, increasing competition, and macroeconomic challenges. Comcast’s long-term success will depend on maintaining stable growth, effective cost management, and continued development of its network infrastructure and media service offerings.

Extended decline at the end of a week! 🚨

US OPEN: Market extends decline at the end of the week

CAD Gains on Strong Canadian Labor Market Data 💡

Constellation Energy: Mixed Results for Q3 2025

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.