Super Micro Computer: Will the AI Infrastructure Provider Become the Next Tech Giant – or Is It Just Hype?

In just two years, Super Micro Computer (SMCI) has transformed from a niche server manufacturer into one of the most exciting companies on the U.S. stock market. For many investors, SMCI has become a symbol of a new wave of “AI infrastructure” — companies that don’t build artificial intelligence models themselves but provide the hardware on which those models run.

Unlike well-known giants such as Nvidia or AMD, Super Micro operates more quietly, focusing on designing, assembling, and delivering servers, GPU systems, liquid cooling solutions, and infrastructure for data centers. That hasn’t stopped it from gaining the trust of major clients such as Microsoft, Meta, Oracle, and Tesla. As global companies pour billions into AI data centers, SMCI is becoming one of the first to benefit from this trend.

But does the company’s current valuation truly reflect its long-term potential — or have investors been swept up in a wave of hype similar to the dot-com era? In this article, we’ll take a closer look at SMCI’s operations, financials, valuation, growth scenarios, and the risks that could shape the future of this fast-moving company.

What Does Super Micro Computer Do?

Super Micro Computer (SMCI) is primarily a manufacturer of high-performance servers and computer systems, used mainly in data centers, cloud computing services, and, most recently, in the fast-growing artificial intelligence (AI) sector. The company specializes in delivering end-to-end hardware solutions — from motherboards and liquid cooling systems to advanced GPU-optimized server platforms.

A key differentiator for SMCI is its ability to rapidly tailor products to the specific needs of customers such as hyperscalers (e.g., Microsoft, Meta, Oracle) and companies developing advanced AI models. This has made Super Micro a preferred partner for projects where time-to-market and hardware performance are critical. Notably, SMCI doesn’t just sell off-the-shelf servers — it often engages in the design and integration process to build solutions customized for each client, setting it apart from larger, more generalized IT hardware manufacturers.

Macro Trends Driving Super Micro Computer

The data center and AI infrastructure market is booming, driven by three major trends:

-

Explosion of AI and Large Language Models (LLMs) – The rapid growth of AI applications is driving massive demand for computing power, which in turn is fueling the need for specialized servers equipped with GPU processors.

-

Expansion of Global Data Center Infrastructure – Hyperscalers such as Microsoft, Amazon, Meta, and Google are investing billions of dollars to expand their data centers, particularly in the U.S., Europe, and Asia, to meet increasing computational demands.

-

Technological Advancements in Cooling and Energy Efficiency – As demand for performance grows, so does the need to reduce energy consumption. SMCI stands out by delivering cutting-edge liquid cooling systems that allow for more efficient and eco-friendly server temperature management.

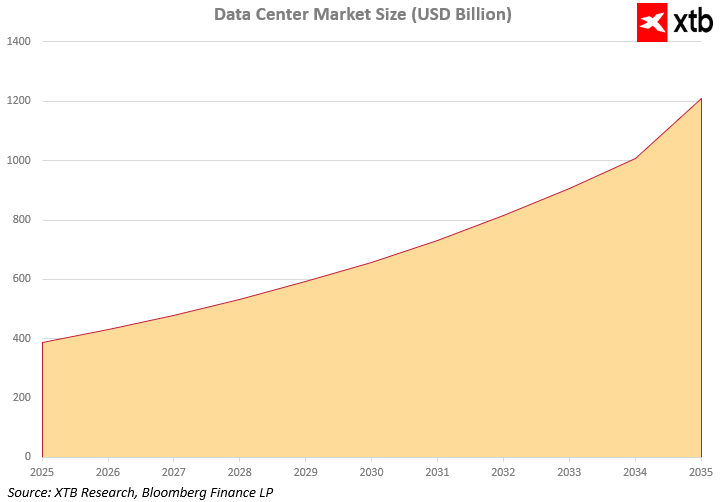

The data center market is growing at an extraordinary pace. Forecasts suggest its value will surge from just under $400 billion in 2025 to over $1.2 trillion by 2035. This presents a massive opportunity for Super Micro Computer. The rising demand for advanced hardware solutions places the company in a strong position to sustain revenue and profit growth. As a result, SMCI is solidifying its role as a key player in one of the fastest-growing global industries.

Financial Analysis

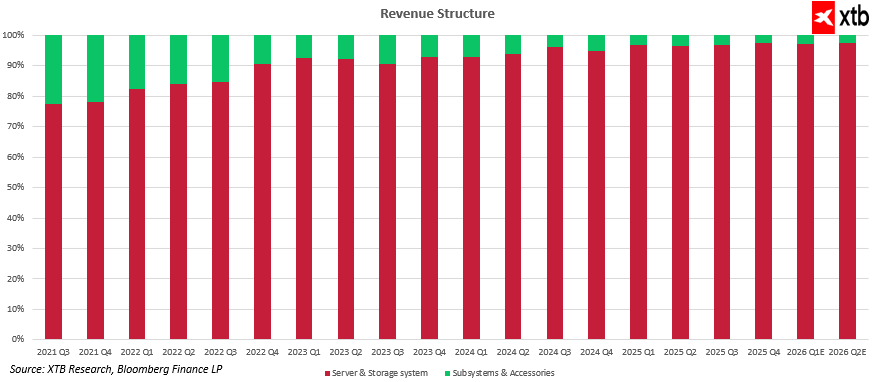

Super Micro Computer’s business model is heavily focused on its Server & Storage Systems segment, which accounts for over 85–90% of total company revenue. This segment involves the production of complete, integrated server systems used primarily in data centers, AI projects, cloud environments, and high-performance computing (HPC) solutions.

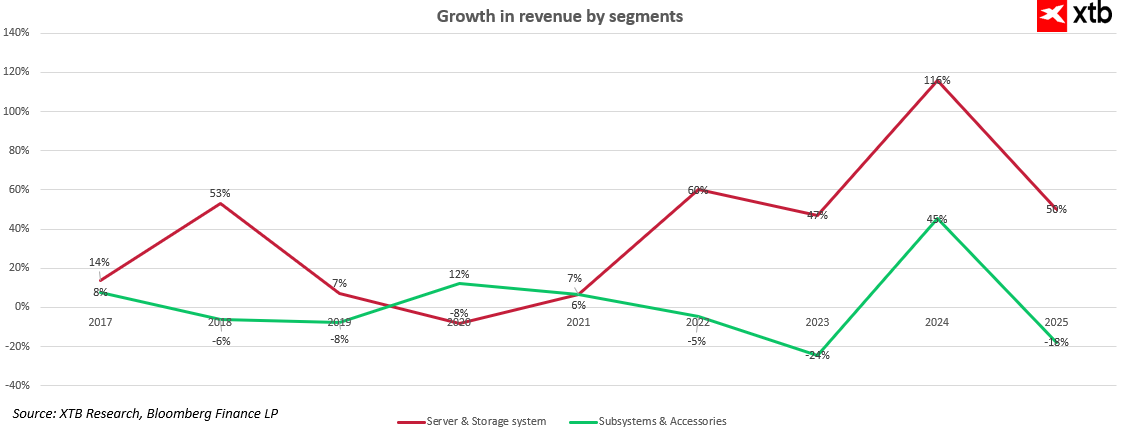

Since 2021, this segment has grown at a blistering pace — from around $693 million in Q3 2021 to a projected $7.4 billion in Q2 2026. That’s more than a tenfold increase in under five years. The growth rate accelerated sharply in the second half of 2023, driven by the AI infrastructure boom and rising demand from global hyperscalers. Annual revenue growth data supports this trend: the Server & Storage Systems segment has consistently seen double-digit increases — +60% in 2022, +47% in 2023, +116% in 2024, and an estimated +50% in 2025.

Meanwhile, the Subsystems & Accessories segment — which includes server components, accessories, and system expansion parts — remains smaller and relatively stable, generating around $150–200 million quarterly. This segment’s revenue share is gradually declining, with uneven growth: +45% in 2024, but -24% in 2023 and -18% in 2025. As such, it plays a complementary role rather than being a key growth driver.

This high concentration of revenue in one rapidly expanding segment offers both significant scalability potential and heightened vulnerability to shifts in that market. However, given the growing demand for AI infrastructure and data centers, the outlook for Server & Storage Systems remains highly favorable.

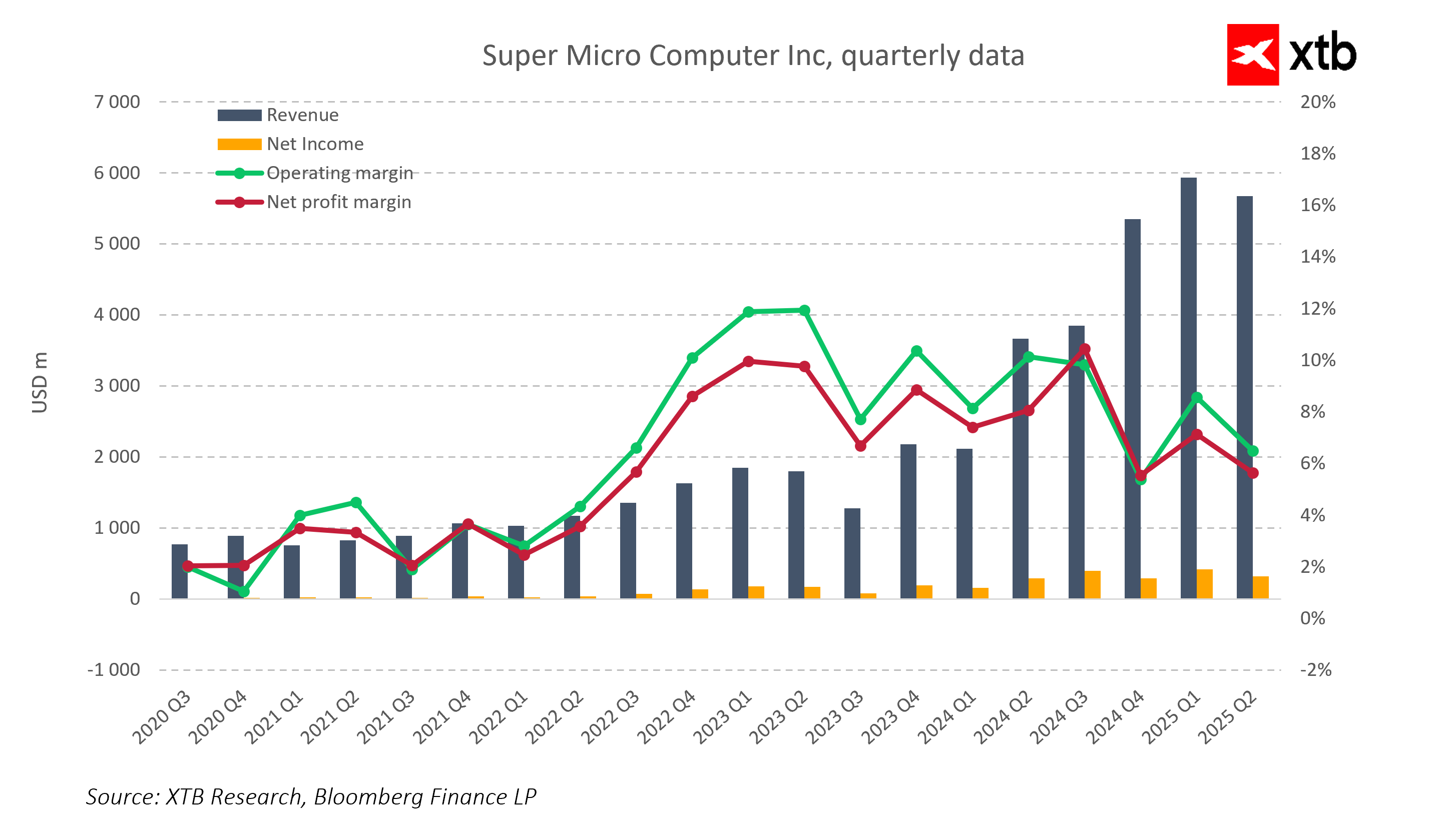

Financial data clearly shows that the company is growing rapidly, particularly evident in its quarterly revenue surge since mid-2023. SMCI’s success aligns with broader macro trends reshaping the global IT and AI infrastructure landscape. The explosion of AI applications, particularly large language models, is fueling intense demand for high-performance data centers and GPU-based servers. Industry giants like Microsoft, Amazon, Meta, and Google are investing billions in expanding computing capacity. Thanks to its flexible production model and ability to customize hardware for client needs, SMCI is emerging as one of the main beneficiaries of this transformation.

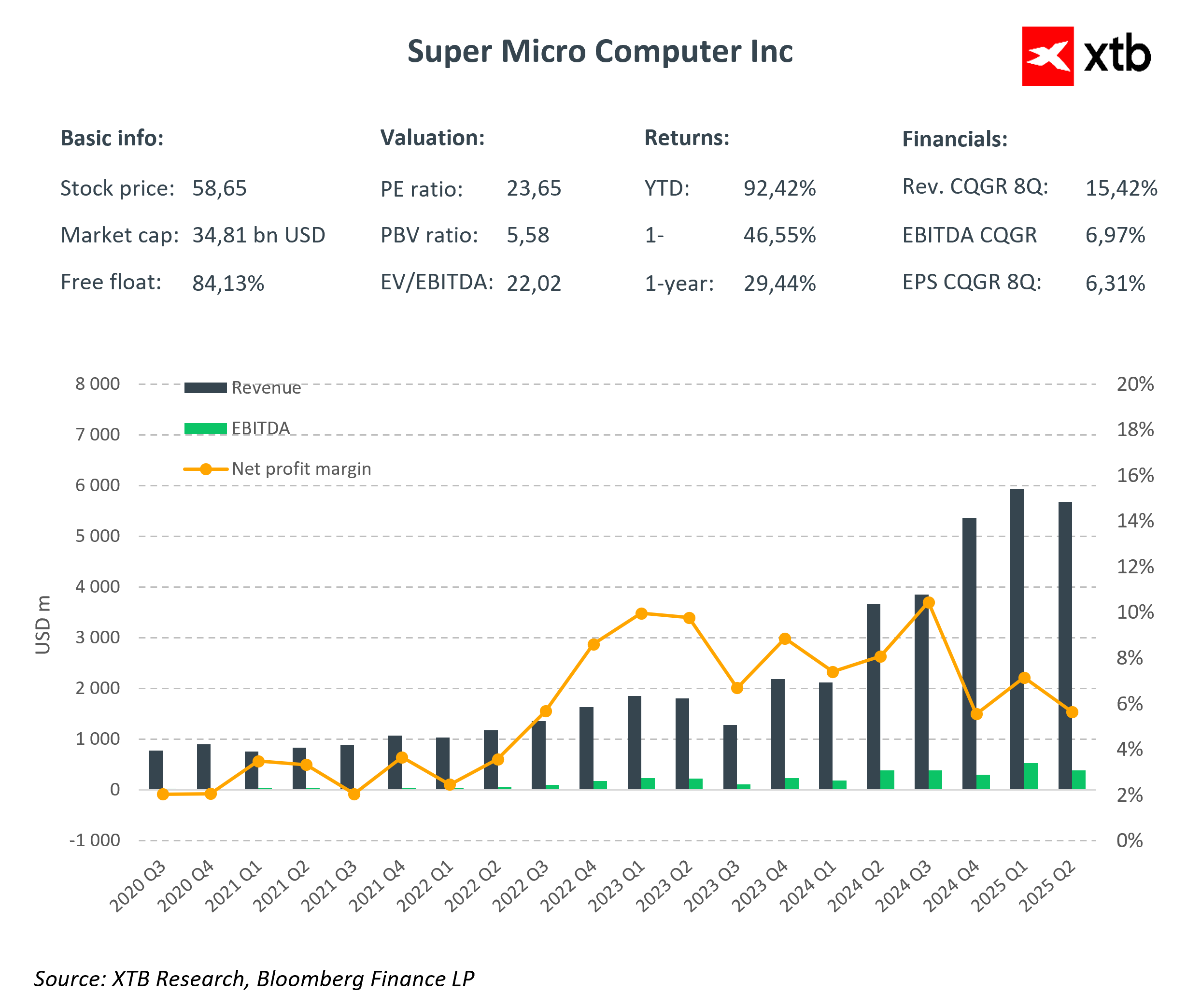

SMCI is not only increasing revenue but also improving profitability and net income — as seen in its quarterly financial results. Since 2023, the company has shown strong sales growth alongside rising operational and financial efficiency. Margins, once volatile, have stabilized in the 6–10% range, showing that the company can grow without losing control over costs.

Both revenue and net income are in a strong upward trend. In some periods, annual revenue growth exceeded 100%. These results are not a fluke — SMCI has steadily built a scalable business model that allows it to respond flexibly to the needs of highly demanding clients. The company is not just riding the AI boom — it’s converting it into a lasting market advantage through innovative technology, high performance, and rapid delivery capabilities.

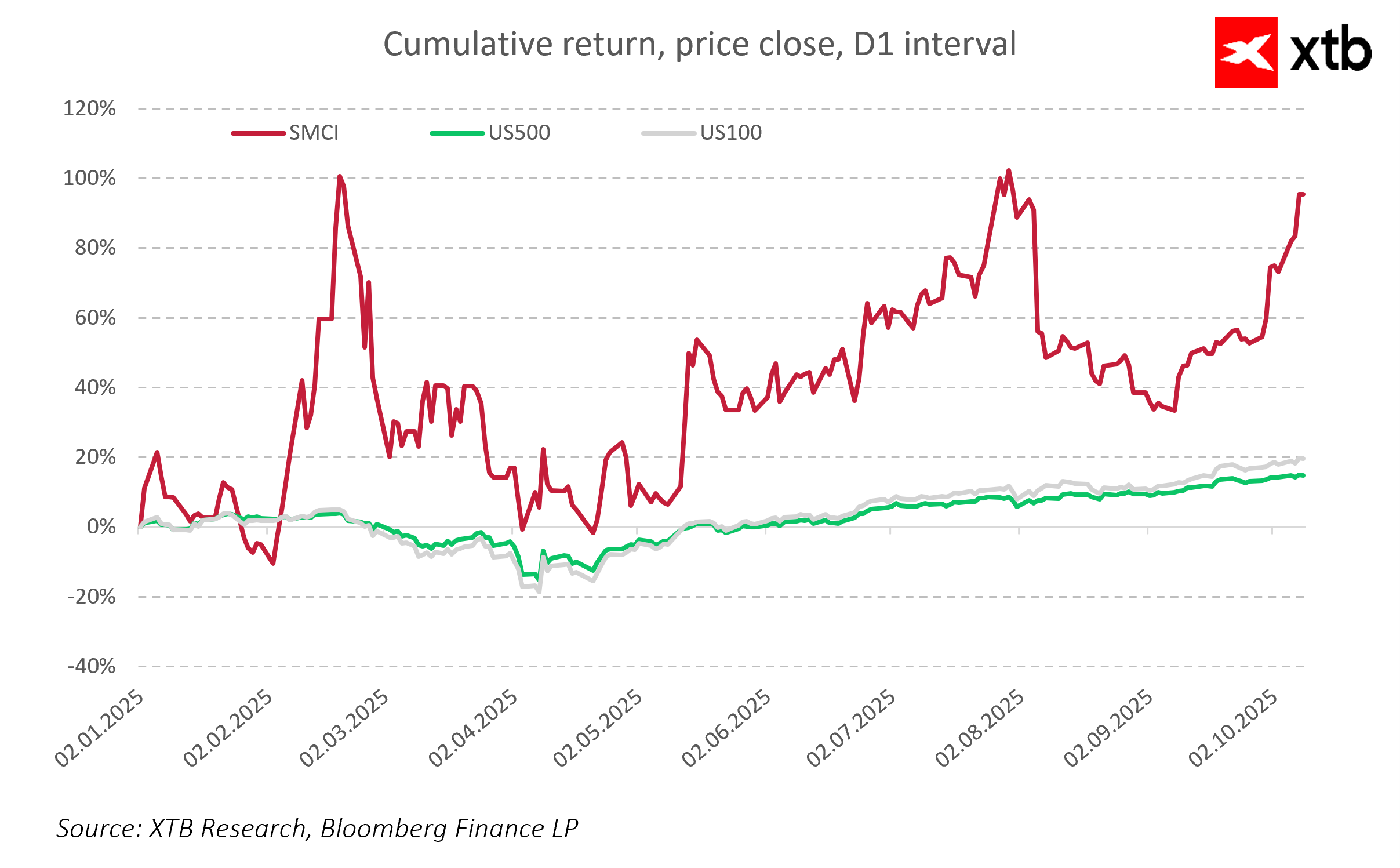

Compared to the broader market, SMCI also stands out in terms of stock performance. A cumulative return chart since the start of 2025 shows SMCI has significantly outperformed the S&P 500 (US500) and Nasdaq 100 (US100). However, its share price shows significantly higher volatility — indicating greater investment risk but also potentially higher returns.

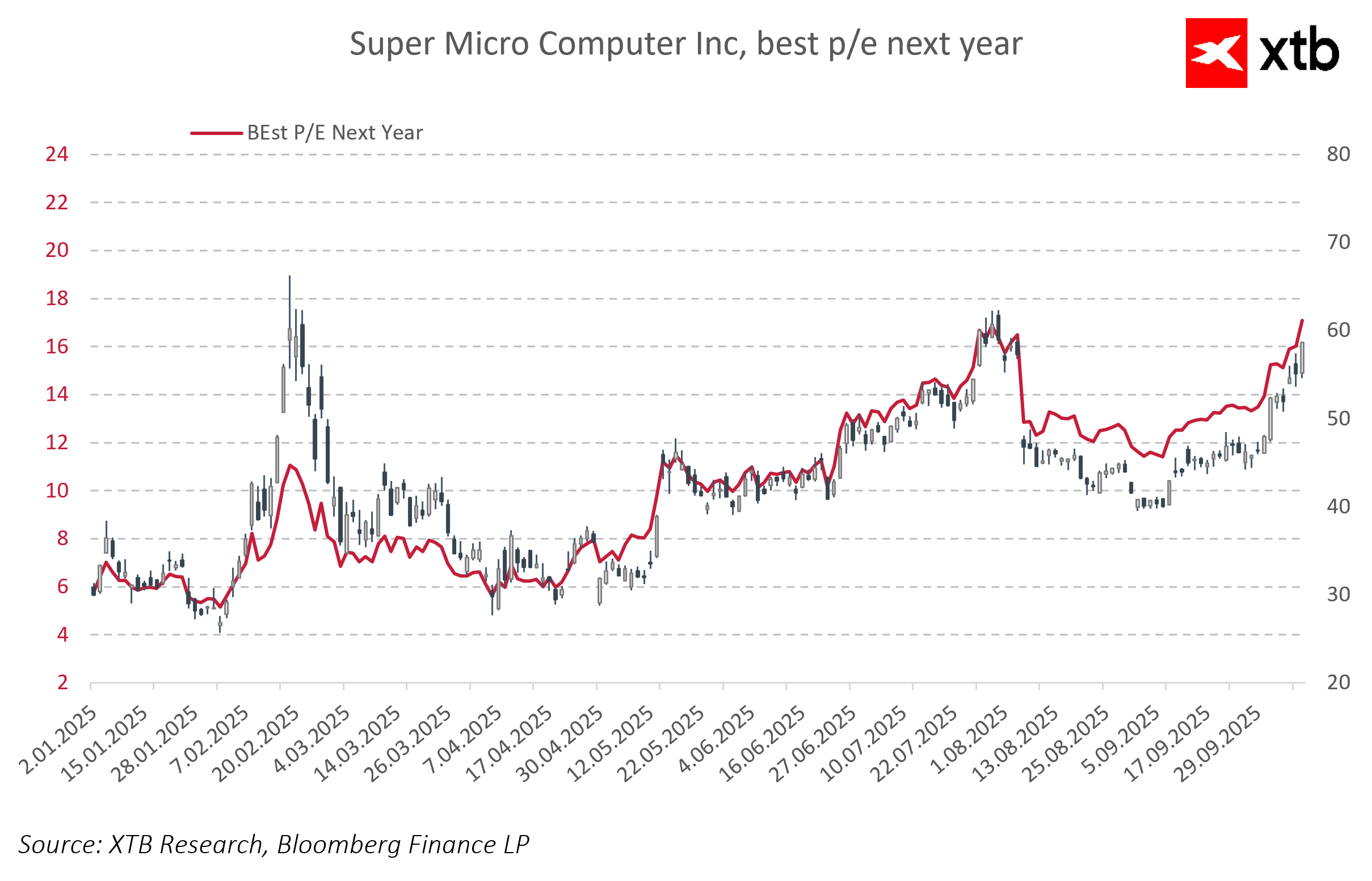

A declining forward P/E ratio is interpreted by the market as a sign of growing expectations for the company’s future results. Investors are assuming rapid profit growth in coming quarters, making the current valuation more attractive relative to future earnings. For many, this also signals that SMCI is no longer seen merely as a hardware supplier, but increasingly as a strategic player in the AI infrastructure and data center ecosystem. A falling forward P/E may reflect rising confidence that the company can not only maintain its current growth trajectory but also develop a durable competitive edge.

Forecast

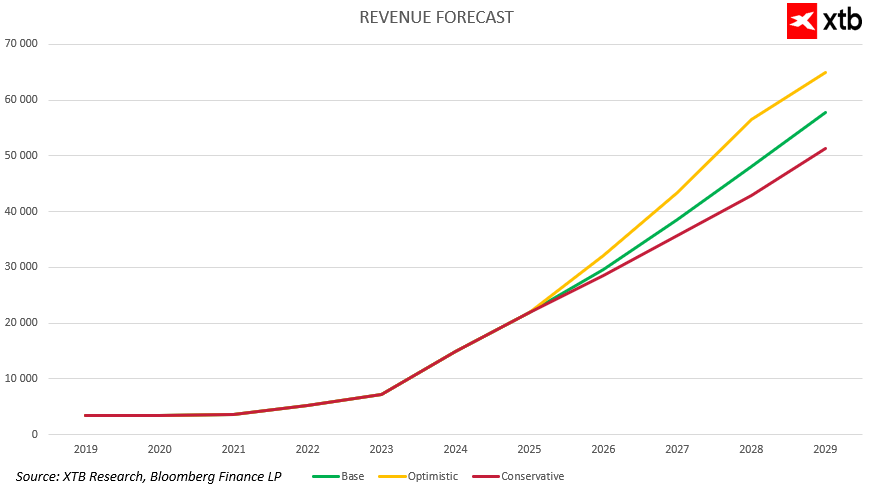

Following record revenue growth in 2023 and 2024, the key question facing the market is: can Super Micro Computer sustain this strong momentum in the coming years? The company operates in a highly promising sector, but the AI and data center boom won’t last forever. Growth will naturally slow over time. The analysis presents three realistic development scenarios: base, optimistic, and conservative, considering both continued AI momentum and potential challenges such as market saturation, margin pressure, and investment cycles.

-

Base scenario assumes very high growth will continue until around 2027, driven by strong demand for AI infrastructure, global hyperscaler investment, and the expansion of large language models. Revenue surpasses $38 billion by 2027, then slows naturally as the market matures and competition increases. Even then, the company continues to scale, reaching nearly $58 billion in revenue by 2029. This is a balanced scenario between continued momentum and market cyclicality.

-

Optimistic scenario sees SMCI not only maintaining but accelerating its growth through continued market and technological expansion. Data center investments remain strong, the company wins new customers, and strengthens its partnerships. Revenue could reach $65 billion by 2029, with stable growth throughout the forecast period.

-

Conservative scenario assumes the biggest growth impulse occurred in 2023–2025. AI investments slow down, competition intensifies, and some clients shift to cheaper or more integrated solutions. Still, SMCI’s revenues continue to grow, albeit more moderately, reaching over $51 billion by 2029. This would still represent a resilient business model even in a tougher environment.

Valuation

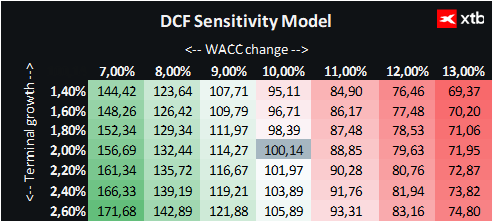

We present a Discounted Cash Flow (DCF) valuation. This is for informational purposes only and does not constitute investment advice or an exact valuation.

The valuation is based on the baseline revenue and earnings forecast scenario. A constant WACC (Weighted Average Cost of Capital) of 10% was used throughout the forecast period. The terminal value was estimated assuming a conservative 2% long-term growth rate. Other financial parameters were averaged based on performance over the past five years.

Based on this, the estimated fair value per share of Super Micro Computer is approximately $100, which is about 71% above the current market price of $58.65. This difference may suggest an attractive investment opportunity, especially for those who believe in the company’s continued rapid growth.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.