- US market opens near the last closing price

- Delta and PepsiCo beat estimates

- China leverages rare earth metals against west

- Powell absent from FOMC conference

- US market opens near the last closing price

- Delta and PepsiCo beat estimates

- China leverages rare earth metals against west

- Powell absent from FOMC conference

Today's opening of the stock markets in the United States is proceeding in moderately cool moods. Investors, after yesterday's euphoria, are approaching trading with greater caution, analyzing both incoming company results and the macroeconomic situation in the face of the ongoing federal administration shutdown. Most indices at the opening remain around yesterday's closing levels. Contracts on US100 are falling by 0.20%.

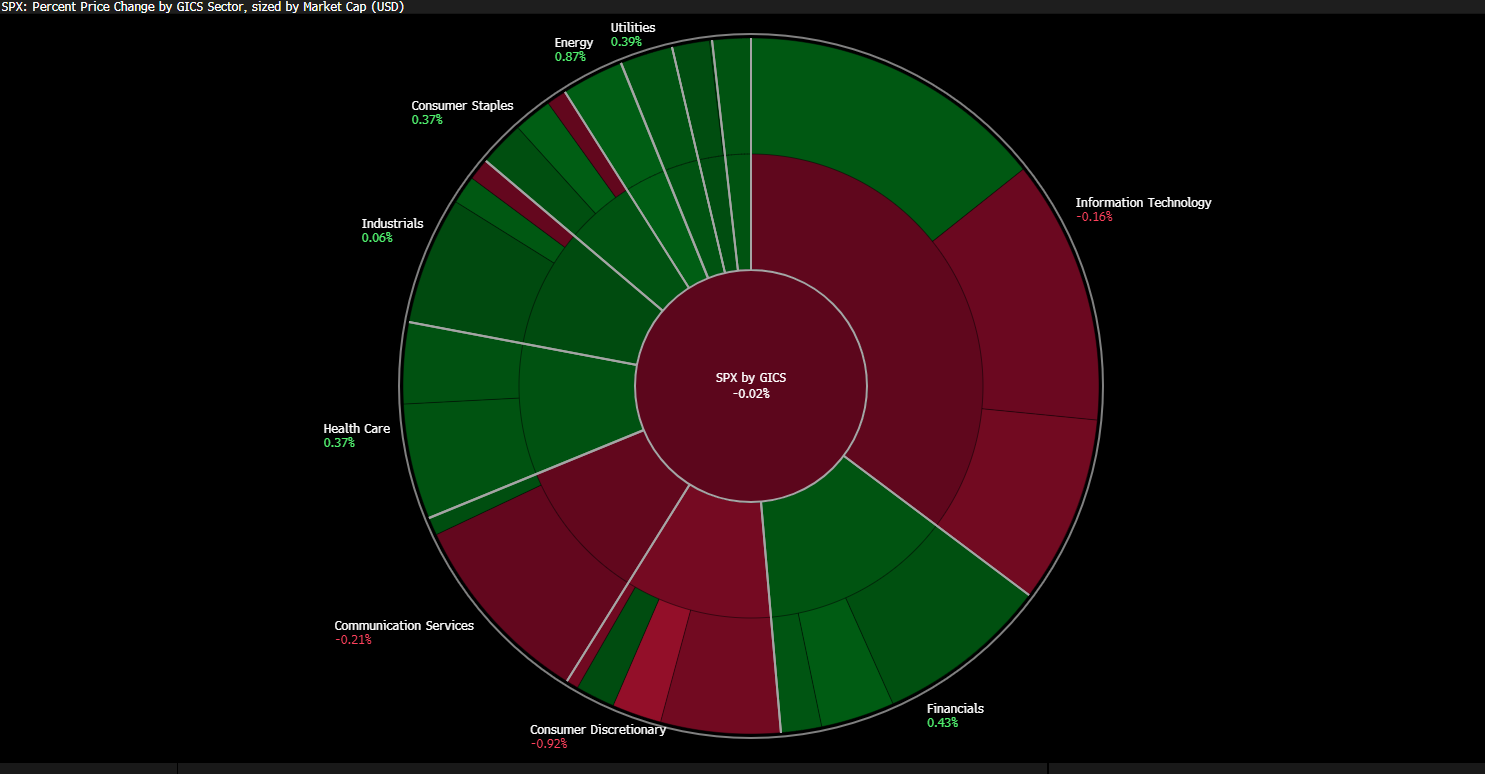

Source: Bloomberg Finance Lp

The mining and financial sectors are performing best today. IT and broadly defined retailers are lagging behind.

Yesterday's session brought further historical highs on the main indices. The publication of the minutes from the last Federal Reserve meeting was interpreted by the market as confirmation of a dovish stance in monetary policy. Market participants interpreted the content of the protocol as a signal that the Fed intends to cut rates by 25 basis points at the next meeting.

The US government shutdown continues, and most key macroeconomic data is not being published. Fed Chairman Jerome Powell could not participate in the planned conference, depriving the market of important clues regarding the future path of monetary policy. The lack of communication from monetary authorities in a situation of limited access to data may increase investor uncertainty.

At the corporate level, quarterly reports from PepsiCo and Delta Air Lines are drawing attention. Both companies published results above expectations, providing valuable information about the condition of American consumers in conditions of limited macroeconomic transparency. Delta's report was particularly well-received after the company's CEO emphasized that the ongoing federal government shutdown does not affect the company's current operations, which supported the carrier's pre-session trading.

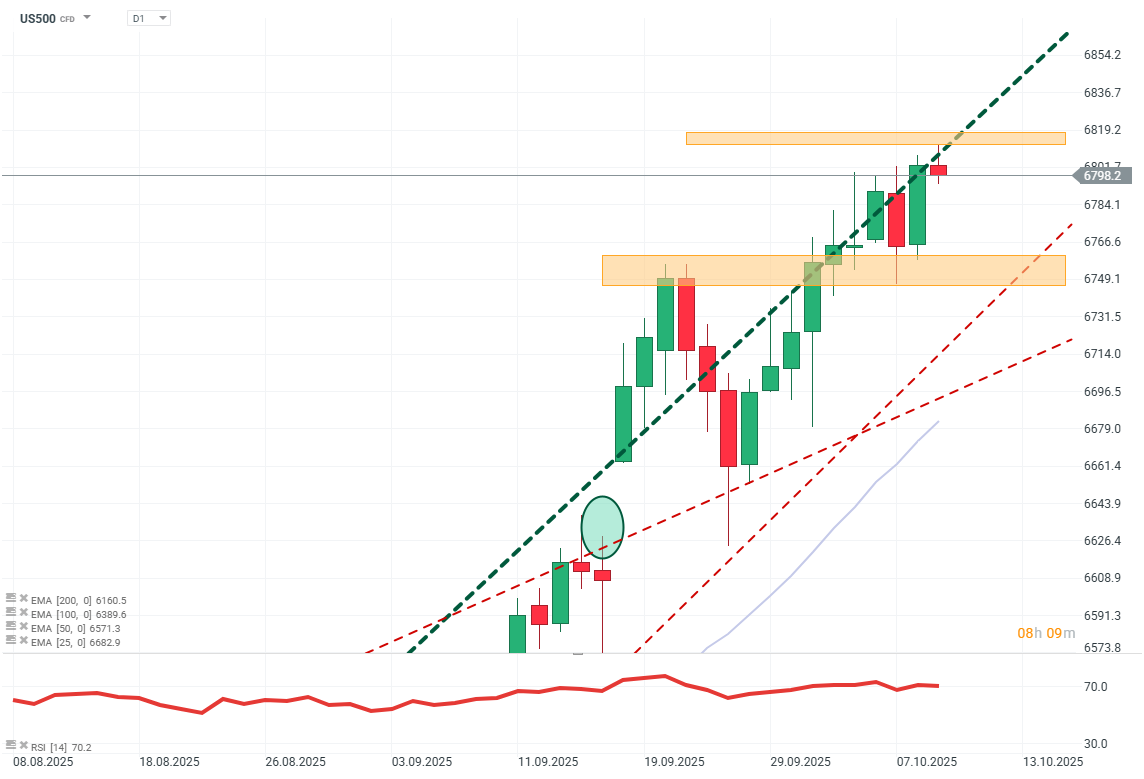

US500 (D1)

Source: Xstation5

The price is currently very close to historical highs, which means, among other things, that the space for potential correction seems relatively large. Considering the ranges of previous corrections, a possible pullback could reach even the lower boundary of the growth channel (marked in red) and around 6700 points. However, for such a scenario to materialize, a clear break of the nearest local support in the region of 6750 points remains a key condition. An additional factor supporting the supply side is the relatively high level of the RSI indicator, which oscillates around 70 points, signaling market overbought and increasing risk of short-term pullback.

Company News:

Nvidia (NVDA.US) - The world's largest company is rising at the opening by about 1%. This is driven by positive news that the chip manufacturer has started selling its AI chips in the UAE as part of a new trade initiative by the US president.

US Rare Metals (USAR.US) - Companies related to the extraction and refining of rare earth metals are rising on the wave of new restrictions from China, which forces increased production in developed countries. US Rare Metals is rising at the opening by over 6%.

Apogee Therapeutics (APGE.US) - The biotech company is losing over 6% at the opening. The valuation of the previously announced public offering at $41 was deemed unfavorable by the market.

PepsiCo (PEP.US) - The soft drink producer published results that slightly beat market expectations regarding EPS (2.29, Ex.: 2.26) and Revenue (23.94B$, Ex.: 23.86B$). At the earnings conference, the CEO indicated plans to cut costs to increase margins and noted that demand from Asia is working in the company's favor.

Freeport (FCX.US) - Copper mining companies are rising on the wave of good sentiment towards the industrial metal and forecasts of its growth in the coming years. The company is rising at the opening by about 2%.

Diginex Inc (DGNX.US) - The software production company is rising by about 30% for the second session in a row. This is caused by the company's strategic growth towards cryptocurrencies, tokenization, and AI.

Delta Airlines (DAL.US) - The leader of American airlines also published its results today, in which it beat expectations. This is a particularly important reading allowing the assessment of the strength of American business and consumers in conditions of reduced macroeconomic transparency. The company is rising at the opening by over 5% thanks to assurances from the CEO that the government shutdown did not affect the results and that the company is recording record operating revenues thanks to demand from premium customers.

Daily Summary: Gold and Indices lower, Dollar bounces back💲

Dollar at its strongest in two months 💲📈 Lack of U.S. data is suppressing the bearish trend

Delta Airlines stock lifts off after earnings✈️

Stock of the Week - Super Micro Computer (09.10.2025)

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.