- Rebound in German data, with a clear improvement in the services sector.

- Slight improvement in French manufacturing sentiment, but a significant decline in services.

- EURUSD continues to recover.

- Rebound in German data, with a clear improvement in the services sector.

- Slight improvement in French manufacturing sentiment, but a significant decline in services.

- EURUSD continues to recover.

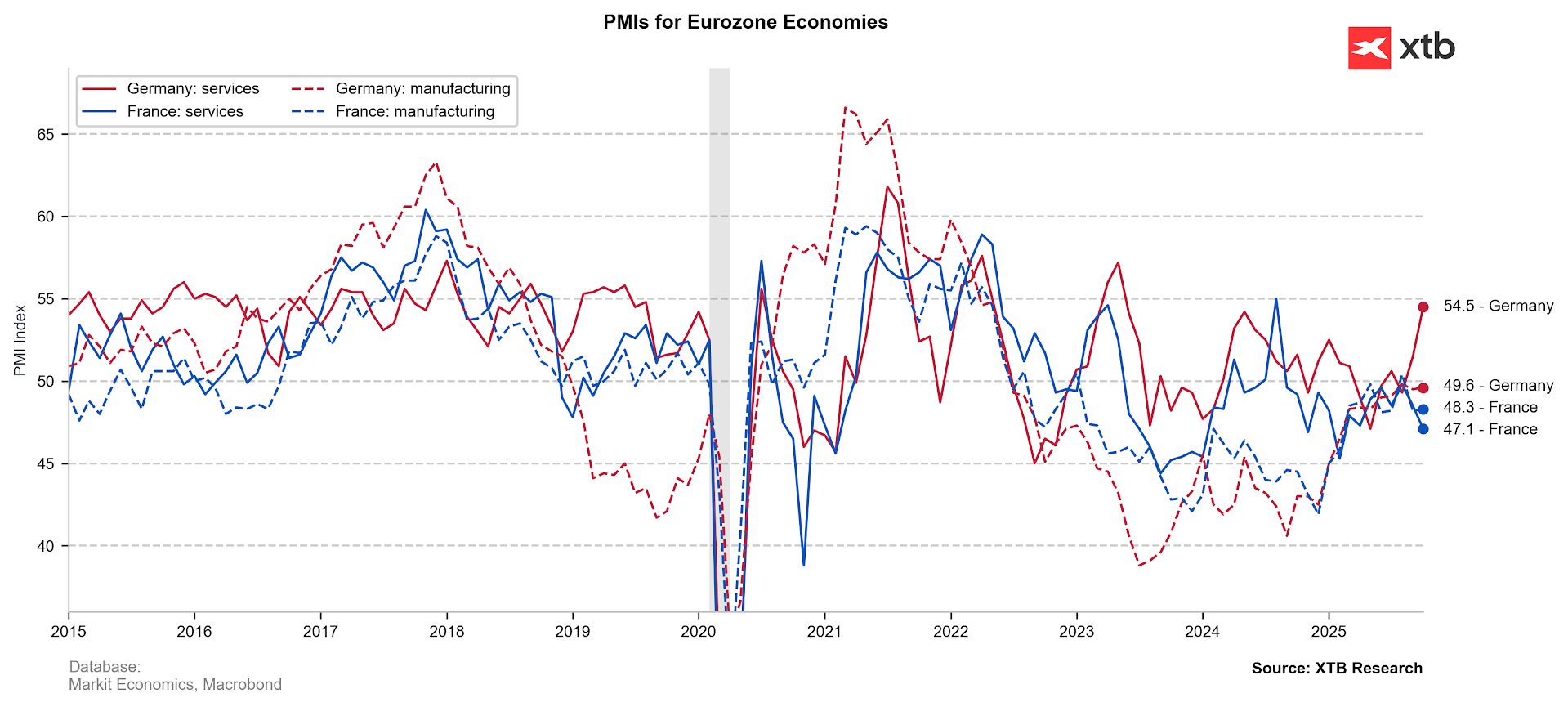

Germany Manufacturing PMI (preliminary, October): 49.6 (expected: 49.5; previous: 49.5)

Germany Services PMI: 54.5 (expected: 51.0; previous: 51.5)

France Manufacturing PMI (preliminary, October): 48.3 (expected: 48.2; previous: 48.2)

France Services PMI: 47.1 (expected: 48.7; previous: 48.5)

Germany PMI: Clear improvement, but risks remain

Germany’s PMI data show the fastest growth in output in over two years, with rising new orders and backlogs in both manufacturing and services. This suggests a strong start to Q4 and a pickup in economic recovery. Particularly positive is the increase in orders and employment in services, although manufacturing continues to see job cuts. Supply-chain uncertainties (notably in semiconductors) persist, negatively impacting sectors such as automotive. Rising labor costs continue to feed through to higher prices, but service firms are managing to pass part of these costs on to clients.

France PMI: Further decline, moderate labor optimism

France’s PMI indicators were weak, with the October Flash Composite PMI falling to 46.8 points, firmly in recession territory. The decline in output across both manufacturing and services points to broad-based demand weakness. Companies remain cautious about the outlook, reflecting a fragile global environment and domestic political uncertainty. On a positive note, labor market resilience and easing price pressures may offer some relief for the ECB. Despite efforts to stimulate sales through price cuts, the French economy continues to face a prolonged period of stagnation.

EURUSD continues moderate gains

Looking at the EURUSD pair, we observe a clear upward attempt over the last three sessions, with buying interest around the 1.1600 level. The U.S. dollar remains uncertain ahead of the Fed’s decision and amid ongoing government shutdown concerns. Although U.S. yields have climbed back above 4%, the EURUSD still shows a significant divergence from TNOTE, suggesting the U.S. dollar may be overvalued.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.