Tesla will publish its Q4 2025 results after the close of trading on Wednesday, January 28. Expectations for the automotive giant’s earnings do not appear to reflect the enormous hopes placed in the company. Referring to Tesla as an “automotive giant” is accurate, but in this context it carries a negative connotation. The company stopped being valued like a car manufacturer long ago, it is valued like a technology company, despite negligible success in that area. At the same time, the company’s fundamentals, the automotive segment that is supposed to serve as the foundation for further, more advanced ventures, are showing clear signs of strain.

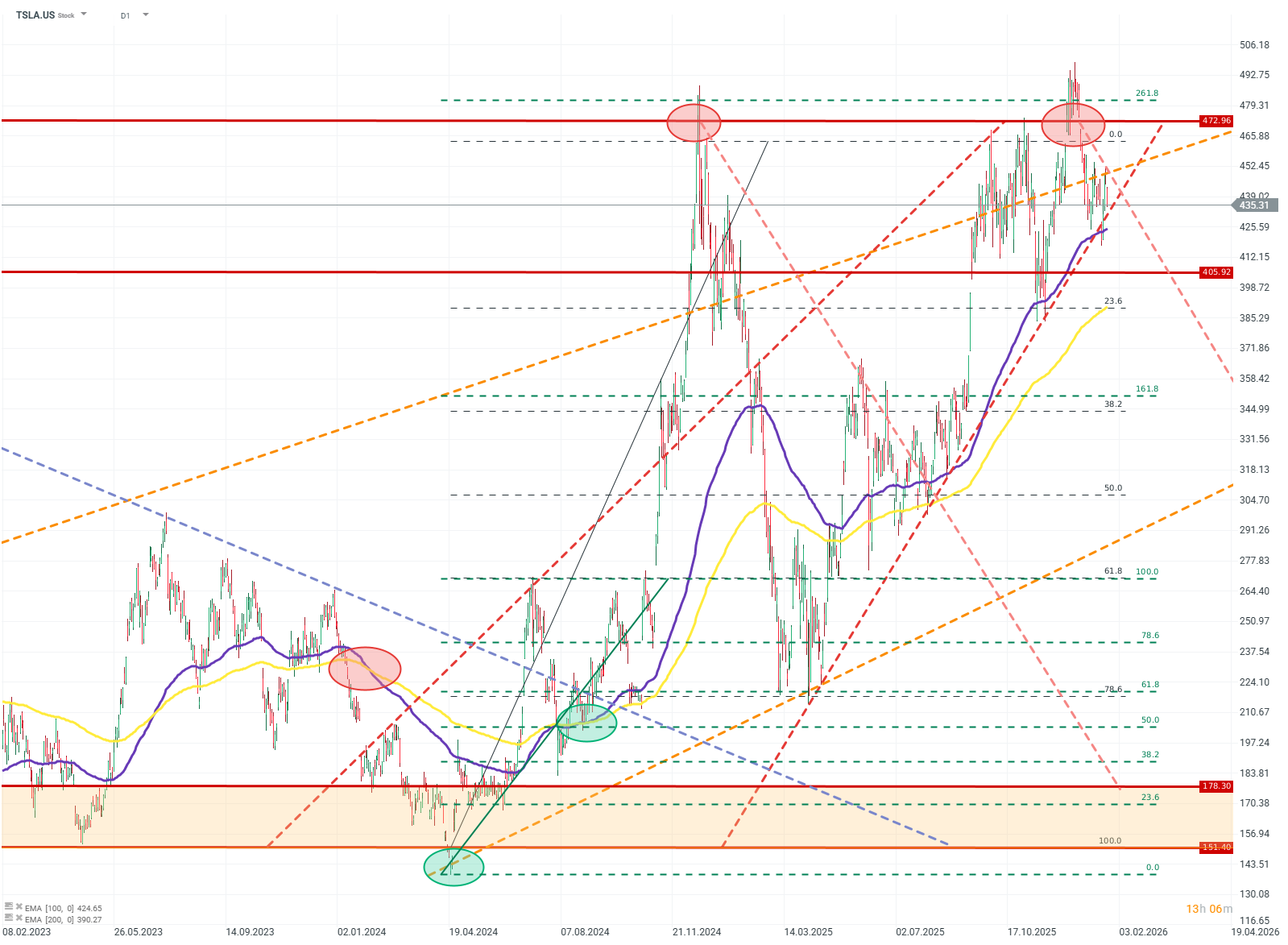

Since the last peak, Tesla’s share price has fallen by around 12%, yet it remains very high within its long-term price channel. Previous results do not justify this. In most of the last dozen earnings releases, Tesla disappointed analysts’ expectations on both EPS and revenue. Will it be different this time?

Ahead of the earnings release, Tesla published its vehicle delivery report. In the fourth quarter, the company recorded the largest drop in its history—down 16% year over year. The consensus for vehicle deliveries was around one million units. Tesla managed to deliver only 418,000.

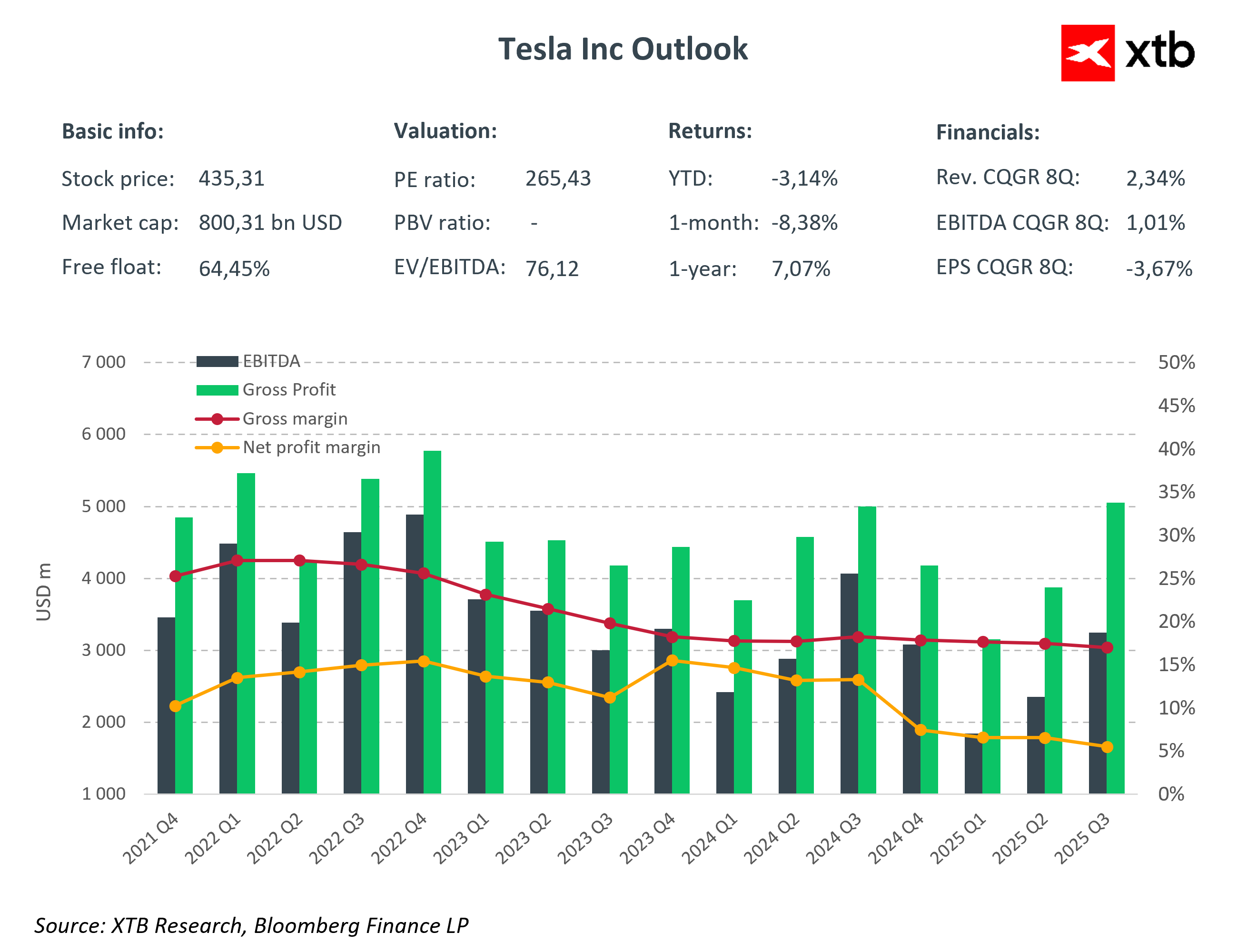

EPS expectations for Q4 are around USD 0.45. This represents a decline of more than 50% compared with 2022. This deterioration is also visible in the company’s margins.

Revenues look somewhat better: the market expects USD 24.7 billion, which is close to the quarterly average. However, this is still lower than in the corresponding periods of 2025 and 2024.

A significant portion of investors has stopped paying attention to financial ratios or hard data. There is a sizeable group of shareholders focused primarily on further announcements regarding the development of FSD and "robo-taxis". Tesla will have great difficulty meeting even these conservative earnings expectations. However, if the company presents promising indicators related to FSD and robo-taxis, it may temporarily sustain current valuations—or even see a rise. The absence of such signals, on the other hand, could lead to a significant sell-off following the earnings release.

Just a few days ago, Tesla introduced changes to access and distribution of its “Autopilot” and FSD, which may allow the company to show growth—if not in FSD subscriptions themselves, then at least in expectations surrounding them.

TSLA.US (D1)

Price has declined from its recent high. A return to growth may be difficult, and there is plenty of room for a correction. Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Amazon shares tumble 10% as investors recoil at the price of AI dominance

Daily summary: Red dominates on both sides of Atlantic

US OPEN: Market under pressure from lacklustre tech earnings season

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.