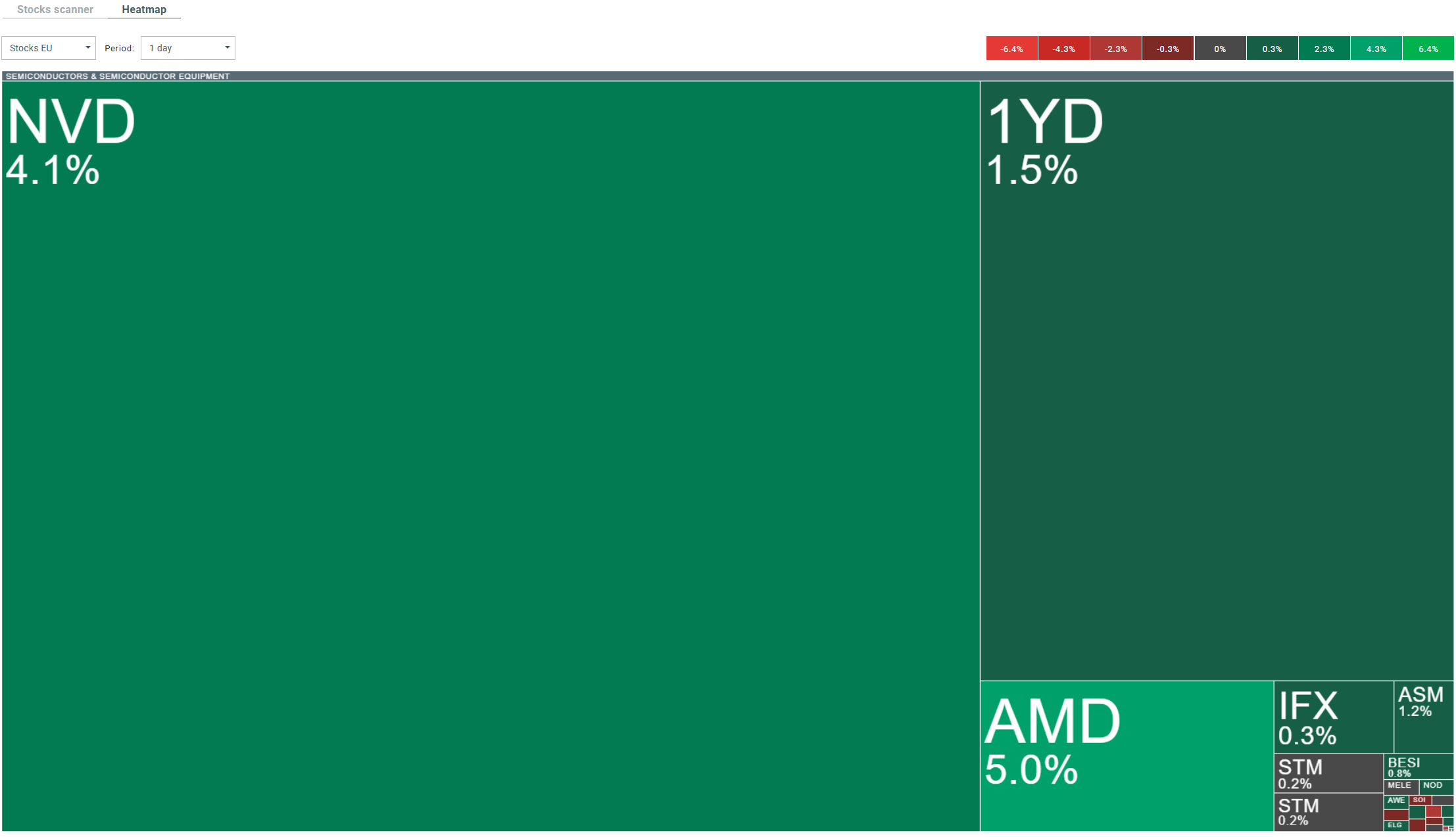

The strong reaction to TSMC's record results (+2.08%) in Taipei is spreading rapidly to global technologies—before Wall Street opens, there is a clear increase in the share prices of Nvidia (+1.92%) and AMD (+3.2%), which are benefiting from positive expectations related to the development of AI and the technology boom.

TSMC published record results for August 2025, recording a 33.8% y/y increase in sales to TWD 335.77 billion (USD 11.09 billion), confirming the strength of demand for advanced chips thanks to the artificial intelligence boom. The company not only dominates the data center chip segment, remaining a key supplier to Nvidia and AMD, but also signals an improvement in demand for consumer solutions in the coming months. TSMC's dynamic sales growth is driving profits and investor optimism, despite the potential risks associated with US-China tensions over technology exports.

The strong market reaction to TSMC's results is spreading to other technology companies – Nvidia and AMD shares are gaining strongly ahead of the Wall Street opening, with investor enthusiasm focused on the AI segment, which is ensuring continued dynamic growth in these companies' profits. The outlook for the semiconductor sector remains very positive: Nvidia points to record spending by hyperscalers on infrastructure development, while AMD is counting on a rebound in demand for personal computers and further expansion in data centers.

Key company results

-

TSMC August: sales of TWD 335.77 billion (+33.8% y/y, +3.9% m/m)

-

TSMC Q3 forecast: revenue of USD 31.8–33 billion (+38% y/y, +8% q/q, forecast confirmed by management)

ADRs of US tech giants listed in Europe are seeing even bigger gains than US stocks before Wall Street opens.

AbbVie near 1-month low after earnings report 📉

Wall Street optimism tempers amid falling odds of December Fed rate cut

DE40: Decline of sentiment in Europe

Atlassian beats revenue and earnings forecasts in Q1 2026

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.