- Earnings season, banks show strength.

- Trump wants to set interest rates.

- Industrial production in the USA is rising.

- RAM manufacturers benefit from shortages.

- Earnings season, banks show strength.

- Trump wants to set interest rates.

- Industrial production in the USA is rising.

- RAM manufacturers benefit from shortages.

Investor sentiment at the end of the week improves the financial sector, which draws market attention with its results. Most companies in this industry positively surprise expectations, supporting the main indices. Investors are also already discounting the potential risk of conflict in Iran, as shown by oil prices. The leader of growth is NASDAQ100, whose contracts are rising by about 4%. S&P500 and Russell limit growth to around 0.2%. The Dow is performing the worst, with contracts falling by about 0.1%.

However, the good results of financial companies are weighed down by statements from Donald Trump. The market has not forgotten the dispute between Jerome Powell and the president's administration. At the same time, the president loudly expressed ideas about introducing an upper limit on loan interest rates for banks in the USA.

Macroeconomic data:

Today, investors received data from the US industry, which according to FED data was doing well in December 2025.

Industrial production increased by 0.4% month-on-month. The annual growth fell from 2.52% to 2%. The manufacturing industry surprised by growing 0.2% despite expectations of a monthly decline. Total capacity utilization increased to 76.3%.

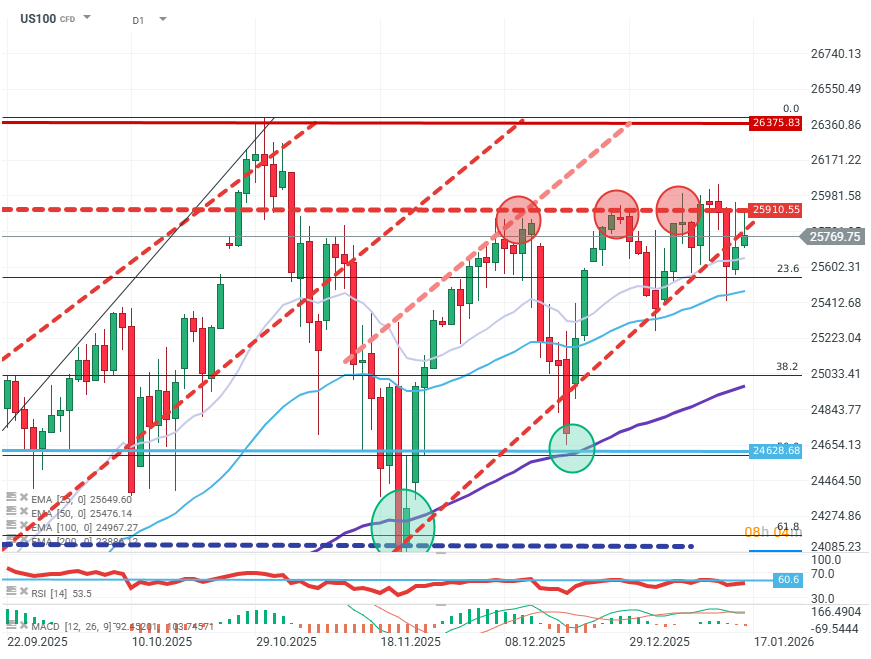

US100 (D1)

Source: xStation5

The market is approaching a key moment where it will have to decide on passing through the resistance zone at 25900. If buyers fail to overcome the level for the fourth time, supply may take the initiative and bring the price around FIBO 38.2.

Company news:

- AST SpaceMobile (ASTS.US): The company is up over 7% after signing contracts for air defense systems.

- Micron (MU.US): The market values further growth of RAM manufacturers amid extreme shortages in this market. The company's valuations are rising by about 4%.

- BlackRock (BLK.US): The well-known fund significantly exceeds market expectations in results. EPS reaches $13.16, and revenues rise to $7 billion. The company rises at the opening by about 7%.

- ImmunityBio (IBRX.US): The biotech company is up 17% after preliminary net profit estimates turned out to be 700% higher than expectations.

- Regions Financial Corporation (RF.US): The company turned out to be an infamous exception in the bank earnings season. As one of the few financial institutions, it disappointed expectations both in terms of EPS and revenues. The stock price falls by over 3%.

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

Amazon shares tumble 10% as investors recoil at the price of AI dominance

Daily summary: Red dominates on both sides of Atlantic

US OPEN: Market under pressure from lacklustre tech earnings season

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.