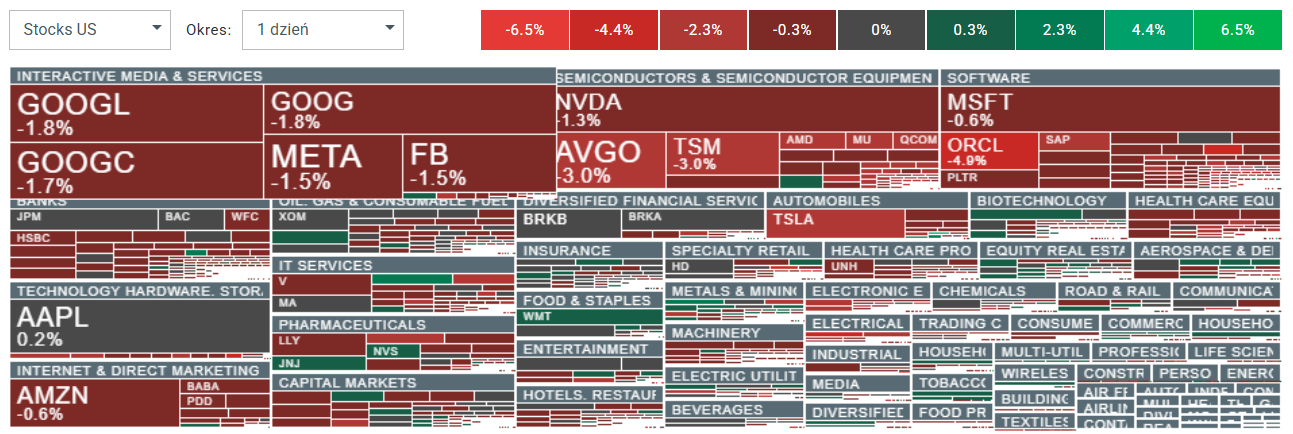

U.S. indices are falling as the dollar strengthens, driven by robust GDP growth, firm durable goods orders, and lower jobless claims. Investors are questioning whether the Fed will really continue monetary easing this year at the previously expected “fast pace.”

-

US500 down more than 0.9%, US2000 drops nearly 2%

-

Lithium Americas rallies on speculation of a potential U.S. government stake

-

Oracle shares react negatively to a Rothschild & Co Redburn report

-

The U.S. dollar gains and Treasury yields climb after Q2 GDP came in at 3.8% YoY, beating forecasts of 3.3%

-

Jobless claims fell to 217K, compared with expectations of 233K and 233K previously

-

Consumer spending rose 2.5% in Q2, well above the 1.6% forecast and just 0.5% previously

US500 Technical View (D1)

The US500 is trading nearly 1% lower today. Key support appears near 6,500 points, where the 50-day EMA (orange line) is located. The index has tested this level three times in recent months. On the upside, resistance is defined by the recent price reaction around 6,800 points.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app

Source: xStation5

Source: xStation5

Company News

-

Immuneering Corp. (IMRX) down ~15% after reporting an 86% overall survival rate at nine months in pancreatic cancer patients treated with atebimetinib plus mGnP. The positive news triggered profit-taking.

-

Jabil (JBL) falls nearly 9% even though the manufacturing services company posted Q4 results that beat analyst estimates.

-

Lithium Americas (LAC) jumps almost 12% following reports the Trump administration is considering taking a stake in the company.

-

Oracle (ORCL) drops nearly 5% amid broader tech sector weakness. Rothschild & Co Redburn initiated coverage with a sell rating, arguing the market is significantly overestimating the value of the company’s cloud revenues. Shares remain well above the 50-day EMA but are testing recent local lows below $300.

Sources: xStation5

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.