The US market has been in a downward trend for over a week. Weak inflation data has negatively affected investors' sentiment, and escalating tensions in the Middle East add downward pressure. However, Thursday's session might slow down the negative momentum. The earnings season so far has provided positive information about the financial conditions of companies, although predictions about the future remain neutral or negative. Optimistic data from the Philly Fed index pushed 10-year bond yields higher, bringing them back to around 4.6%, which could further exert selling pressure on US indices.

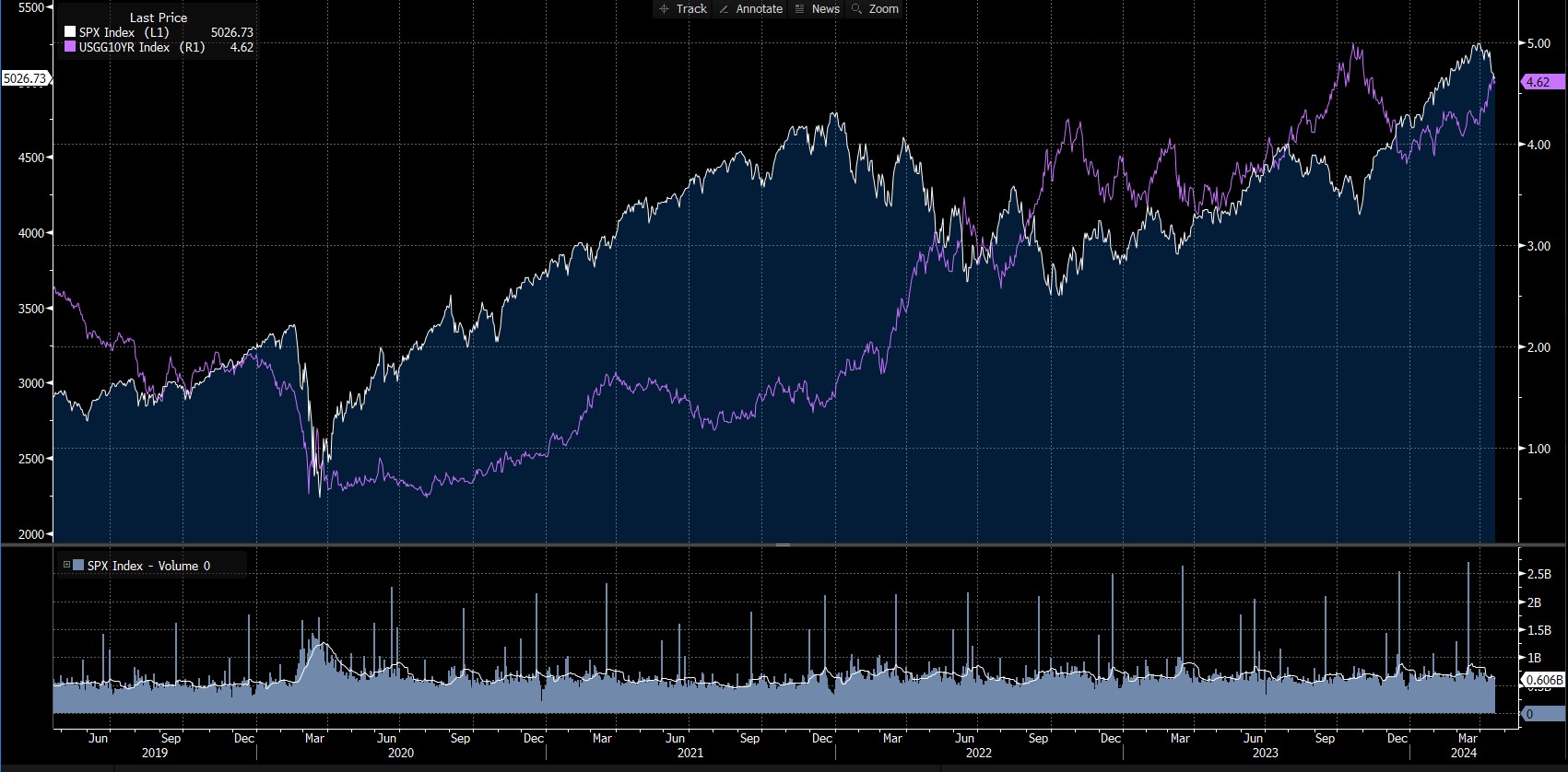

S&P 500 index in relation to the yield of 10-year US bonds. Source: Bloomberg Finance L.P.

S&P 500 index in relation to the yield of 10-year US bonds. Source: Bloomberg Finance L.P.

After the first hour of trading in the US, the S&P 500 index contract (US500) is experiencing minimal gains. It continues to remain in a downward price channel that started after achieving ATH in March 2024. Currently, the contract price is below the exponential moving averages (EMA20 and EMA50), and the indicator values themselves are narrowing their difference. This could act as an additional signal exerting selling pressure on the contract quotes. The first expected support level is at 5046.5 points, and if it is eventually broken, support can be expected around the psychological barrier of 5000 points. Source: xStation.

Stock news:

- Taiwan Semiconductor Manufacturing (TSM.US) experienced a -4% drop at the opening, despite beating market expectations. Both the company's first-quarter results and predictions for the second quarter of 2024 are above expectations. However, investors may be concerned about the lowered forecasts for semiconductor market growth (excluding memory semiconductors) in 2024 to 10% YoY.

- Duolingo (DUOL.US) gained approximately 7.5% at the opening after announcing that the company will join the S&P MidCap 400 index. The inclusion date is set for April 22th, and Duolingo will take the place of Cable One (which is also experiencing gains of around 3.5% today).

- Las Vegas Sands (LVS.US) is down approximately -7.5% at the opening after reporting its 1Q24 results. The company achieved $2.96 bln in revenue (+40% YoY), and adjusted EBITDA increased to $1.21 bln (+273% YoY), surpassing market forecasts of $1.19 bln. EPS rose to $0.75 compared to expectations of $0.62 and $0.28 in the previous year.

- Netflix (NFLX.US) will release its 1Q24 results after the market closes today. Forecasted revenue is $9.26 bln, EPS is $4.59, and the expected increase in new subscribers is 4.84 mln, which would represent a 176% YoY growth. The expected stock volatility after the report is 7%. Currently, investors are neutral at the beggining of the session before financial statement is released, and the stock rice is fluctuating between -1.7% and +0.5% from yesterday's closing price.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.