U.S. equities are recovering roughly an hour after the opening bell, attempting to halt the cascade of selling seen in recent days. On the US100 chart, two strong bullish candles stand out, with buyers once again stepping in around the key technical support area near 24,600 points. Software and semiconductor stocks are rebounding as well, while Nvidia (NVDA.US) erases its early losses and trades over 1% higher and Micron (MU.US) shares surge to ATH zone.

- Switzerland has committed to investing $200 billion in the United States as part of a new trade agreement, in exchange for lowering the tariff rate to 15%.

- Fed member Schmid reiterated today that the current monetary policy stance remains appropriate.

- Investors also received an update from the Department of Commerce, which released the schedule for upcoming macroeconomic releases — including October’s PCE inflation, set for publication on November 26 at 1:30 BST.

Source: xStation5

Company News

- Avadel Pharma (AVDL.US) shares gain around 21% in premarket trading after the company revealed it received a non-binding acquisition proposal from H. Lundbeck A/S, valuing the stock at up to $23 per share.

- Cidara Therapeutics (CDTX.US) is trading nearly twice as high today, soaring 104%, after Merck agreed to acquire the company for $221.50 per share in cash, valuing the deal at roughly $9.2 billion.

- Crypto-linked names — MicroStrategy (MSTR.US -5.8%) and Coinbase (COIN.US -5%) — are under pressure as Bitcoin drops below $100,000. Investors are pulling capital from token-linked ETFs, reflecting a broader shift back into risk-off sentiment.

- Gap Inc. (GAP.US) rises approximately 1.4% after Jefferies upgraded the stock from hold to buy.

- Shares of Globant (GLOB.US) fall about 3% as the company’s results and cautious outlook highlight a challenging environment. Analysts, however, point to encouraging early signs of stabilization.

- Home Depot (HD.US) declines around 1% after Stifel downgraded the retailer from buy to hold and cut its price target from $440 to $370.

- Scholar Rock (SRRK.US) jumps 14% after the biotech stated that a third-party manufacturing facility it works with remains on track to be reinspected by the end of 2025.

- AI-related stocks — including Palantir (PLTR.US -5%), Crucial Wave (CRWV.US -5%), and Bloom Energy (BE.US -8%) — are sliding in premarket trading. The move suggests the recent weakness in the artificial intelligence sector may deepen as concerns grow over the durability of the earlier rally.

- StubHub (STUB.US) sinks 20% after analysts highlighted the surprising absence of quarterly guidance in the company’s communication — a detail the market interpreted negatively.

- TripAdvisor (TRIP.US) edges slightly higher following an upgrade from Mizuho Securities, which raised the rating from underperform to neutral.

- Sentiment toward U.S. airline carriers continues to deteriorate — Delta (DAL.US -2.4%), United (UAL.US -2.2%), and American Airlines (AAL.US -1.8%) all trade lower. Investors fear that the longest government shutdown in U.S. history may prevent airlines from salvaging what has already been a difficult year.

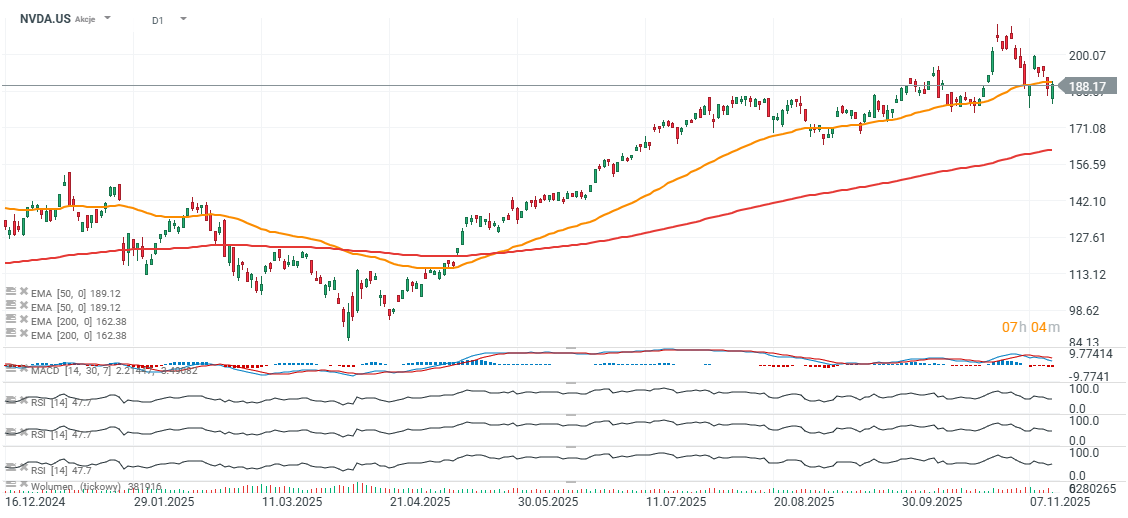

Nvidia (Daily Chart)

Nvidia shares are once again rebounding from the $185 area — close to the EMA50 (orange line) — and attempting to resume their upward move ahead of the company’s earnings release scheduled for November 19 (Wednesday after the U.S. session).

Source: xStation5

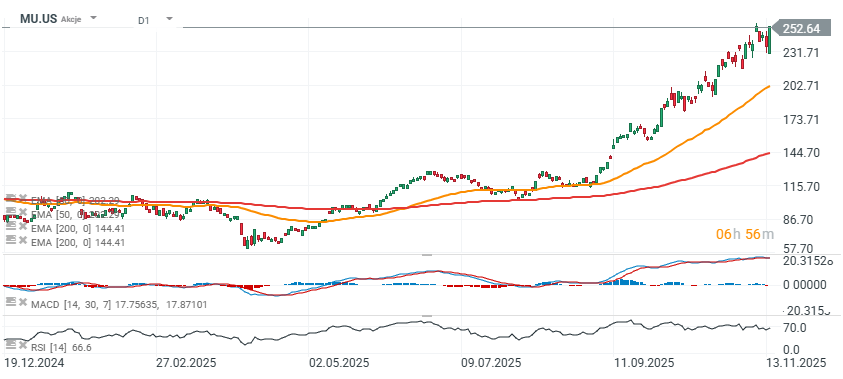

Micron reaches ATH on strong DRAM pricing

Morgan Stanley has sharply lifted its price target for Micron Technology (MU), setting a new high of $325, up from $220. The upgrade comes as analysts point to an extraordinary jump in DDR5 memory prices, which have tripled in just a month — a move not seen since the 1990s. According to the bank, this pricing environment creates a rare setup for Micron to deliver record-breaking financial results.

- The firm expects DRAM prices to continue climbing into the first half of 2026, potentially rising another 15–20%, with some spot deals already trading at premiums as high as 50% above standard market rates. The engine behind this surge is the explosive demand from AI data centers, which are consuming an increasingly large share of global DRAM output. As manufacturers prioritize high-bandwidth memory (HBM) used in AI accelerators, the supply of DDR5 available for PCs and consumer hardware remains constrained.

- Analysts also stress that the current cycle looks very different from past shortages. Unlike 2018—when memory makers struggled with profitability—Micron enters this upswing already generating record margins and earnings, putting it in “uncharted territory” in terms of potential upside. Although companies like Samsung and SK Hynix are ramping up capacity, demand continues to run ahead of supply.

Even after soaring 180% year-to-date, Morgan Stanley argues that Micron’s rally may not be over. Persistent demand for both DRAM and HBM driven by AI infrastructure could keep the momentum going well into the next phases of the cycle.

Source: xStation5

Source: XTB Research, Bloomberg Finance L.P.

Daily summary: Markets recover optimism at the end of the week

Three Markets to Watch Next Week (09.01.2026)

US OPEN: Investors exercise caution in the face of uncertainty.

Oklo shares surged in a true “atomic open” on today’s session

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.