- Stock index futures on Wall Street have been trending upwards since the start of today's trading session. S&P 500 is up 0.2% and Nasdaq increases 0.33% at the start of the cash session

- Wall Street indices are seeking for their 9th consecutive week of growth amidst heightened expectations for interest rate cuts in the United States.

- The market forecasts a 80% probability of a US interest rate cut in March. 10-year bond yields remain below 4.9%.

- Japanese regulators are developing a new antitrust law that will constrain Apple and Alphabet's control over app stores and mobile payments. However, stock prices are climbing at the commencement of the first trading session following the Christmas holiday.

The last week of trading this year on Wall Street has begun. Boxing Day is usually a working day in the US, so the session will operate according to the typical schedule. The trading session started with marginal gains that are an extension from Friday after positive inflation data indicated a more rapid decline in inflation towards the target. On Friday, money markets showed an 88% probability of an interest rate cut before the Federal Reserve in March 2024.

However, trading might remain subdued this week. At present, many markets are closed or will close earlier on Friday. From Wall Street's perspective, key data will be released on Thursday and will pertain to applications for unemployment benefits.

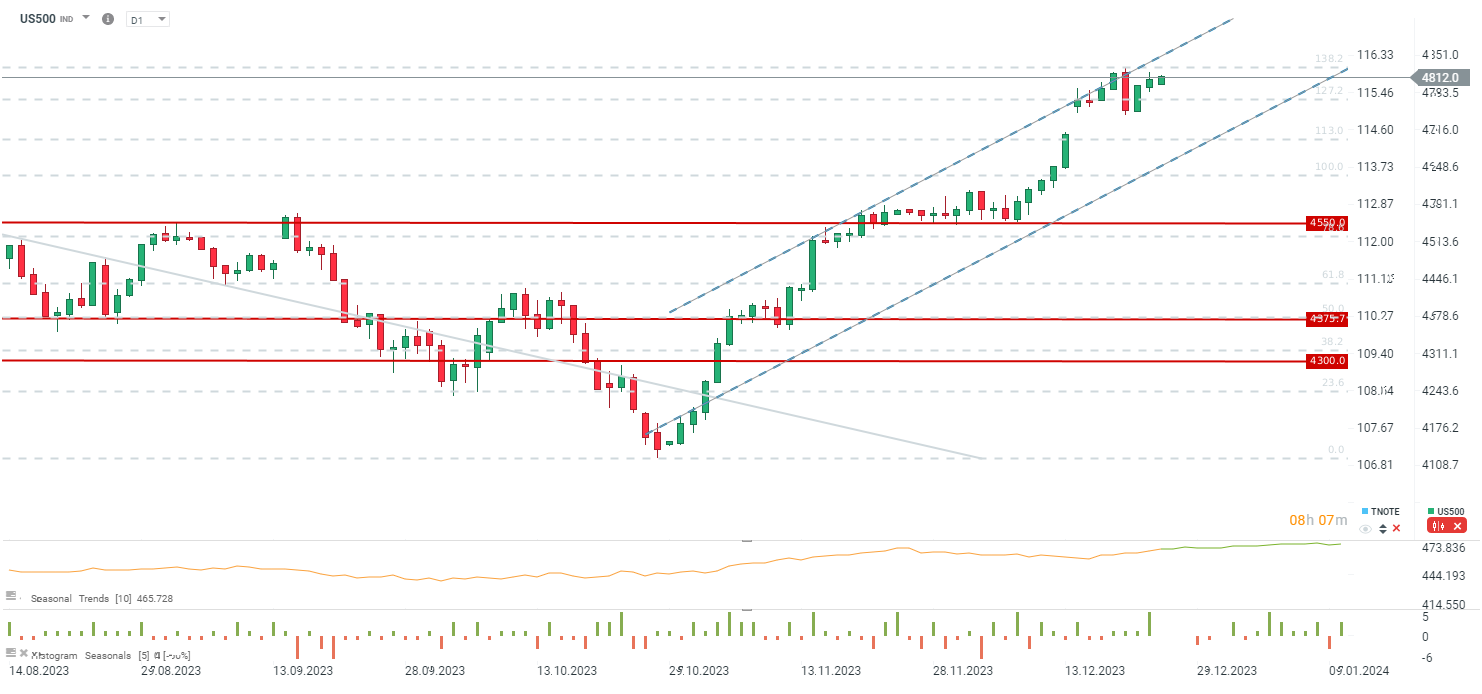

The US500 is up 0.11% at the opening of today's session and is seeking its 9th consecutive week of gains. Source: xStation5

News from companies:

According to Nikkei, Japanese authorities are planning to create a new antitrust law that will curb Apple and Alphabet's influence over app stores. This is intended to be another step in limiting the power of the largest Big Tech companies. However, the deadline for submitting the bill to the Diet has been set for the end of next year. The law is intended to enable the imposition of financial penalties for violations. Fines may reach approximately 6% of revenues generated by violations.

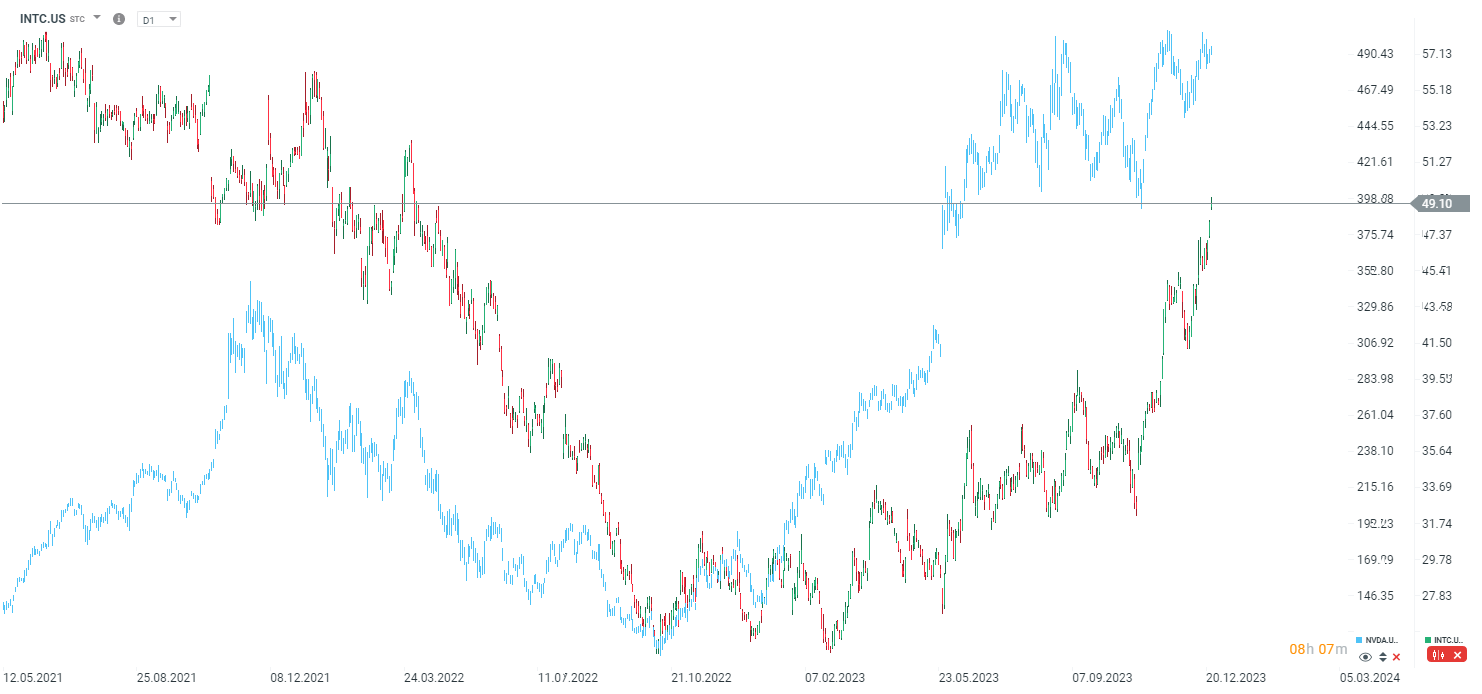

Intel is gaining approximately 2% at the beginning of the trading session after news emerged that the company plans to invest USD 25 billion in Israel, following receipt of incentives from the government in the form of support of USD 3.2 billion. Support for the company was granted in June, but this information was not made public until today. The company's investment is aimed at enhancing the resilience of the global supply chain and diversifying its portfolio, in addition to planned investments in Europe and the United States. The company intends to further increase investments in order to catch up with its rivals such as Nvidia and TSMC.

Manchester United shares surged by more than 3% in pre-market trading today following news that billionaire Jim Ratcliffe had reached an agreement to acquire a 25% stake in the club at a price of $33 per share.

Since the February low, Intel's shares have gained almost 100%, although this is still a significantly worse result than in the case of Nvidia. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.