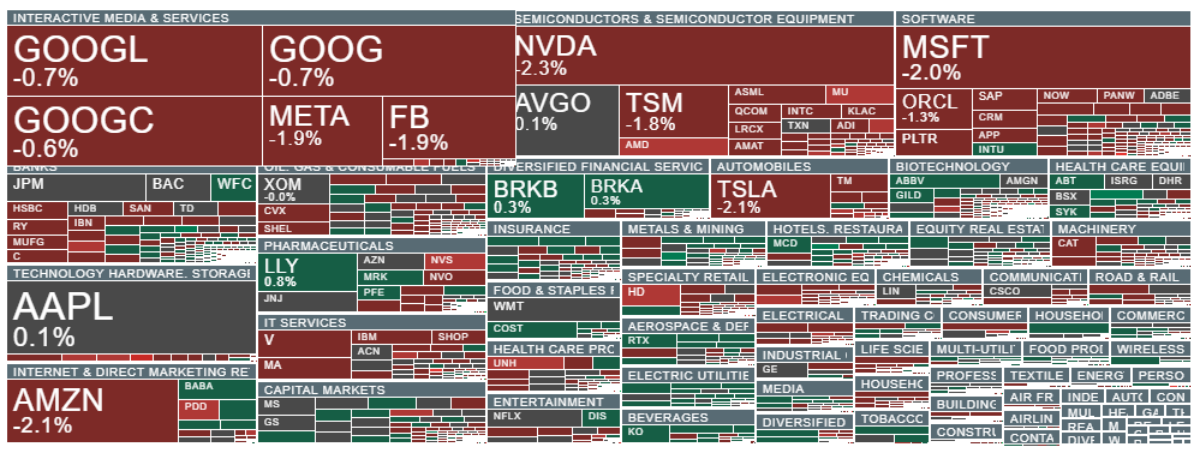

On Tuesday, US stock futures are falling. For several days now, markets have been watching a prolonged, sharp sell-off in cryptocurrencies, which appears to be the result of widespread risk aversion and increased volatility in the stock markets. Uncertainty is growing about the sustainability of the recent technology-driven rally, and Wall Street's attention is slowly turning to Nvidia's (NVDA.US) upcoming financial report, which will be released tomorrow after the US session. Positive comments from Evercore ISI analysts were not reflected in the stock price today, which is down more than 2%.

- In the week ending October 18, 2025, the number of new applications for unemployment benefits in the US was 232,000, which is almost unchanged from the previous period and remains above the averages of recent months.

- The number of people continuing to receive benefits was 1.957 million, a slight increase from the previous week's 1.947 million.

- This figure remains relatively close to its highest level since 2021. During the federal government shutdown, unemployment reports and key economic data were not published according to the established schedule, making it difficult to accurately assess the current situation in the labor market. Neither the dollar nor the indices reacted to this delayed data. We are waiting for the labor market report on Thursday and real wages on Friday.

Among the technology sector, AMD and Micron stand out today with declines, correcting recent gains that persisted despite risk aversion on the indices. Shares of China's PDD Holdings (owner of Temu, PDD.US) are also down today after disappointing results.

Source: xStation5

Source: xStation5

US macro

US Core Durable Goods Revise MoM: 0.3% vs 0.4% exp. and 0.4% previously

- US Durable Goods Revised YoY: 2.9% (Forecast 2.9%, Previous 2.9%)

US Factory Orders MoM Actual 1.4% (Forecast 1.4%, Previous -1.3%)

NAHB Housing Market Index came in 38 vs 37 exp. and 37 previously

USDIDX slightly loses after slightly weaker than expected US macro data signalling lower than expected monthly rise in Durable Goods orders.

Company news

Axalta (AXTA.US) shares gain today after announcing a merger with Akzo Nobel, which will create a global industrial coatings giant with an estimated value of $25 billion. The transaction is expected to close between late 2026 and early 2027, giving Akzo Nobel shareholders a 55% stake in the new entity and Axalta shareholders 45%. The combined company plans to generate approximately $17 billion in annual revenue and achieve $600 million in cost synergies, 90% of which will be realized within the first three years. The company will maintain dual headquarters in Amsterdam and Philadelphia, and after a transition period during which it will be listed on two stock exchanges, it will ultimately be listed on the new NYSE under a new name and symbol. Greg Poux-Guillaume, CEO of Akzo Nobel, will lead the combined company, which will comprise more than 100 brands, 173 manufacturing sites, and 91 research and development centers.

Source: xStation5

Blue Owl Capital (OWL.US) is down about 5% after renewed pressure from the decision to suspend the redemption of shares from investors in the $1.8 billion private BDC fund until it merges with the larger, $17.6 billion public OBDC early next year. Once the merger is complete, investors in the private fund will receive OBDC shares, which, given the current market discount, could mean investment losses of up to 20%. Blue Owl claims that this will create a more efficient platform, increase earnings potential, and restore liquidity to private fund holders, emphasizing that BDC's recent volatility is natural and reflects market dynamics rather than a deterioration in credit quality.

LifeMD (LFMD.US) is down more than 10% after reporting third-quarter results that fell short of expectations in both revenue and earnings, despite 13% year-over-year sales growth. The company updated its guidance to reflect the impact of the majority sale of its stake in WorkSimpli Software. In the fourth quarter of 2025, the company expects revenues of $45 to $46 million and adjusted EBITDA of $3 to $4 million. Full-year 2025 revenues are now forecast at $192 to $193 million, down from $250 to $255 million previously. Adjusted EBITDA, on the other hand, is forecast at $13.5-14.5 million, an increase of approximately 254% compared to 2024.

Ceva (CEVA.US) is down more than 10%, but has already recovered some of the losses caused by the opening of a public offering of 3 million shares, and insurers have been given a 30-day option to purchase an additional 450,000 shares. All shares are being sold by the company, which plans to use the proceeds for potential acquisitions or investments in technologies or complementary businesses, as well as for general purposes such as working capital, capital expenditures, or share buybacks.

Source: xStation5

Arista Networks closes 2025 with record results!

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.