- The market stands still, awaiting the rates decision or news

- Jobless claims decline again

- Meta grows despite regulatory risks

- Micron abandons consumer markets

- The market stands still, awaiting the rates decision or news

- Jobless claims decline again

- Meta grows despite regulatory risks

- Micron abandons consumer markets

The American market enters a state of anticipation during Thursday's session, as next week the market will receive information from the FED regarding interest rate levels. Currently, the market expects a 25 basis point cut with a probability of about 90%. Movements in the main indices at the beginning of the session in the USA remain negligible. Contracts on the main indices reduce price changes to a maximum level of 0.1%.

Macroeconomic Data:

Investors learned today about the weekly reading of the number of unemployment benefit claims. The published reading turned out to be below expectations at the level of 219k and amounted to 191k, falling for another consecutive month, reaching the lowest level since the beginning of last year. A strong labor market puts pressure on indices and supports the dollar by limiting pressure on the FED to cut rates.

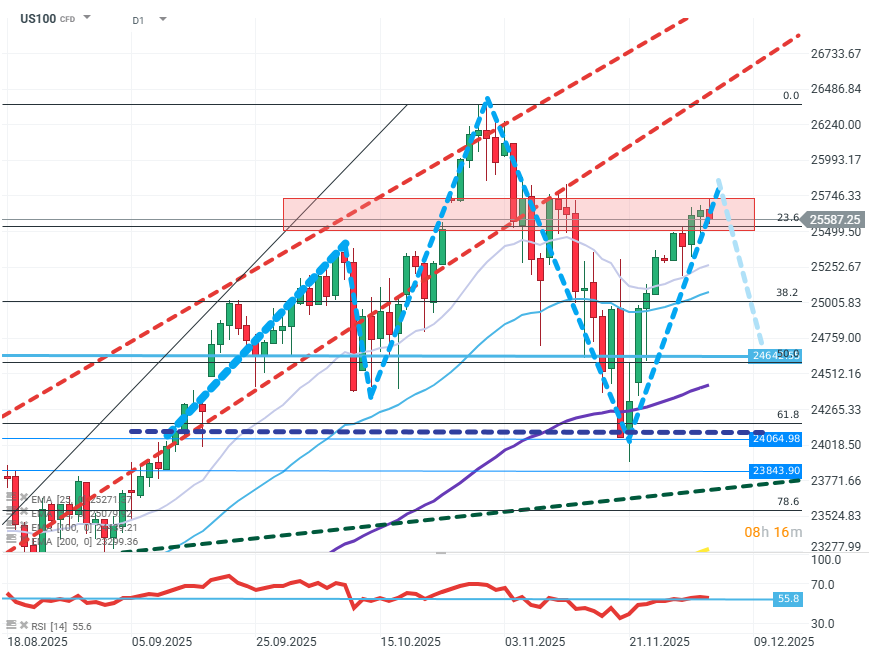

US100 (D1)

Source: xStation5

On the chart, the formation of the RGR pattern can be observed. The growth dynamics—although still upward—is clearly weakening. Currently, buyers have stopped at the FIBO 23.6 level of the last upward wave. To maintain growth, it will be necessary to overcome this barrier as quickly as possible. If the price retreats, it will open the way towards levels ~24500 and the possible realization of the trend change pattern.

Company News:

Snowflake (SNOW.US) - One of the significant players in the cloud services market is losing over 8% after results. The company showed a forecast containing a decline in margin and revenue growth.

Toast (TOST.US) - The company is up over 2% after receiving a positive recommendation from an investment bank.

Stellantis (STLA.US) - The US president has withdrawn from his earlier assurances about liberalizing regulations regarding emissions and fuel consumption, which would make European cars less competitive. The group's price is up over 3%.

Micron (MU.US) - The manufacturer, among others, of RAM announced its withdrawal from the consumer market in this segment to focus on corporate clients and AI.

Meta (META.US) - The company has once again found itself at the center of attention of European regulators amid doubts about the legality of some AI functionalities. At the same time, the company's CEO announced a reduction in involvement in the "Metaverse" project, which investors welcomed with significant relief. As a result of this news, the stock is up over 5%.

Symbotic (SYM.US) - The company is losing almost 15% after a negative recommendation from an investment bank.

Philips (PHG.US) - The company's stock valuation is down as much as 8% after an investment bank pointed out the company's troubles due to tariffs and weak growth in China.

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Amazon shares tumble 10% as investors recoil at the price of AI dominance

Daily summary: Red dominates on both sides of Atlantic

US OPEN: Market under pressure from lacklustre tech earnings season

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.