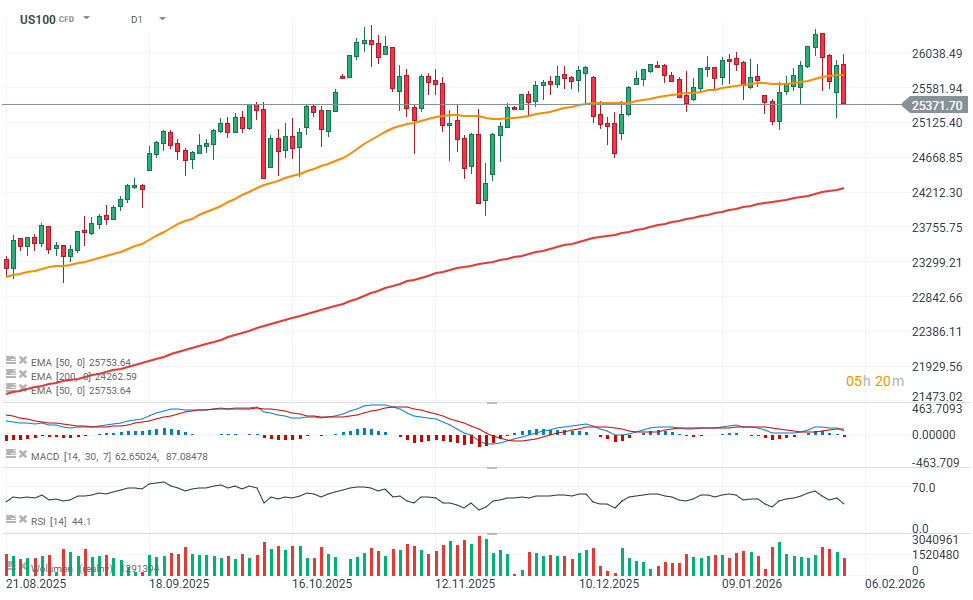

U.S. technology stocks are having a very weak session today, with Nasdaq 100 futures (US100) sliding to around 25,370 points, down nearly 2% on the day. The drop is being driven mainly by an accelerating sell-off across the tech sector, where Nvidia and Microsoft are both down more than 3%. However, today not only BigTech stocks are bleeding, but broader IT & Software stocks are seeing 'systematic selling' with potentially institutions realizing profits or exiting big trades. The downside impulse was further amplified by reports that an Iranian Shahed drone was shot down by an F-35 fighter near the USS Abraham Lincoln carrier strike group. The prospect of higher oil prices could undermine market hopes for Fed rate cuts later this year.

Source: xStation5

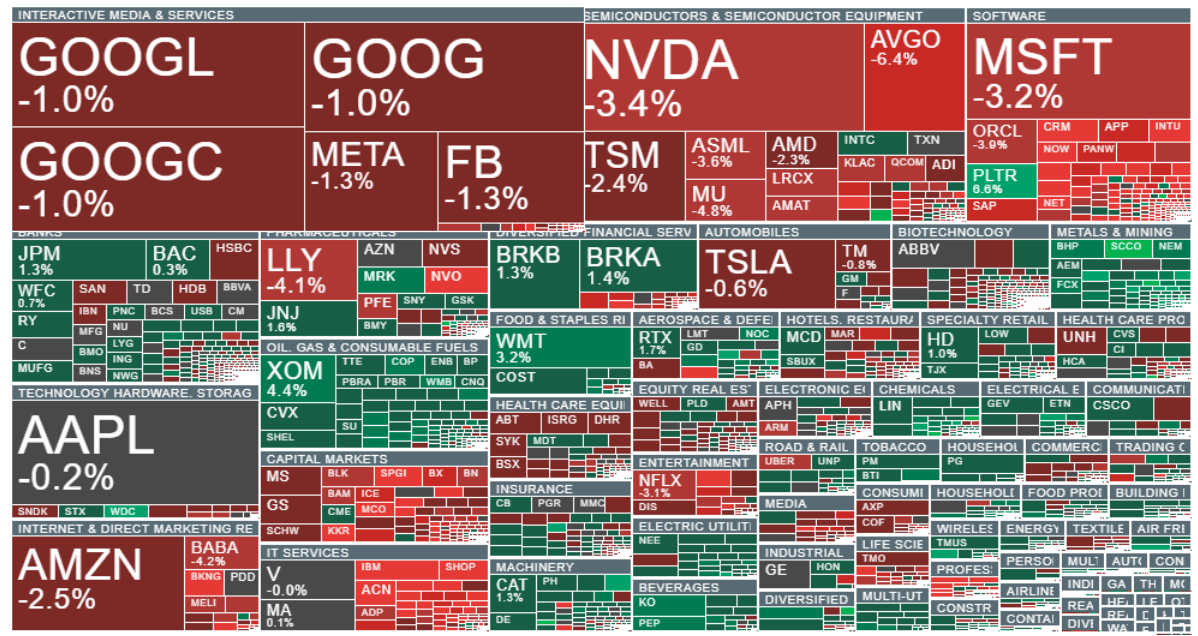

Broadcom shares are down more than 6%, while major software names are also taking heavy losses, including Intuit, ServiceNow, Salesforce, and NetApp. The sharp declines across IT have ultimately spilled over into semiconductors and memory suppliers, with Micron falling nearly 5%. Eli Lilly and Novo Nordisk are also down more than 4%. In contrast, stocks tied to precious metals, oil and gas, as well as banks and the defense sector, are holding up notably better.

Source: xStation5

Dailu summary: Sell-off on Wall street 📉 Bitcoin and Ethereum extend downfall in panic

Software stocks in panic mode 📉Will Anthropic AI disrupt tech valuations?

The launch of Xeon 600 and cooperation with SoftBank. Is this a breakthrough for Intel?

US Open: US100 slides 0.5% under pressure from IT sector 📉ServiceNow drops 6%

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.