Why Meta’s Q4 2025 Results Matter

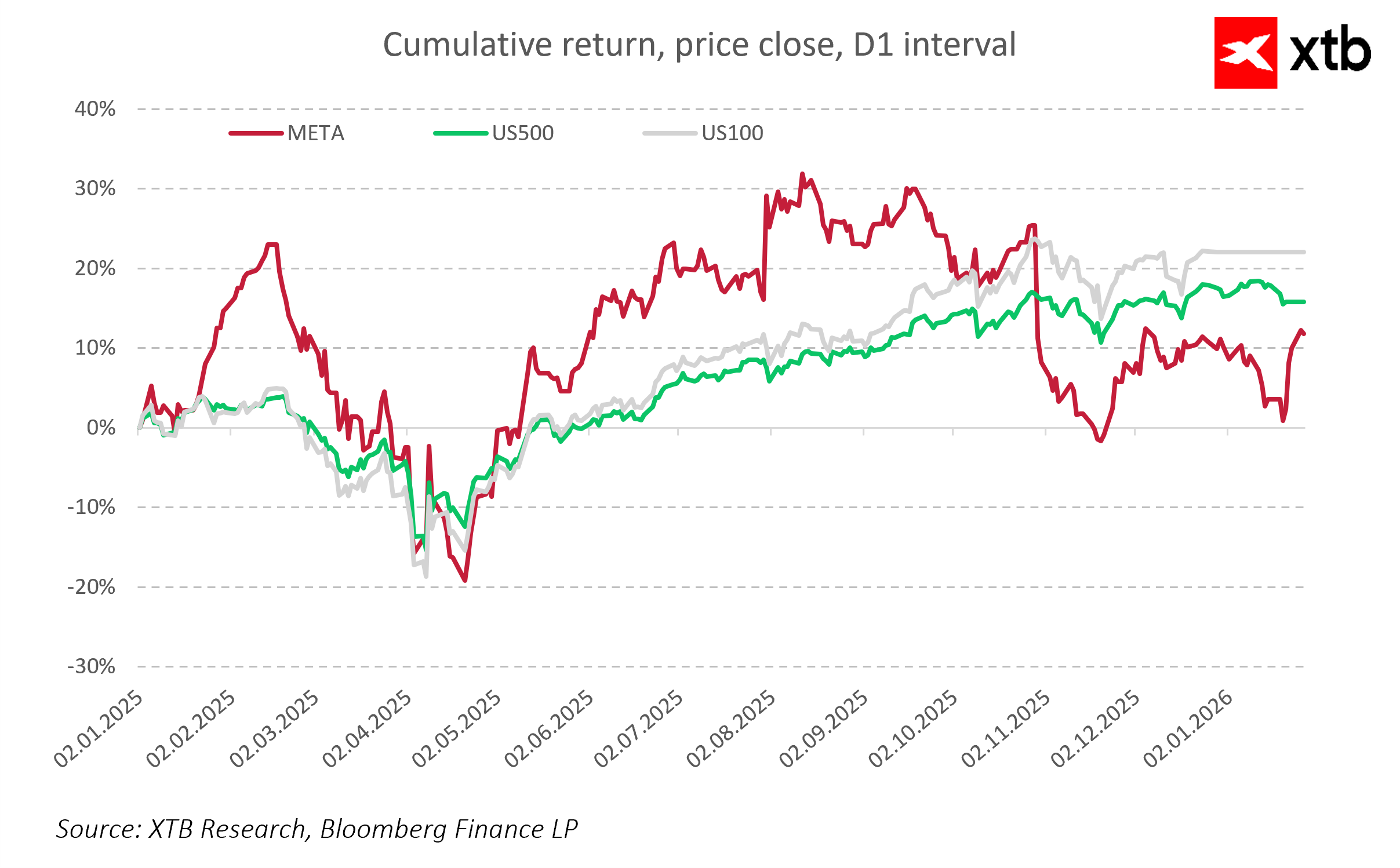

Meta Platforms enters the Q4 2025 earnings season as one of the most profitable yet fastest-growing technology companies in the world. Following deep cost restructuring in previous years and a clear return to strong revenue growth, the company is once again in the spotlight for investors. Today’s results will test whether Meta can maintain exceptionally high profitability while significantly ramping up investments related to artificial intelligence.

The market expects not only solid numbers but, more importantly, confirmation that the company’s aggressive investment strategy in AI and computing infrastructure strengthens its long-term potential without undermining its ability to generate robust cash flows.

Market Consensus

-

Total Revenue: $58.40 billion

-

Net Income: $26.53 billion

-

EPS: $10.16

-

Gross Margin: 81.0%

-

Net Margin: 45.4%

-

EBITDA: $29.96 billion

-

CapEx: $21.97 billion

For investors, the key focus remains the growth structure. Meta is still largely an advertising-driven business, so the market will analyze whether revenue growth stems from genuine improvements in monetization efficiency and algorithms, rather than merely benefiting from a favorable macroeconomic environment.

Advertising and Algorithms – The Core of the Business Model

Digital advertising remains the absolute foundation of Meta’s results. Platforms like Facebook, Instagram, and WhatsApp provide the company with global reach, data scale, and precise targeting capabilities, resulting in some of the highest margins in the tech sector. The application of artificial intelligence in content recommendation systems and campaign optimization enhances ad effectiveness and increases return on investment for advertisers.

The development of generative AI tools also supports user engagement and improves monetization across existing platforms. Rapid, direct monetization of AI is one of Meta’s key competitive advantages among Big Tech peers.

AI and CapEx – A Conscious Scaling Strategy

Meta is significantly increasing capital expenditures, focusing on expanding data centers, computing infrastructure, and its own AI models. High CapEx is part of a deliberate strategy aimed at securing long-term competitive advantages and supporting increasingly sophisticated AI applications.

The company clearly communicates that the priority is scale and quality of infrastructure, even at the cost of short-term pressure on Free Cash Flow. Investors will, however, assess whether the pace of investment aligns with revenue growth and whether AI investments are beginning to deliver increasingly tangible financial returns.

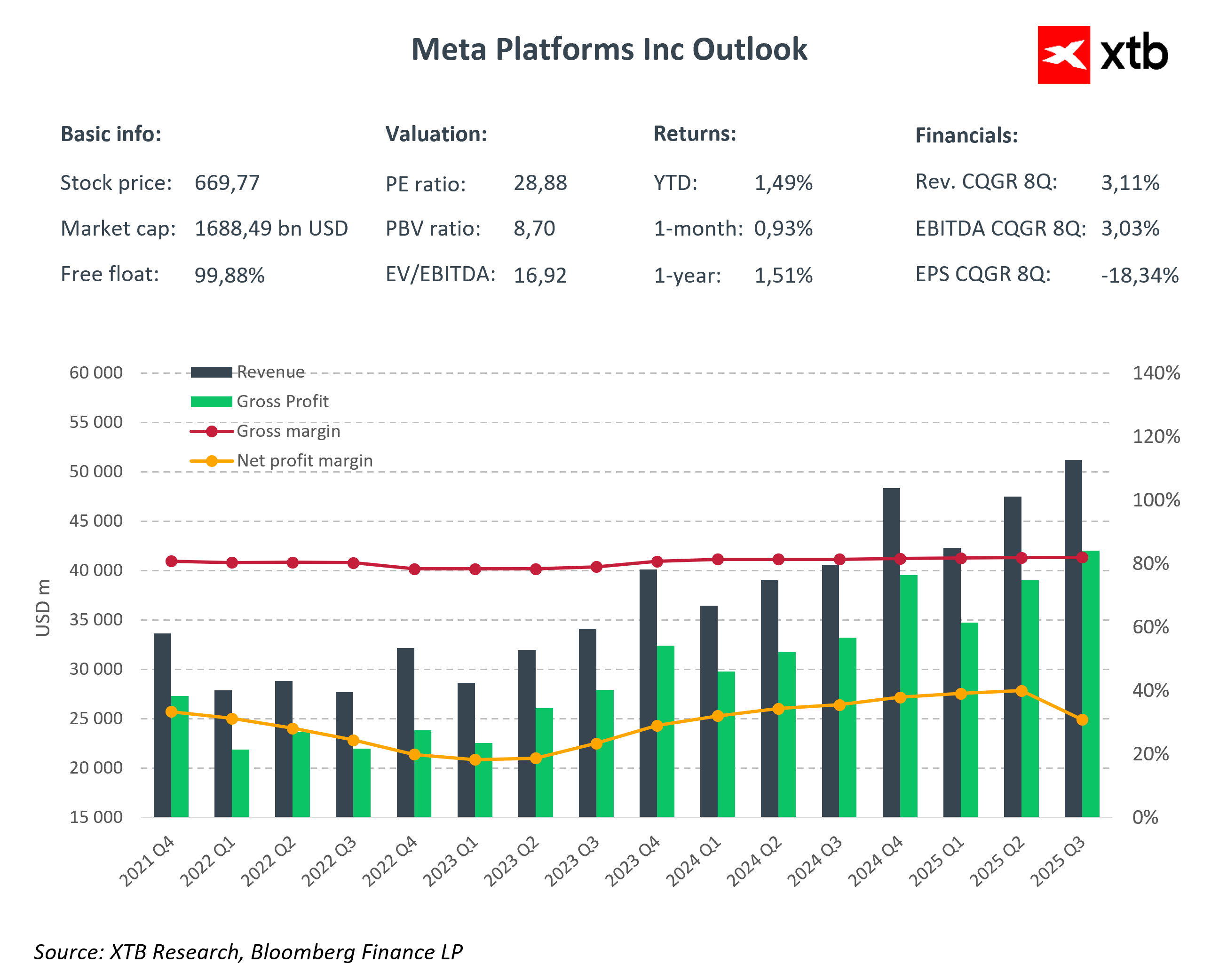

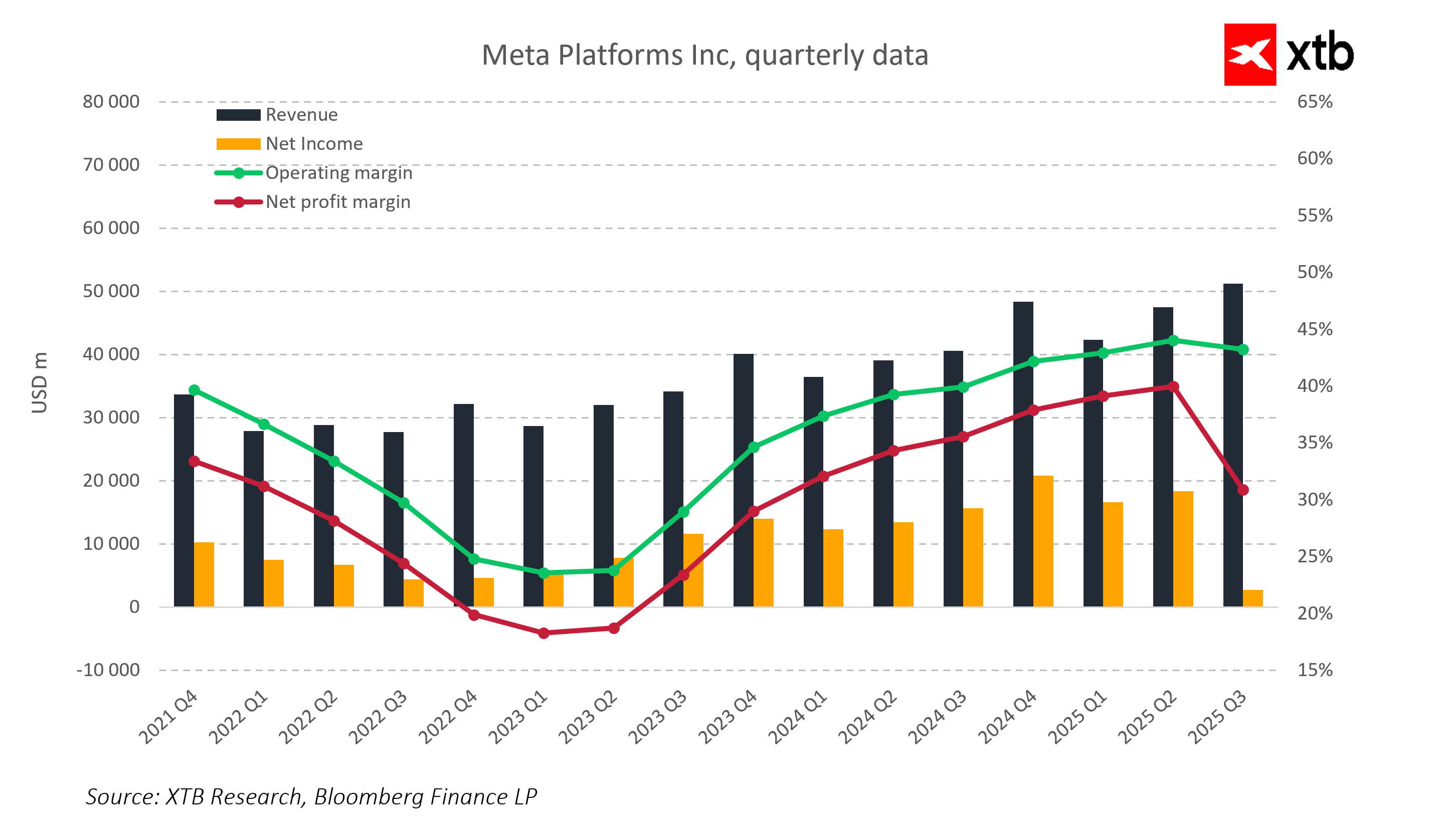

Profitability and Operational Discipline

Despite aggressive investment, Meta remains one of the most profitable technology companies globally. Gross and net margins remain exceptionally high, reflecting the effectiveness of prior restructuring actions and the strength of its advertising model. The combination of high operating profitability and intensive investment positions Meta as a company with significant potential for further value expansion.

Key Takeaways

Meta is currently in a phase where it combines dynamic revenue growth, exceptional profitability, and aggressive AI investments. The central question is not whether the company can grow, but whether it can maintain balance between investment scale and its ability to continue monetizing its user base and AI technologies.

If Meta demonstrates that rising CapEx effectively translates into advertising revenue growth while maintaining high margins, the company could remain one of the most attractive players in the global technology sector. In this scenario, Q4 2025 results could confirm that the current strategy is not only working but also laying solid foundations for further value expansion in the coming years.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.