FOMC decision was expected to be a key event of the week. However, a sell-off that arrived on the markets at the beginning of this week showed that developments around Chinese developer Evergrande may be a much bigger risk for the markets. Nevertheless, the Federal Reserve remains the most important and impactful central bank in the world so its actions should not be ignored. Let's take a look at what to expect from today's announcement.

Focus on tapering

Interest rate will, of course, stay unchanged and no one expects a different move. However, the situation looks less certain when it comes to asset purchase schemes. There is a growing feeling in the markets that the Fed will finally announce a taper timeline today. There are some factors that back this view - inflation continues to run rampant and more Fed members begin to call for the launch of tapering this year. On top of that, today's meeting is a quarterly one and will be accompanied by the release of a new set of macroeconomic forecasts. Fed prefered to use those quarterly meetings to announce major policy changes in the past. Moreover, solid retail sales data for August proved that the US consumer and economy are strong. All of this supports higher dot-plot and better forecasts.

Having said that, the taper announcement today cannot be ruled out. However, factors that would support tapering were present in the previous months as well but Powell went to great lengths to assure investors that it is too early to withdraw monetary support. There are rumours that Powell may use recent issues in China to continue with a massive support for the economy.

Will China issues matter?

Some say that turmoil surrounding Evergrande and a risk that the company may collapse sending shockwaves through the markets may lead the Fed to stay on hold today when it comes to major announcements. While collapse of the Chinese developer and potential spillover effects are for sure one of the risks to the global economy, it should be noted that it remains uncertain whether those risks will materialize. Evergrande announced that it will not default and will make interest payments scheduled for tomorrow. There are also news circulating saying that Evergrande may be taken over by the Chinese government and restructured. Such a result would make any negative impact from the event limited, especially abroad. Having said that, Fed is more likely to focus on domestic factors today and, as we have mentioned before, high inflation and strong retail spending favour a hawkish move.

A look at the markets

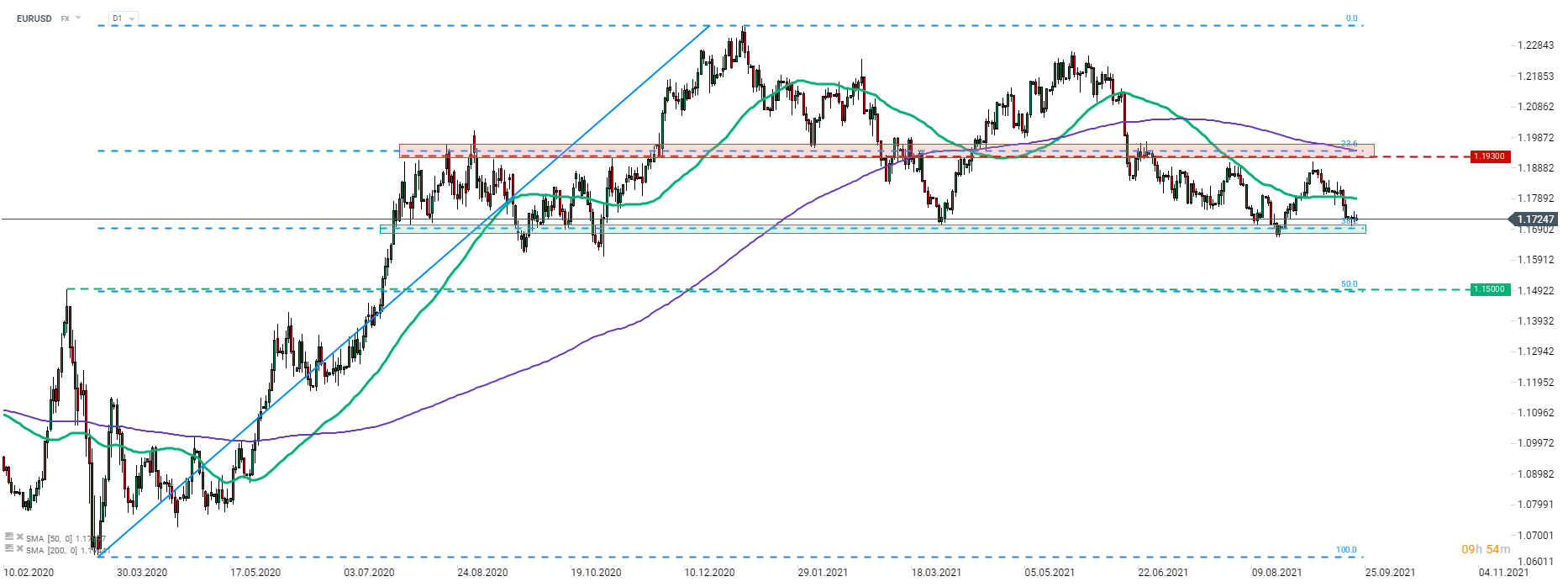

EURUSD

The main currency pair - EURUSD - has been stuck between 23.6 and 38.2% retracement of the post-pandemic recovery move recently. A lower limit of the range at 1.1700 was reached this week but sellers were unable to push the pair below. Hawkish announcement from Fed would boost USD and may lead to a break below the 1.1700 mark. Sticking to a dovish narrative could see EURUSD gain and move towards its 50-session moving average (green line).

Source: xStation5

Source: xStation5

GOLD

Gold has been struggling so far this month. Precious metal dropped almost $100 per ounce off its monthly high reached at the beginning of September. Sell-off was halted at the $1,750 support zone and price jumped $20 since. In case of a hawkish announcement from the Fed today, GOLD may find itself under pressure and the aforementioned $1,750 support will be on watch once again. On the other hand, lack of taper announcement would be viewed as a very dovish message and GOLD may look towards resistance near 50% retracement ($1,800 area). Source:

xStation5

xStation5

US100

When it comes to equities, tech sector is expected to be the most impacted by a potential taper announcement. US100 managed to halt recent sell-off near mid-August lows (14,800 pts area). The index trades significantly above its near-term support at 14,560 pts, marked with the 23.6% retracement and the lower limit of local market geometry. This will be the level that will be on watch in case Fed turns hawkish.

Source: xStation5

Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.