- Tesla to report Q1 earnings today after market close

- Stock is trading over 40% year-to-date lower

- Q1 deliveries and production data disappointed

- Price cuts hint at weakening demand outlook

- Company needs to convince investors turnaround is in sight

Tesla (TSLA.US) is scheduled to publish its Q1 2024 earnings report this Tuesday after close of the Wall Street session. Tesla stock has been sliding for over half a year and has recently dropped to the lowest level since late-January 2023. Earnings report can be a chance to turn sentiment on the stock, but company will need to prove that outlook is improving.

What market expects from Tesla earnings?

The upcoming release from Tesla will be analysed closely given the ongoing sell-off in company's shares. Deliveries and production data for Q1 2024 was already released, and it disappointed significantly, so now traders will try to find any positives in the full quarterly report. Analysts expect flat revenue growth compared to a year ago quarter and a drop in gross profit, driven by increased costs and expenses.

Q1 2024 expectations

- Revenue: $23.37 billion (+0.2% YoY)

- Cost of revenue: $19.25 billion (+2.2% YoY)

- Gross profit: $3.96 billion (-12.2% YoY)

- Gross margin: 16.9% (19.3% a year ago)

- Operating expense: $2.33 billion (+25.9% YoY)

- Operating income: $1.73 billion (-35% YoY)

- Operating margin: 7.4% (11.4% a year ago)

- Net income: $1.66 billion (-33.9% YoY)

- Net margin: 7.1% (10.8% a year ago)

- Adjusted EPS: $0.59 ($0.85 a year ago)

- Capital Expenditures: $2.46 billion (+18.8% YoY)

- Free Cash Flow: $1.19 billion (+170% YoY)

Q1 deliveries and production disappoints

Data on deliveries and production in Q1 2024 was already released, and it turned out to be a huge disappointment. Company reported significant quarter-over-quarter declines in deliveries and production. Deliveries and production were also lower on a year-over-year basis, marking the first annual drop since Q2 2020. Company explained that weakness came from shipping diversions caused by Red Sea hostilities and arson at German factory, as well as early phase of production ramp-up at Fremont factory. However, while those explain weakness in production, they do not explain weakness in deliveries.

Tesla Q1 deliveries and production

- Deliveries: 386 810 vs 449 080 expected (-20.1% QoQ)

- Model 3/Y: 369 783 vs 426 940 expected (-10% QoQ)

- Production: 433 371 vs 452 976 expected (-12.5% QoQ)

- Model 3/Y: 412 376 vs 439 194 expected (-13.5% QoQ)

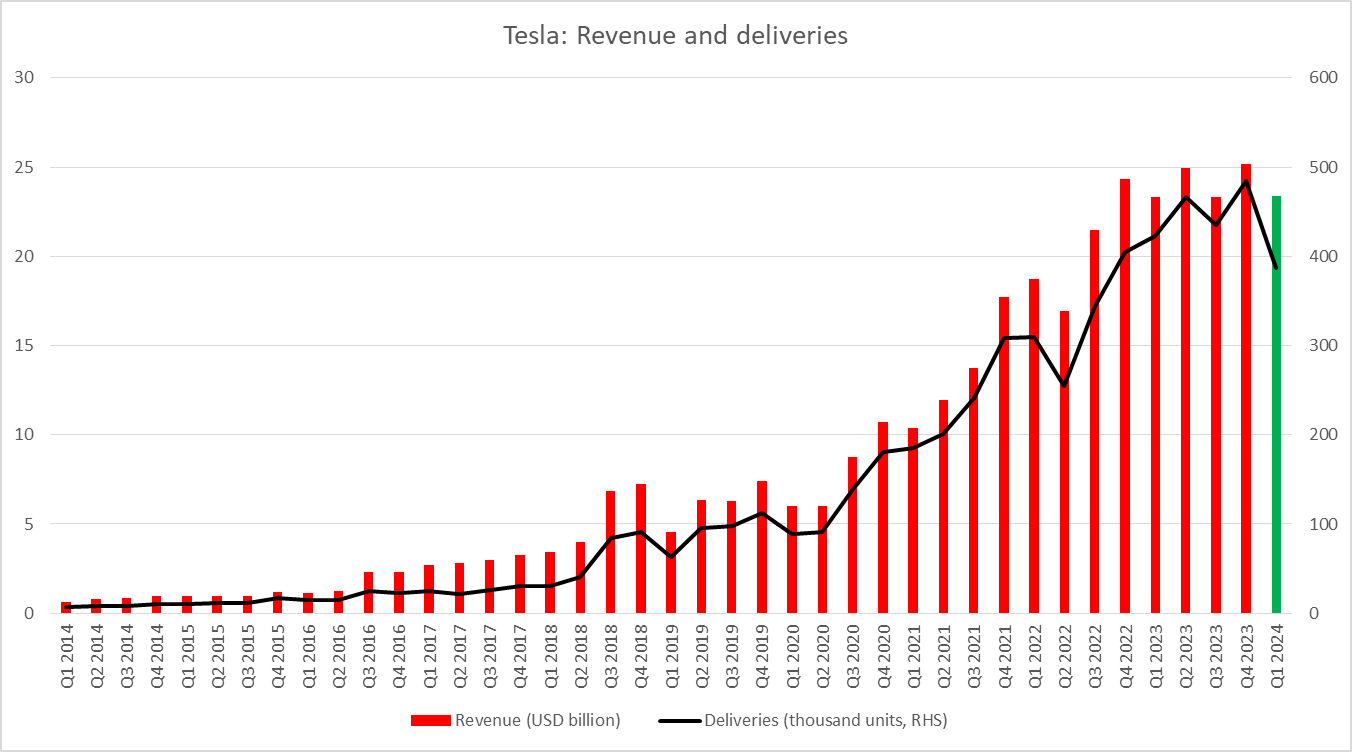

Dips in Tesla deliveries were often accompanied by dips in revenue. Green column represents Q1 2024 revenue expectations. Source: Bloomberg Finance LP, XTB Research

Dips in Tesla deliveries were often accompanied by dips in revenue. Green column represents Q1 2024 revenue expectations. Source: Bloomberg Finance LP, XTB Research

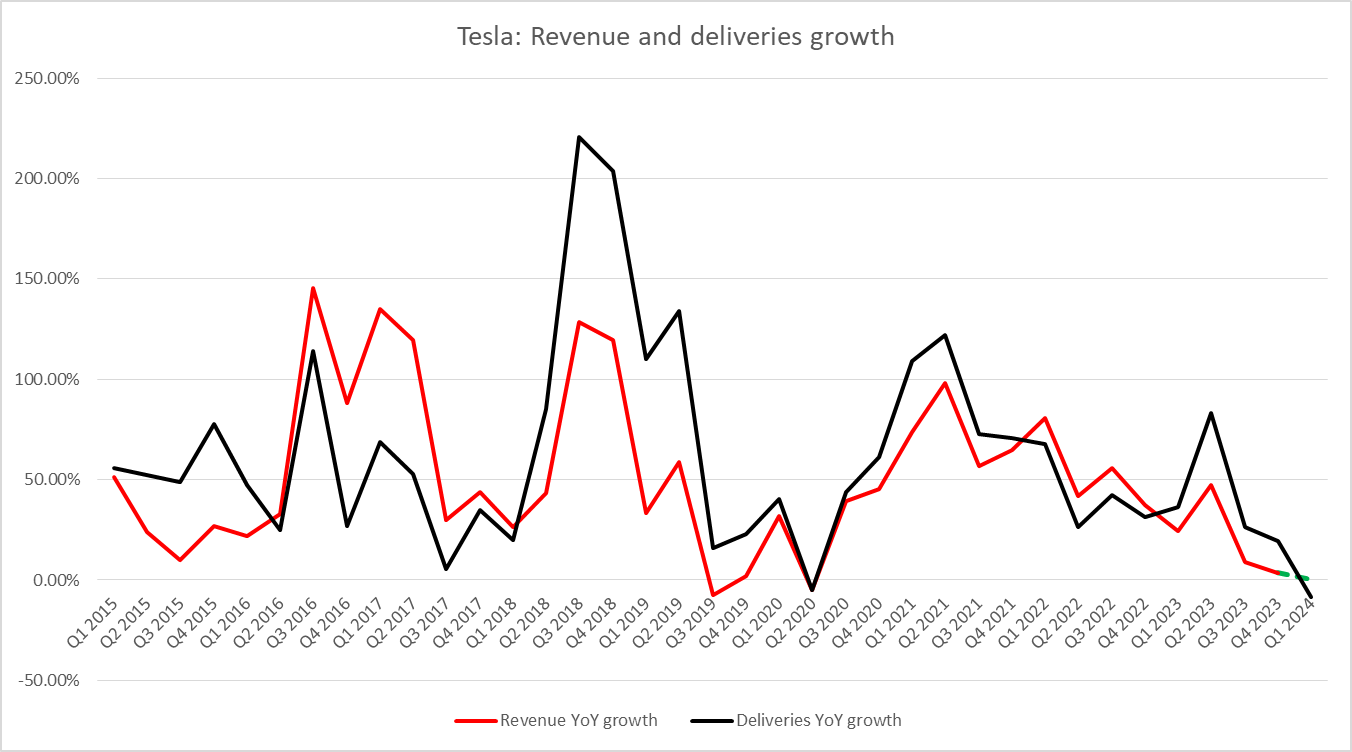

Tesla's revenue growth has been slowing in recent quarters, along with a slowdown in deliveries. However, will year-over-year drop in deliveries also results in lower year-over-year revenue in Q1 2024? Green color represents Q1 2024 revenue forecast. Source: Bloomberg Finance LP, XTB Research

Tesla's revenue growth has been slowing in recent quarters, along with a slowdown in deliveries. However, will year-over-year drop in deliveries also results in lower year-over-year revenue in Q1 2024? Green color represents Q1 2024 revenue forecast. Source: Bloomberg Finance LP, XTB Research

Price cuts and competition in China

Q1 delivery data was a strong suggestion that demand for Tesla vehicles is struggling. Investors have recently received another news supporting this view. Tesla announced price cuts of up to $2,000 per vehicle over the weekend, as well as cut prices of its self-driving software by around a third.

Companies do not have to encourage customers with price cuts if demand for their products is strong. Having said that, the latest move from Tesla seems to be a clear and another sign that demand outlook is deteriorating. Strong competition from Chinese EV manufacturers seem to be a prime reason behind weakness in Tesla fundamentals. However, Tesla competitors are unlikely to be fended off by price cuts. In fact, some Chinese EV manufacturers, like for example Li Auto (LI.US), have already responded with cuts to their vehicle prices.

Tesla needs to show that turnaround is in sight

As one can see from the paragraphs above, there are fundamental reasons behind the slump in Tesla's share price. Tesla was one of the pioneers in the EV industry, and the promise of EVs being the future of the automotive industry has sent its valuation into the sky. However, as industry matures and competition grows, Tesla struggles to keep its lead. Its Chinese EV competitors offer cheaper products, while its traditional automotive competitors enjoy higher profit margins.

Having said that, a beat in Q1 2024 headline results may not be enough to turn the tide for Tesla stock. Company will need to show that a turnaround is underway and the outlook is improving.

Tesla (TSLA.US) has been struggling, with its stock trading over 40% year-to-date lower. Share price plunged to a 15-month low yesterday, following price cut news. With fundamental picture deteriorating, the company will have a hard time convincing investors that good times are ahead. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.