- Goldman Sachs sees no downside risk to commodity prices despite the prospect of a banking crisis and sees an average 28% upside potential over the next 12 months;

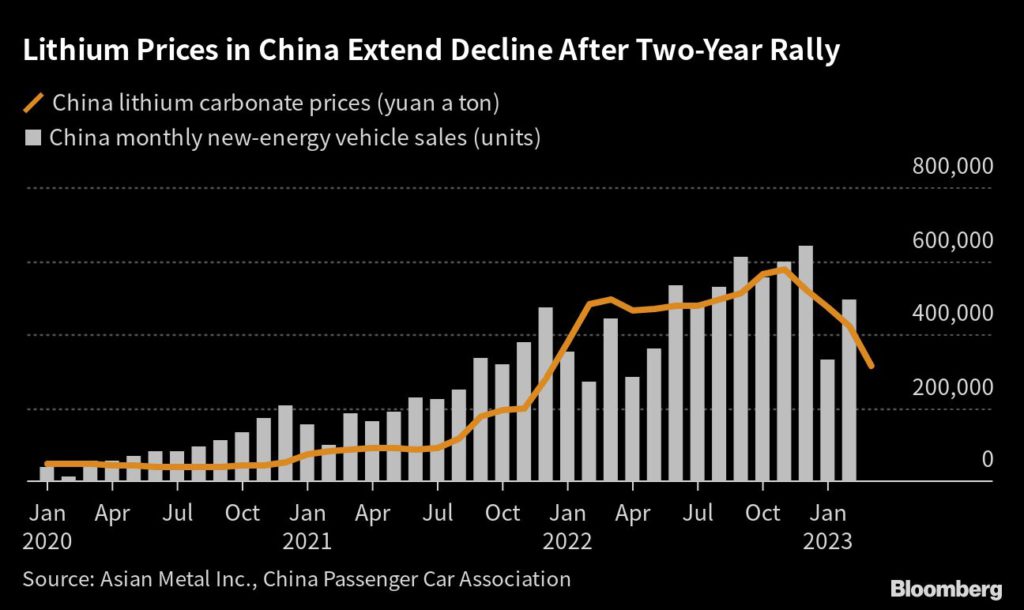

- Despite declines in lithium prices, demand for electric cars in China remains at higher levels due to the opening up of the Chinese economy and moderately loose monetary policy in the Middle Kingdom;

- The US has implemented the Inflation-Reduction Act (IRA) programme, which could lift demand for electric cars in the US. Energy prices have fallen convincingly that electric cars can be a competitive source of transport.

Albemarle (ALB.US) has been the largest supplier of lithium for electric vehicle batteries since 2020. Lithium prices are a key factor in the company's profitability - sentiment around its shares has deteriorated as they have fallen. Albemarle also specialises in niche chemical services (bromine, catalysts) but lithium accounted for 68% of its revenues in 2022. The company has issued optimistic forecasts for 2023 and expects demand to improve. The main risks appear to be the spectre of a financial crisis, tighter credit conditions for consumers and potential geopolitical risks arising from strained Washington-Beijing relations. The company has a manufacturing facility in China.

New plant and further higher demand?

Albemarle will invest US$1.3bn in a new lithium processing plant in the US, securing a domestic supply chain for the strategic raw material. According to the company, the plant will double its lithium processing capacity and help serve major customers (including Tesla, TSLA.US) who are reporting higher demand for batteries. The South Carolina plant will be able to process 50,000 tonnes of lithium per year (approximately 2.4 million EVs per year).The company sees the US as a major area for expansion thanks to, among other things, tax credits for electric cars. Construction of the giant project is expected to begin in late 2024; the company has not yet announced an opening date for the plant.

Despite falling lithium prices, the company expects demand to increase. In Q4 2022, the company's net margin was over 36%. The company aims to almost triple production capacity by 2027. In 2022, it reported revenue and EBITDA growth of 120% and 299% y-o-y, respectively. For the current year, Albemarle estimates significant sales growth in the range of 55% - 75% and operating cash flow of US$2.2bn. Despite business growth, the company's shares are still trading at attractive fundamental valuation ratios, at a discount to the average for US equities. P/E is 8 (Nasdaq average 19), C/Wk around 3 (Nasdaq average 4).

Lithium prices have fallen since Q4 2022 but higher EV sales in China have increased and may support a rebound. Source: Bloomberg

Lithium prices have fallen from a peak reached in late 2022 but still have long-term potential for a rebound. Source: Bloomberg Albemarle (ALB.US) share chart, D1 interval. The price has settled below the 38.2 Fibonacci retracement of upward wave started in march 2020 and now is trading below the SMA200 and SMA100. However fundamental valuation ratios contrary to technical analysis suggest that the current valuation of the company's business may be much more attractive. The PEG ratio is 0.6 against an average of 2.1 for the US chemical industry. Source: xStation5

Albemarle (ALB.US) share chart, D1 interval. The price has settled below the 38.2 Fibonacci retracement of upward wave started in march 2020 and now is trading below the SMA200 and SMA100. However fundamental valuation ratios contrary to technical analysis suggest that the current valuation of the company's business may be much more attractive. The PEG ratio is 0.6 against an average of 2.1 for the US chemical industry. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.