Prices reversed some of the previous week's gains—which were driven by expectations of a Chinese recovery and supply uncertainty from Russia—as the new week began. Last week, prices peaked near $70 per barrel, reaching their highest level in nearly two months, although gains were significantly curtailed by the end of Friday's session.

OPEC+ Strategy and Supply Overhang Risk

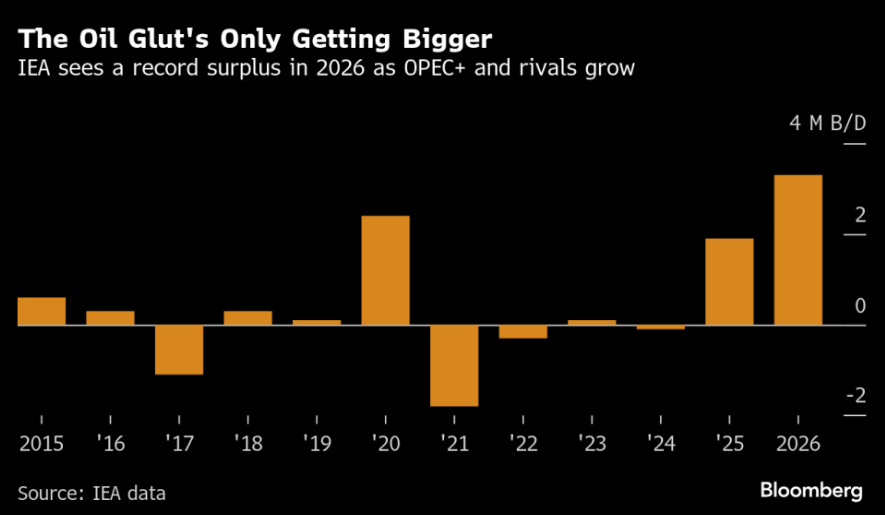

Unofficial reports over the weekend suggested that OPEC+ is considering another production increase from November, potentially exceeding the previously announced 137,000 barrels per day. Such a decision would continue the alliance's strategy to regain market share at the expense of its traditional role as a price regulator, raising concerns about a further surge in the global supply overhang. The IEA estimates that the surplus could reach as high as 3 million barrels per day next year. Under this scenario, Goldman Sachs estimates Brent and WTI could fall to the $50-$60 per barrel range.

IEA anticipates a massive supply overhang next year. Source: Bloomberg Finance LP

IEA anticipates a massive supply overhang next year. Source: Bloomberg Finance LPThis week, the statement from the Saudi Arabian Oil Minister on Wednesday will be crucial, as will the cartel's upcoming meeting scheduled for October 5. If plans to increase production limits are confirmed, a further decline in prices is possible, especially given the current period of seasonal inventory build-up.

Russian Risks Remain a Counterbalance

It is important not to overlook the persistent supply risks related to Russia. Over the weekend, Ukraine launched further attacks on Russian oil infrastructure, which could entrench domestic fuel shortages. However, reduced crude processing in Russia could also necessitate an increase in the export of crude oil itself—a negative factor for the market. Currently, up to 30% of Russia's refining capacity is offline, and storage capacity is limited. Therefore, to avoid shutting down production, Russia may be forced to increase its crude exports.

Furthermore, speculation suggests that Donald Trump has unofficially granted Ukraine permission to use US-supplied equipment for strikes deep inside Russia. This move implies potentially greater pressure on Russia. Trump is known to desire that countries like India and China cease purchasing Russian commodities.

Key Market Focus Points for Investors

-

Confirmation of the OPEC+ production increase decision at the meeting in the first week of October.

-

API and EIA data on inventory changes, which could reinforce or alleviate current supply pressure.

-

The pace of economic recovery in China and Europe as signaled by central banks.

Technical Outlook

Oil is currently testing the 50-period moving average near $64 per barrel. Should the price close today at current levels or lower, it would complete an Evening Star formation, indicating a continuation of the decline. However, if the price rebounds in the latter part of today's session, a retest of the $65-$66 per barrel range is possible. Source: xStation5

Oil is currently testing the 50-period moving average near $64 per barrel. Should the price close today at current levels or lower, it would complete an Evening Star formation, indicating a continuation of the decline. However, if the price rebounds in the latter part of today's session, a retest of the $65-$66 per barrel range is possible. Source: xStation5

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.