Resumen:

- La startup de criptomonedas Bakkt, una de las ICOs más conocidas, recauda 182 millones de USD ICE’s cryptocurrency trading platform Bakkt raises $182 million

- El Ethereum recupera la segunda posición en el ránking de criptomonedas con mayor volumen de mercado

- Segundo día de tendencia alcista en el mercado de criptos

The new year has started rather optimistically for major cryptocurrencies. Yesterday’s trading resulted in some rises, and these gains were extended for today’s trading as well. What’s interesting, we could notice some change at the list of the largest cryptocurrencies as Ethereum overtook Ripple, and it reached the second place again. According to CoinMarketCap, the capitalization of the whole cryptocurrency market stands around $130 billion handle while Bitcoin accounts for roughly 51% of this value.

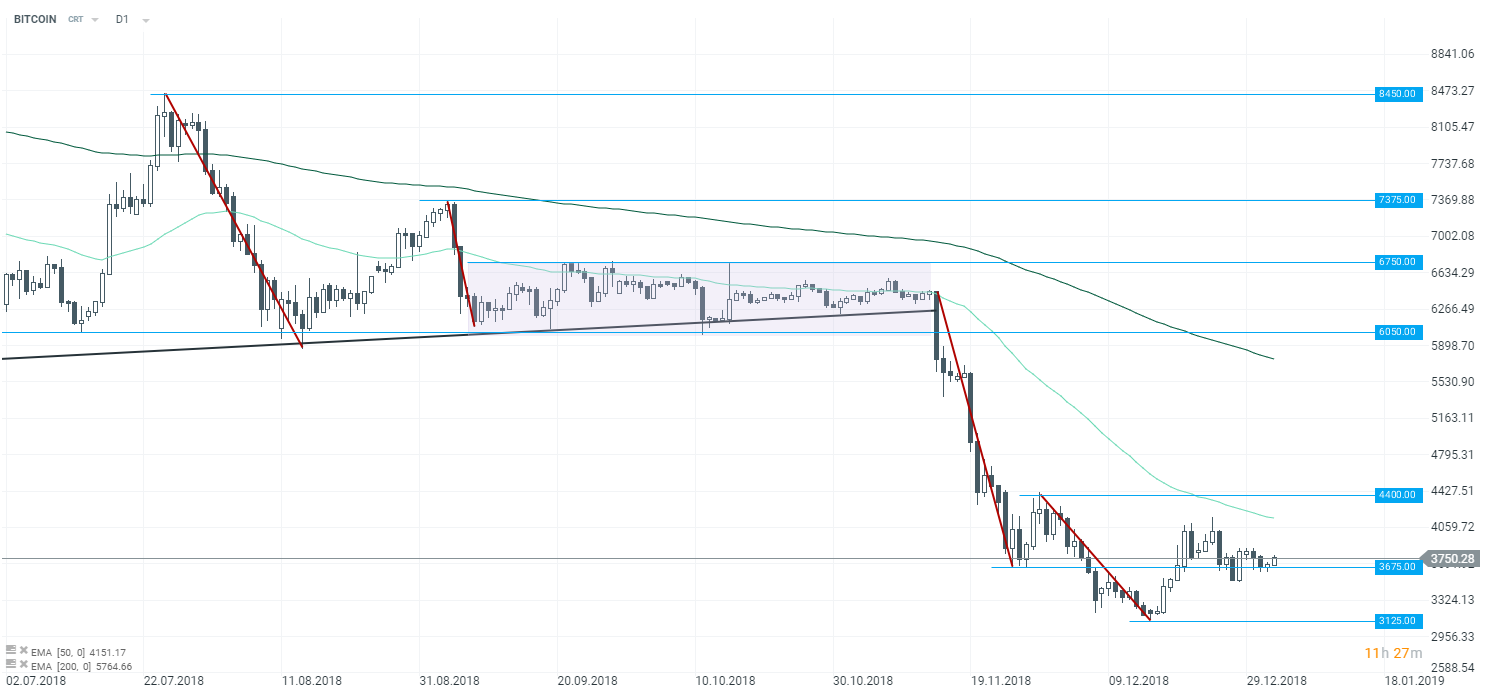

Bitcoin (BITCOIN on xStation5) has increased for a second day in a row. The largest digital currency is moving around the $3750 handle at the time of preparing of this analysis. Source: xStation5

Bitcoin (BITCOIN on xStation5) has increased for a second day in a row. The largest digital currency is moving around the $3750 handle at the time of preparing of this analysis. Source: xStation5

ICE’s cryptocurrency trading platform raises over $180 million

Intercontinental Exchange’s (which is well known as the New York Stock Exchange’s partner company) cryptocurrency trading platform called Bakkt has raised around $182 million from a group of 12 partners and investors in the first round of funding. The mentioned group includes, among others, Boston Consulting Group, Galaxy Digital, Goldfinch Partners, ICE, Pantera Capital and Protocol Ventures. Moreover, the ICE announced in a separate notice published on Monday that the launch of Bakkt had been delayed again. “The launch had previously been set for January 24, 2019, but will be amended pursuant to the CFTC’s process and timeline”, as Intercontinental Exchange reported in its communique.

Ethereum (ETHEREUM on xStation5) is among top gainers in the cryptocurrency market today. The cryptocurrency has risen nearly 8% thus far. Source: xStation5

Ethereum (ETHEREUM on xStation5) is among top gainers in the cryptocurrency market today. The cryptocurrency has risen nearly 8% thus far. Source: xStation5

Ethereum outstrips Ripple

Ethereum overtook Ripple, and it became the second largest cryptocurrency once again. Let us remind that Ethereum experienced a heavy sell-off in November, and the cryptocurrency hit nearly $80 in during the first half of December. However, Ethereum experienced also significant rises, and it is trading a notch below the $150 handle at press time. It means that the cryptocurrency increased from around $80 to around $150 during around two weeks. As a result, Ethereum surpassed Ripple, and it returned to the second place at the list of the largest virtual currencies which it was occupied by Ethereum for a long time in the past. Bear in mind that previous months were not so successful for this cryptocurrency, thus recent increases may have improved the Ethereum’s outlook only moderately.

The third largest cryptocurrency has experienced only a slight upward movement. Ripple (RIPPLE on xStation5) is trading in the vicinity of the $0.36 handle at press time. Source: xStation5

The third largest cryptocurrency has experienced only a slight upward movement. Ripple (RIPPLE on xStation5) is trading in the vicinity of the $0.36 handle at press time. Source: xStation5

"Este informe se proporciona sólo con fines de información general y con fines educativos. Cualquier opinión, análisis, precio u otro contenido no constituyen asesoramiento de inversión o recomendación en entendimiento de la ley de Belice. El rendimiento en el pasado no indica necesariamente los resultados futuros, y cualquier persona que actúe sobre esta información lo hace bajo su propio riesgo. XTB no aceptará responsabilidad por ninguna pérdida o daño, incluida, sin limitación, cualquier pérdida de beneficio, que pueda surgir directa o indirectamente del uso o la confianza de dicha información. Los contratos por diferencias (""CFDs"") son productos con apalancamiento y acarrean un alto nivel de riesgo. Asegúrese de comprender los riesgos asociados. "