The Nikkei (JP225) futures contract has enjoyed a strong bullish run, pushing the index to fresh all-time highs above the 43,000 mark for the first time in history and continuing to climb in recent sessions.

- Earlier gains were partially capped by mixed sentiment towards Japanese blue chips and automakers. However, today investors are once again optimistic about U.S.–Japan trade relations, supported by a favorable macroeconomic backdrop and solid corporate earnings from Japanese companies.

- Potential U.S. interest rate cuts could also provide a positive boost for Japanese businesses. Leading the rally are technology giant SoftBank, Sony Group, and semiconductor players Advantest and Renesas Electronics. Shares of premium tire maker Yokohama Rubber and footwear company Asics also surged following strong earnings.

- One ongoing risk for exporters is the potential appreciation of the yen, which appears increasingly likely should the U.S. embark on a series of rate cuts. However, if demand for Japanese goods holds or increases, strong order volumes could offset currency headwinds.

JP225 Chart (D1)

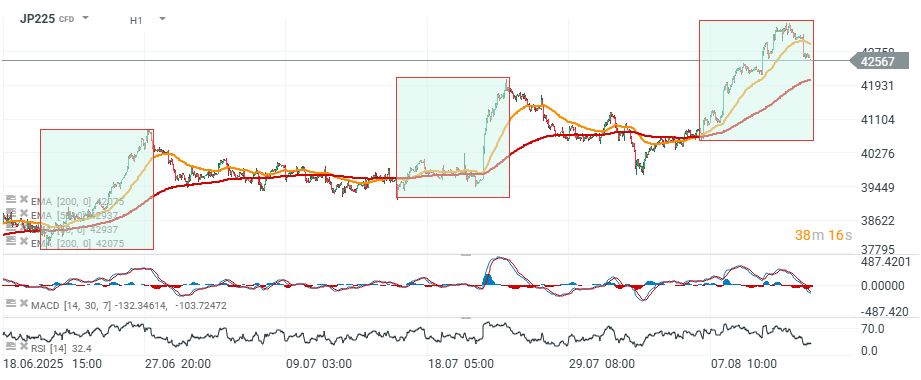

Today, sentiment is stabilizing and profit-taking is emerging, with the index down over 1% and retreating to its record 2024 levels. Volatility in JP225 may rise ahead of key U.S. macroeconomic releases this week (PPI, retail sales). The Nikkei’s RSI recently climbed above 70 (overbought territory) before easing to just under 65 today. On July 24, the RSI was also above 70, followed by four consecutive sessions of decline. Of course, such historical patterns are not a guarantee of future outcomes.

Source: xStation

JP225 Chart (H1)

Source: xStation5

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.