-

Cocoa bean exports from the Ivory Coast fell 31% year-over-year between October 1 and 19.

-

Cocoa futures recently hit 20-month lows.

-

Cocoa grinding data show a 17% year-over-year decline in Asia (the lowest level in 9 years) and an almost 5% year-over-year drop in Europe (the lowest in 10 years).

-

The North American grind report surprised with a year-over-year increase of more than 3%.

-

Cocoa prices are attempting to rebound from multi-month lows despite negative fundamental news.

-

Production in the 2025/2026 harvest season is expected to increase.

-

Cocoa bean exports from the Ivory Coast fell 31% year-over-year between October 1 and 19.

-

Cocoa futures recently hit 20-month lows.

-

Cocoa grinding data show a 17% year-over-year decline in Asia (the lowest level in 9 years) and an almost 5% year-over-year drop in Europe (the lowest in 10 years).

-

The North American grind report surprised with a year-over-year increase of more than 3%.

-

Cocoa prices are attempting to rebound from multi-month lows despite negative fundamental news.

-

Production in the 2025/2026 harvest season is expected to increase.

Cocoa (COCOA) is attempting to recover after a major sell-off that pushed the ICE contract below $6,000 per ton. The market’s biggest concern right now lies in the weak cocoa grind data from Asia and Europe (down by more than 17% and 4.8%, respectively), which indicates potential demand-side problems. On the other hand, data from North America showed an unexpected year-over-year increase of 3.2%, reaching almost 112.8 thousand metric tons.

Apart from the U.S. grind report—which initially had little market impact—the recent price rebound can be partly attributed to short covering, following signs of a slowdown in cocoa exports from the Ivory Coast, the world’s largest cocoa producer.

According to government data released on Monday, Ivory Coast farmers shipped 133,209 metric tons of cocoa from ports between October 1 and 19 of the new season, representing a 31% decline compared with 192,804 tons in the same period last year.

COCOA (D1 timeframe)

Grinding data suggest that the number of global buyers has fallen amid the parabolic price rally, which has sharply increased chocolate and derivative product prices. Meanwhile, the harvest season in West Africa has begun fairly successfully, and total yields are expected to rise significantly year-over-year.

Additionally, the governments of Ivory Coast and Ghana have recently raised the prices paid to farmers for cocoa beans, which should stimulate sales and boost supply. The RSI indicator on the hourly chart remains below 30, reflecting market pessimism about a medium-term price recovery. At the same time, much of the negative news for prices seems already priced in, while several potentially supportive factors—such as the decline in Ivorian exports and higher North American grindings—could offer a temporary balance.

Source: xStation5

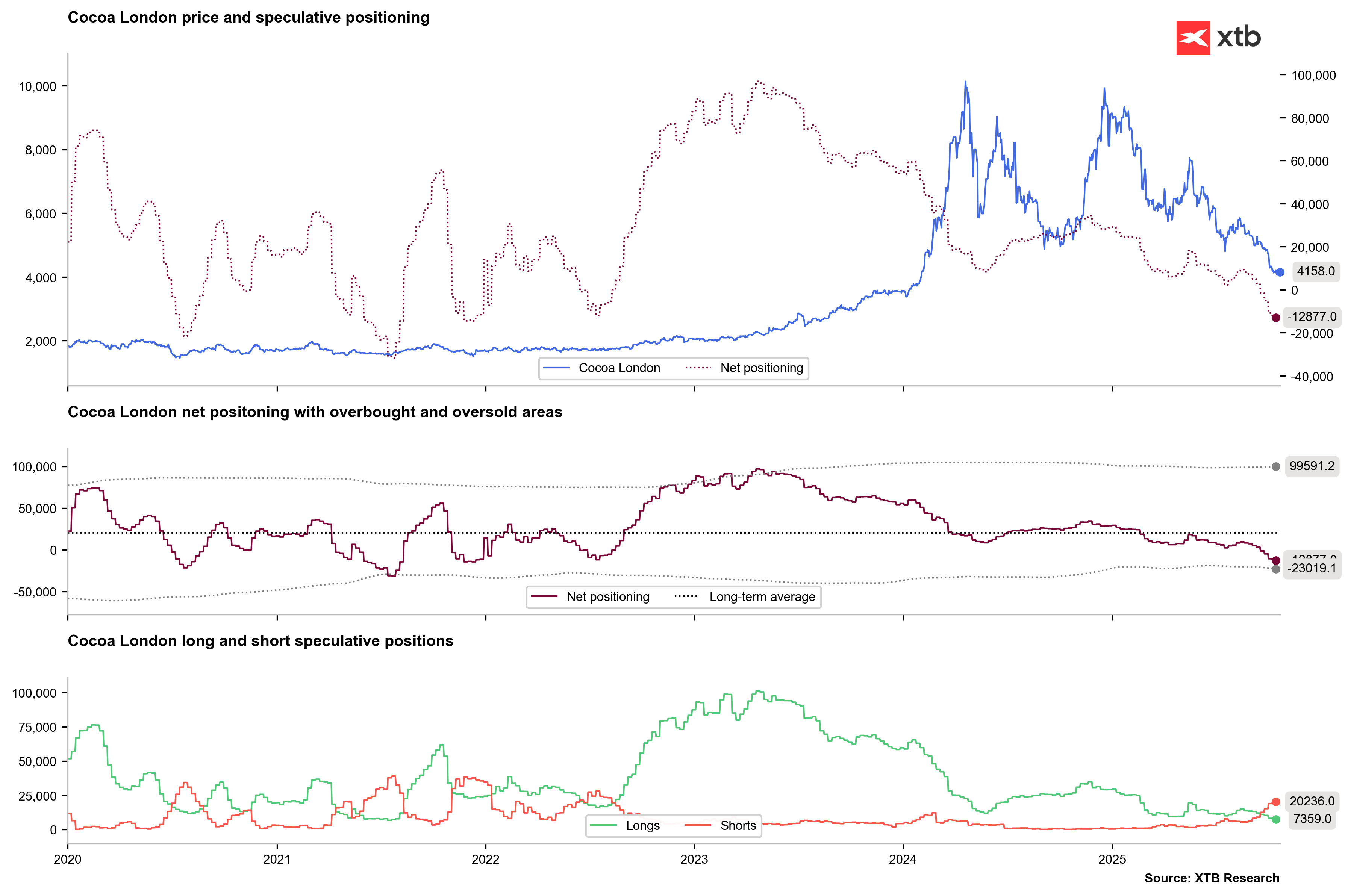

Looking at speculative fund positioning, data indicate that speculators have built their largest short position since autumn 2023; net positioning has fallen to levels signaling a “market oversold” condition.

Source: XTB Research, ICE Europe

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.