- Day starts with declines but optimism menadge to return onto market as the day go

- Nestle gains on promise to lay off 16,000 workers

- Large cumulation of reports from Sweden

- FOMC and EBC speeches likely biggest price-movers during later part of the day

- Day starts with declines but optimism menadge to return onto market as the day go

- Nestle gains on promise to lay off 16,000 workers

- Large cumulation of reports from Sweden

- FOMC and EBC speeches likely biggest price-movers during later part of the day

The European session began under the sign of trade-financial tensions related to relations with Russia and China, but also with good company results. Despite initial, slight declines in major indices, investors gradually regained optimism. As a result, around noon, most European markets managed to recover morning losses and turned slightly positive.

Noteworthy are the solid quarterly results published by TSMC, Nestlé, and Sartorius, which strengthened market sentiment. After the session ends, three large Scandinavian companies: Industrivärden, Investor, and Nordea Bank will present their quarterly reports. The results of these companies may have a significant impact on sentiment in the region. Investors interested in the local market should closely follow these publications.

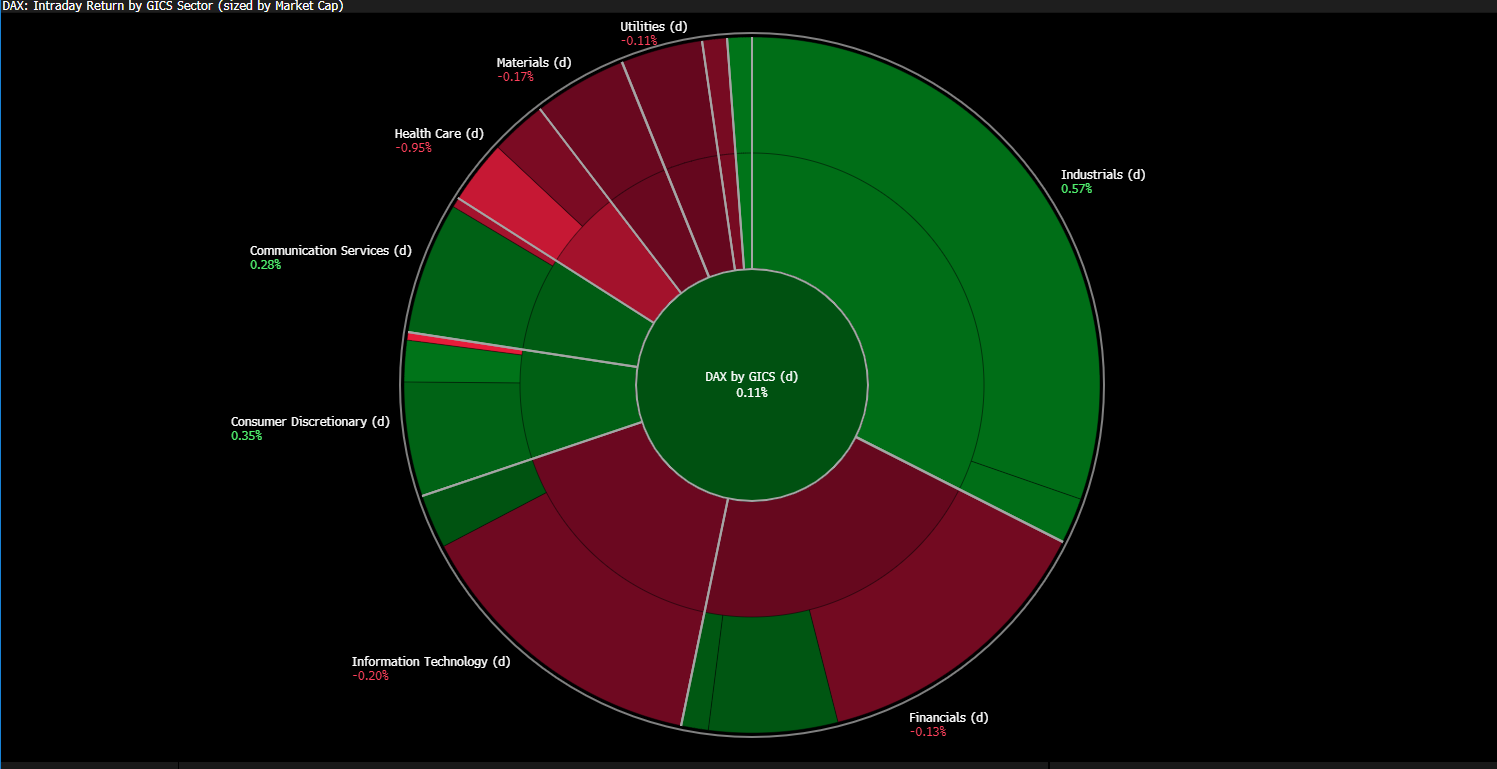

Source: Bloomberg Finance Lp

The biggest contributor to today's growth is clearly industry, while Healthcare pulls the indices lower.

Macroeconomic Data:

Additionally, the latest data on trade balances of European Union countries confirmed the ongoing export surpluses.

In the second half of the day, investors will closely follow speeches by members of the FOMC and ECB.

The market will also be waiting for the EIA report on oil inventories, which may influence the further direction of commodity prices and market sentiment. Moderate declines in inventories are expected.

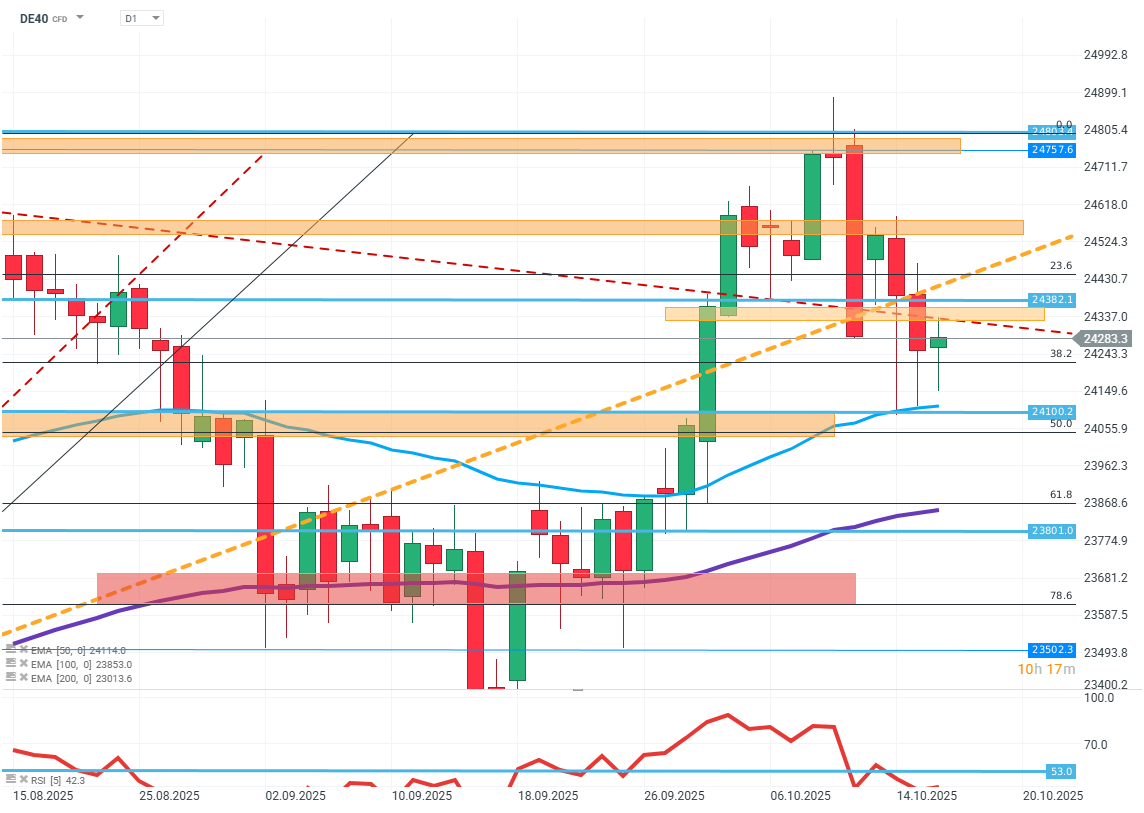

DE40 (D1)

Source: xStation5

The stock price remains around a clear resistance near 24,380 points, but buyers show significant weakness as the price visibly slips below the zone and struggles to stay above. Currently, the price is around the FIBO 38.2 level and below it can rely on support from EMA50 and FIBO 50, the level towards which the price is currently heading. For buyers, it is essential to break above the FIBO 23.6 level to regain initiative on the chart.

Company News:

Nestlé (NESN.CH) — The Swiss conglomerate published its results for the first 3 quarters today. The company's financial results were decent, close to expectations. The company recorded slight growth in most areas of activity. However, what caused nearly an 8% increase in stock was the plan to lay off 16,000 employees over the next 2 years. The layoffs are mainly expected to affect the administration area.

Sartorius (SRT.DE) — The energy company published an optimistic sales forecast. The company sees a 7% increase in sales next year. The stock price is rising by as much as 3%.

Kering (KER.FR) — The British retailer received a negative recommendation from an investment bank. The stock, after yesterday's gains, is depreciating by almost 3%.

flatexDEGIRO (FTK.DE) — The German investment services provider reports revenue growth to 550 million euros, beating analysts' expectations. The company is growing by over 5%.

Kinnevik (KINVB.SE) — The Swedish investment firm improved its results after recent losses and reported a net profit of 741 million Swedish kronor compared to a 1.9 billion kronor loss a year ago. The company's shares are rising by over 6%.

Repsol (REP1.ES) — The Spanish energy company received a negative recommendation from Morgan Stanley, pointing to Shell and Total as better energy integrators in Europe. The stock price is falling by over 1%.

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.