- Futures contracts on US stock indices are not showing any significant price changes ahead of the opening of the cash market in Europe. JP225 contracts rose slightly after the weekend elections in Japan.

- The Japanese yen rose at the start of Monday's session following the results of the Japanese upper house elections.

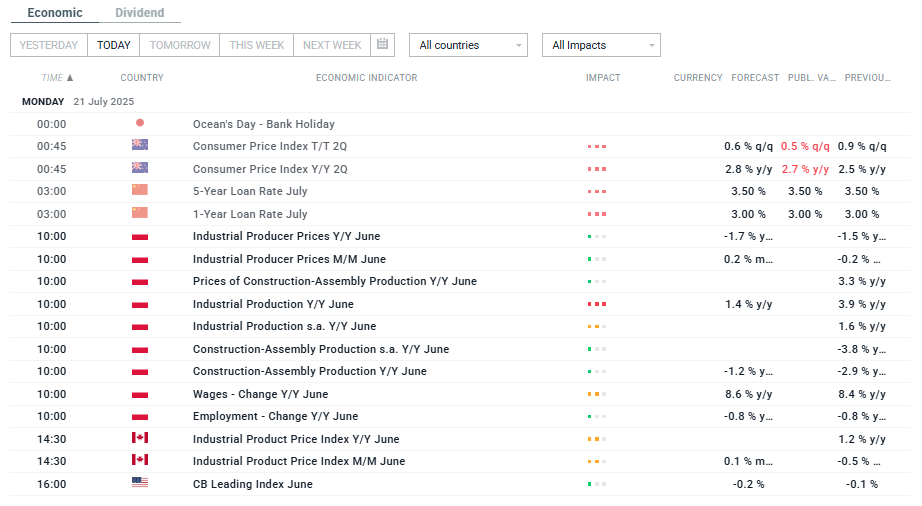

- Investors' attention will turn today to data from the Polish labor market and industrial price data in Canada.

We are starting a new week on the financial markets. The main topic of the first part of the session is the elections in Japan, which confirmed the loss of the majority in the current ruling coalition, although the scale of this weakness was lower than investors had expected before the weekend.

In terms of data releases, Monday may be quiet (except for numerous releases from Poland), so investors' attention may turn to corporate news and possible reports on global customs changes.

Below is a detailed macro calendar for today's session:

Economic calendar: US CPI in the spotlight (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.