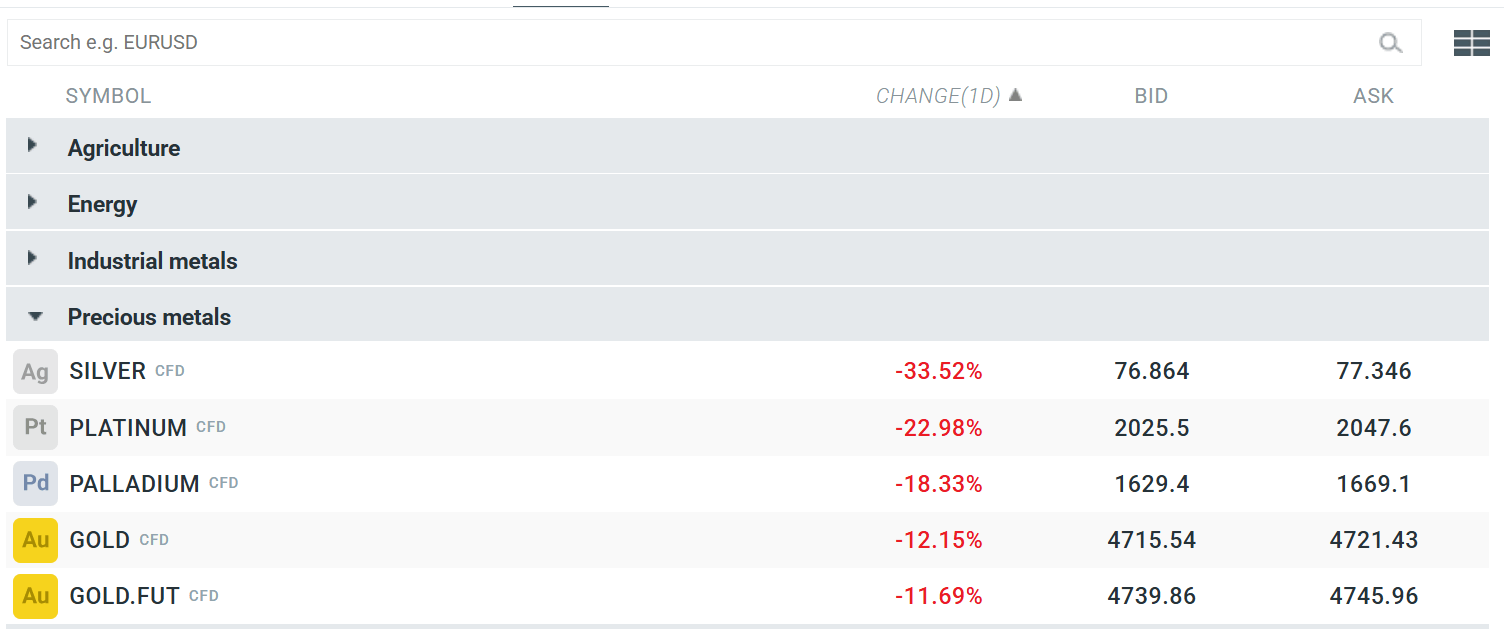

Gold and silver are experiencing unprecedented declines, closing the most difficult day in their modern trading history. Gold has already lost more than 12% of its value, falling to $4,716/oz. Silver is doing even worse, falling by as much as 34% to $76.5/oz, which is the worst daily percentage result in the history of trading this commodity, surpassing even the famous Hunt brothers' crash of the 1980s. The market lost nearly $10 trillion in capitalisation in just 24 hours, clearly indicating the bursting of the speculative bubble that had been forming over the last few months of a frenzied bull market fuelled by fears of inflation, political uncertainty and massive purchases by central banks.

Despite the dramatic correction, current levels remain historically high – gold at £4,716 is still an unimaginably high price compared to previous years. Analysts point to technical support below the £4,000 level, where long-term investors and "strong hands" ready to buy the dip may step in. The market is waiting for several critical catalysts: Trump's decisions on Iran, the Supreme Court's ruling on tariffs, and Kevin Warsh's first public comments as the newly elected head of the Fed, which may signal a new direction for monetary policy.

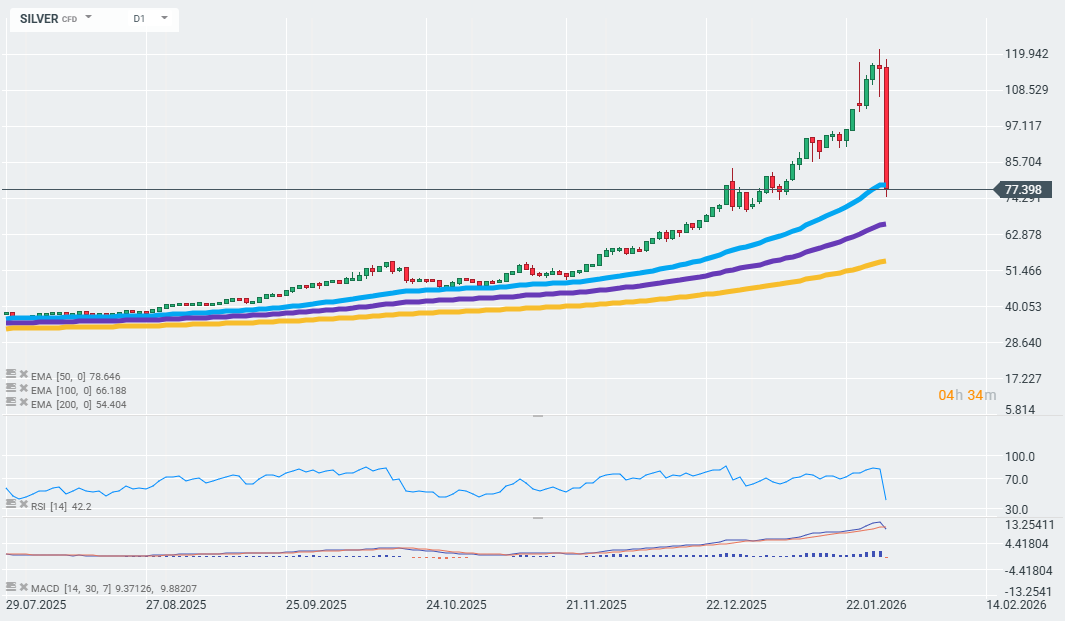

Source: xStation

SILVER is currently testing the long-term support marked by the 50-day EMA.

Source: xStation

Daily Summary: Precious metals are bleeding, and the US government is shut down again!🔒

⚠️Gold pares losses

Daily summary: A historic day for precious metals; SILVER loses 30%; USD gains 💡

Three Markets to Watch Next Week (30.01.2026)

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.