- Earnings well above consensus

- Record contract from Poland

- Margin expansion

- Company split into segments

- Earnings well above consensus

- Record contract from Poland

- Margin expansion

- Company split into segments

Kongsberg Gruppen (not to be confused with Kongsberg Automotive), a Norwegian defence manufacturer, published its results today, after which the company is posting a fantastic gain of around 15% in a single session. The Oslo-listed company had been stuck in place in terms of valuation for quite some time, despite strong gains across the entire European defence sector driven by large-scale rearmament. It is possible that today’s results mark the end of this price stagnation.

The Q4 results leave little doubt:

Revenue rose to NOK 16.8bn, beating market expectations, and operating profit reached NOK 2.46bn, exceeding consensus by 5% and 22%, respectively. The operating margin increased from 12.7% to 14.7%.

The company’s core business, "Defence and Aerospace”, increased sales by 44% year on year, while also lifting the margin to 18.7%.

Kongsberg specialises primarily in air-defence systems and airspace surveillance. In the face of the persistent threat from Russian drones, these products are in greater demand than ever. This is reflected in a bill-to-book ratio of 2.8. A major part of the large order intake comes from Poland. Kongsberg has been selected as one of the companies expected to deliver the “San” system, designed to protect Polish airspace and the eastern border. The total value of the project is approx. PLN 15bn (around NOK 40bn), although it is not yet known what share of this amount may accrue to Kongsberg.

The company’s management also shared a number of highly important points for shareholders:

- The company committed to a generous dividend policy on the back of record profits.

- In addition, the company’s “Maritime” segment, which has lower margins, is to be carved out of the company.

- Company representatives also assure that ongoing rearmament efforts will continue to benefit Kongsberg and its shareholders.

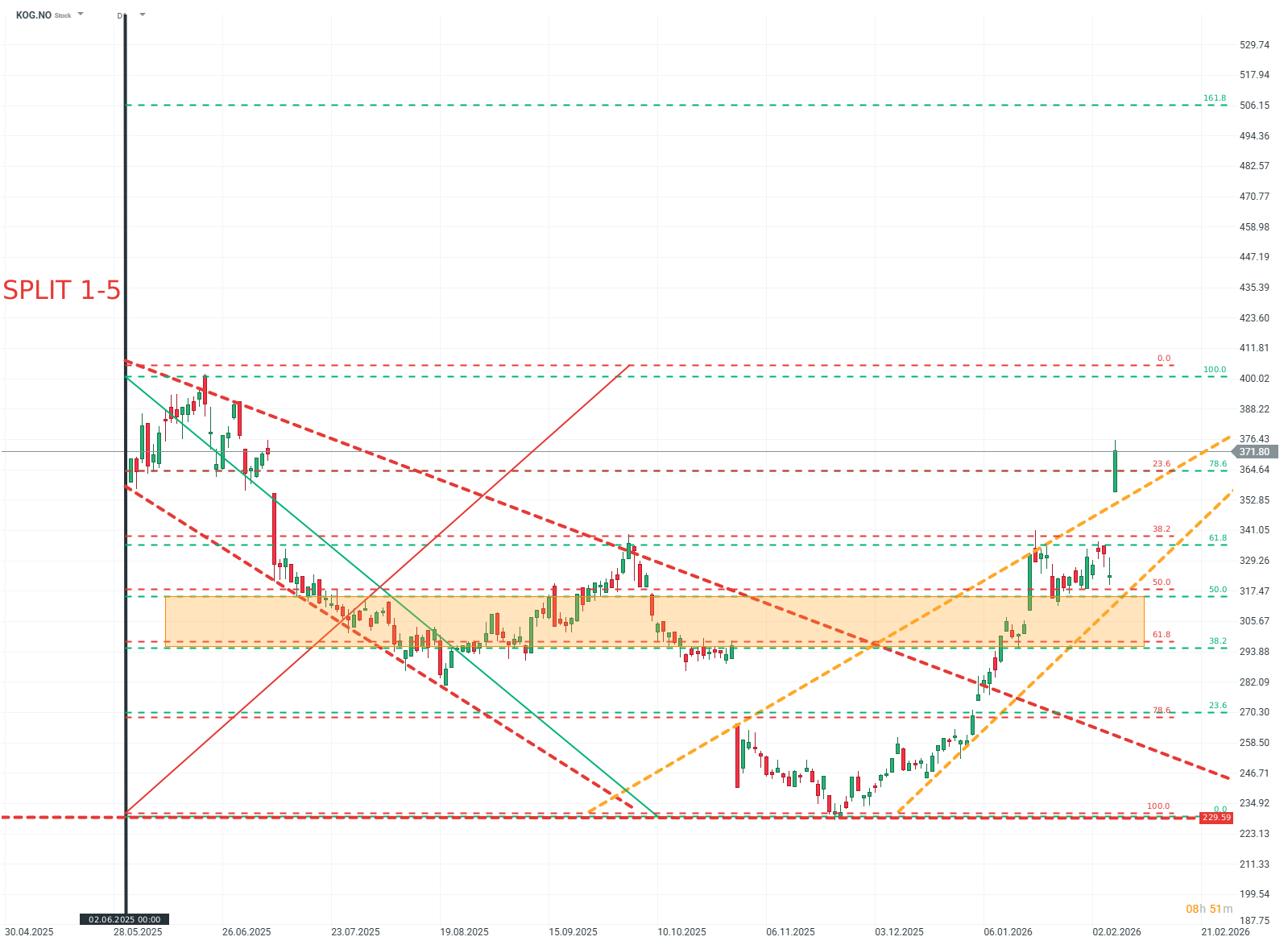

KOG.NO (D1)

After reaching local lows at the turn of 2025/2026, the valuation rebounded from the 230 level and has been rising steadily, with an observable acceleration of the trend in recent weeks. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.