-

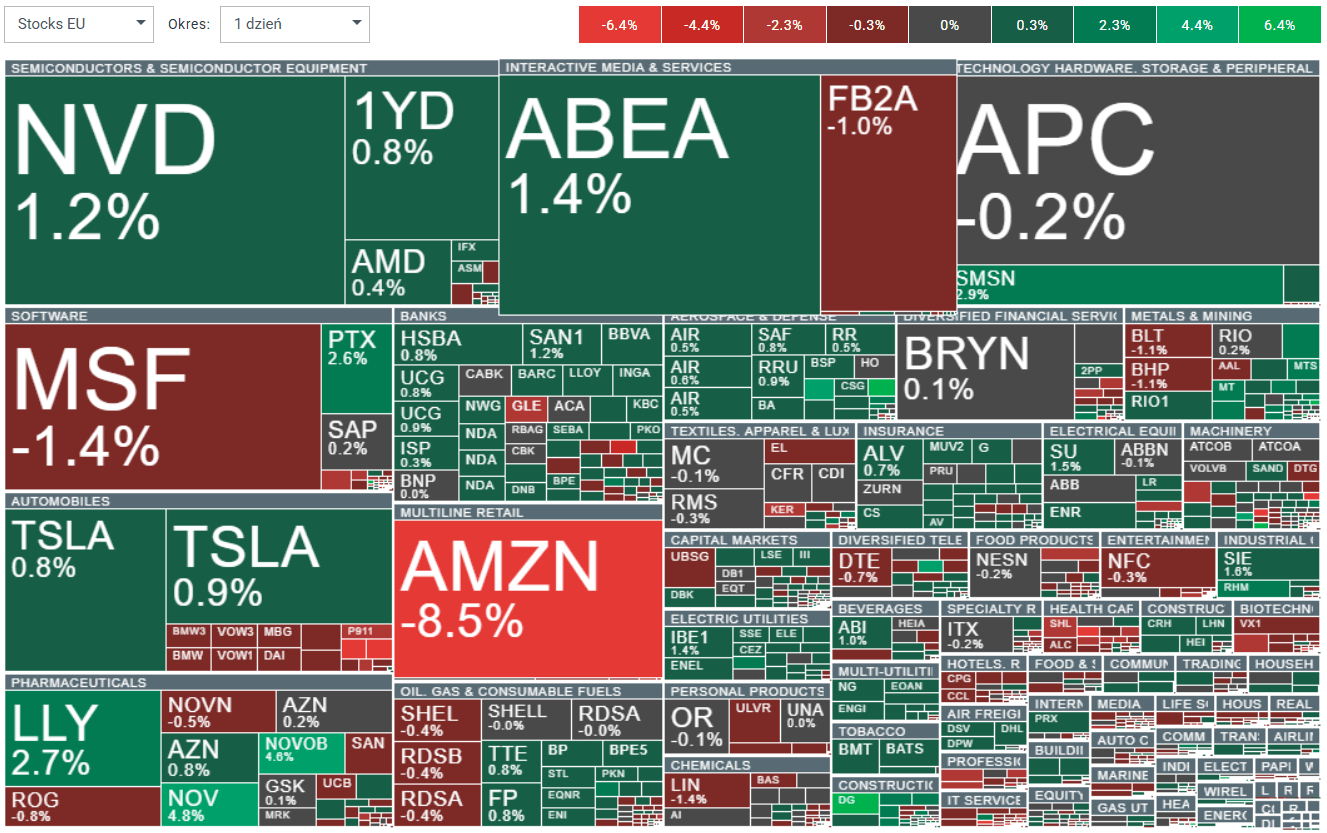

European stocks and indices started Friday with a mildly positive tone. Futures on the Euro Stoxx 600 are up 0.40%, reflecting a calmer mood after a volatile US session.

-

The broader global backdrop remains fragile following a weak close on Wall Street. US equities saw a very sharp selloff on Thursday, and moves across asset classes pointed more to heightened volatility than to a clear risk-on or risk-off environment.

-

BNP Paribas noted that quality stocks are no longer expensive and could begin to outperform if economic growth holds up. The bank highlighted that valuations have retraced toward long-term averages.

-

The MSCI Europe Quality Index is trading around its long-term average forward P/E, while the Stoxx 600 appears slightly more expensive on that basis. The valuation premium for top-quality companies has fallen to around 20%, close to the lower end of its range over the past 12 years.

-

Barclays, however, is cooling enthusiasm around a return of quality stocks as market leaders, arguing that a clear catalyst is still needed. The bank points out that capital positioning in the sector remains elevated while sentiment is weak.

-

Barclays also stresses that macro fundamentals continue to favor value stocks. Stabilizing real interest rates, improving macro data, and fiscal stimulus keep the risk-reward profile for value attractive, despite the recent rise in valuations.

-

JPMorgan’s models indicate an “early recovery” phase, which typically benefits value stocks, small caps, and higher-risk strategies. The bank believes that easing monetary policy and a weaker dollar will continue to support cyclical stocks at the expense of defensives, with value leading the market.

-

German macro data highlighted how difficult it remains to revive industrial momentum. Industrial production fell 1.9% m/m in December, well below expectations.

-

Weakness was concentrated in cyclically sensitive segments. Output excluding energy and construction dropped 3.0%, driven mainly by autos (-8.9%) and machinery and equipment (-6.8%). Energy production fell 1.8%, while construction rose 3.0%.

-

Despite the weak December print, the quarterly picture still suggested a small positive contribution to growth. Output in Q4 2025 was about 1% above the previous quarter’s average, consistent with GDP growth of roughly 0.3% q/q — with full details due on February 25.

-

There were also signs of improving demand that could support a gradual recovery in the second half of 2026. Industrial orders jumped 7.8% in December, the strongest increase in two years, and the Ifo business climate index for manufacturing improved at the start of 2026, although it remains at low levels.

-

Bloomberg Economics expects only modest growth in early 2026 before fiscal spending delivers a stronger boost later in the year. Forecasts point to 0.2% GDP growth in Q1 2026 and 0.3% in Q2 2026, with a sharper acceleration in the second half driven by infrastructure and defense investment.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.