US stock futures fell on Friday as investors waited for President Trump’s decision on the next Federal Reserve chair. Markets are increasingly pricing in Kevin Warsh as the likely Fed pick, following reports he may be Trump’s choice. However, European stocks are performing well, with German DAX up almost 0,5% (supported by 4% Adidas shares rebound) and slightly gaining British FTSE and French CAC40.

S&P 500 futures dropped almost 1%, Nasdaq 100 futures sank 1.2%, and Dow futures slid 0.7%, pointing to another risk-off session (especially for tech). The most important macro data scheduled for today will be US PPI at 12:30 PM GMT and Chicago PMI 1:45 PM GMT

-

Kevin Warsh is viewed as relatively hawkish, with a history of being tougher on inflation, although he has recently supported rate cuts, aligning more with Trump’s messaging.

-

Trump reportedly met Warsh at the White House on Thursday and said he would announce his Fed nominee on Friday morning.

-

The US dollar strengthened as betting shifted toward Warsh, while Treasury yields moved higher, led by the 30-year yield (+5 bps).

-

Gold and silver sold off sharply, cooling what had been an overheated rally.

-

Gold fell heavily (roughly 4–7% intraday, depending on the moment).

-

Silver plunged dramatically (over 10%, with some reports noting even deeper drops).

-

Platinum also dropped steeply (around 10%+).

-

-

Bitcoin and most crypto assets stayed under pressure. Sell-side notes from today:

-

Peel Hunt initiates Aviva at Buy, highlighting diversified scale supporting ROE in the high teens.

-

Oddo BHF upgrades Worldline to Neutral, citing a more credible recovery plan through 2030.

-

-

European companies headlines:

-

Adidas ADRs rise as preliminary Q4 profit beats expectations.

-

Swatch FY operating profit misses estimates.

-

Signify Q4 comparable sales miss; strategic review launched.

-

Raiffeisen dividend beats estimates; sees stable profitability.

-

CaixaBank raises 2025–27 targets; Q4 net income beats; proposed cash dividend €0.3321/share.

-

Other notable updates include results/outsized moves from SKF, Atoss Software, Electrolux, Scatec, Airtel Africa, Billerud, WDP, and more.

-

-

Ratings changes:

-

Upgrades: Accesso Technology, Aena, Fraport, Fugro, Jenoptik, SEB, Worldline.

-

Downgrades: Alma Media, Antofagasta, Carrefour, Grenergy Renovables, Kojamo, Orion, Pandora, Stolt-Nielsen, Suominen, WAG Payment, Whitbread.

-

-

Beyond the Fed story, trade tensions are back in focus:

-

Trump threatened a 50% tariff on Canadian aircraft imports.

-

He also warned the US could decertify new jets from companies like Bombardier, citing certification barriers against US Gulfstream jets.

-

Mexico may face new levies after Trump pledged tariffs on countries supplying oil to Cuba.

-

-

Big Tech earnings were mixed, and Apple’s report did little to lift sentiment:

-

Apple shares were flat premarket after beating profit expectations, supported by record iPhone sales.

-

CEO Tim Cook warned that a global memory shortage could pressure future margins.

-

-

Sandisk (SNDK.US) surged 20% premarket after strong results and upbeat guidance, extending a massive YTD rally. Earnings pare share came in almost 100% higher than expected.

-

The company cited surging demand tied to AI-driven memory and storage needs, with a big jump in its data center segment.

-

-

The day’s key earnings to watch include Exxon and Chevron (before the open), plus American Express and Verizon.

-

Despite the volatility, major US indexes were still mostly up for the week, and all were tracking January gains, with the Dow slightly lagging.

-

Perplexity reportedly signed a $750M, three-year cloud deal with Microsoft Azure, expanding beyond its longtime reliance on AWS and gaining access to frontier models via Microsoft’s Foundry ecosystem.

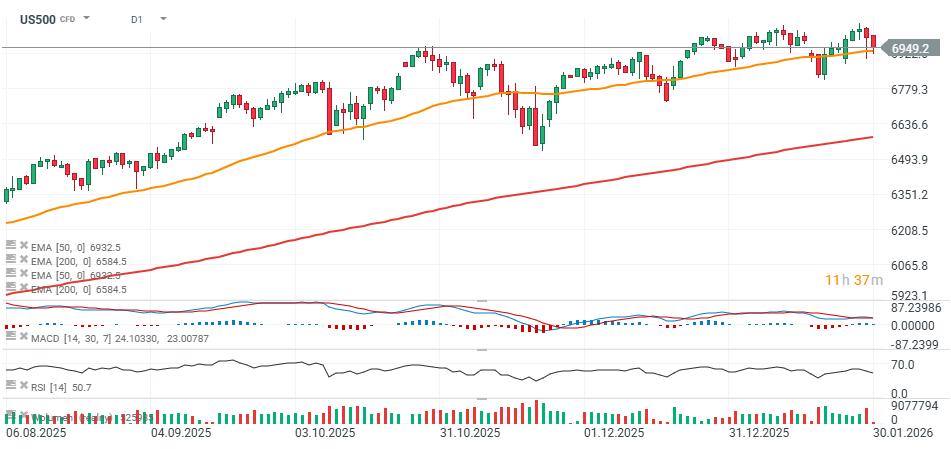

Charts of the US500 and DE40 (D1 interval)

Source: xStation5

Source: xStation5

Daily Summary: Precious metals are bleeding, and the US government is shut down again!🔒

The Oracle paradox. Huge investments and the paradox of growing debt

Palantir Preview: Perfection already priced in?

US Open: America rises, precious metals fall!

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.