Record-Breaking Financing and Its Purpose

Oracle has announced plans to raise record-breaking financing of up to USD 50 billion in 2026, primarily intended for the expansion of Oracle Cloud Infrastructure (OCI) and the development of artificial intelligence projects. The objective is to support contracts with the world’s largest global clients, including AMD, Nvidia, Meta, OpenAI, TikTok, and xAI.

The scale of the investment is unprecedented: the expansion of OCI infrastructure may absorb 80–90% of the capital raised, while AI-related projects could account for an additional 10–20%. For comparison, Oracle’s total annual revenue amounts to approximately USD 50 billion, meaning the company plans to raise nearly the equivalent of one full year of revenues to finance its ambitious strategy. In practice, this implies that the pace and execution of investments must be tightly and precisely controlled to avoid excessive cost escalation and further debt accumulation.

Financial Condition and Debt Burden

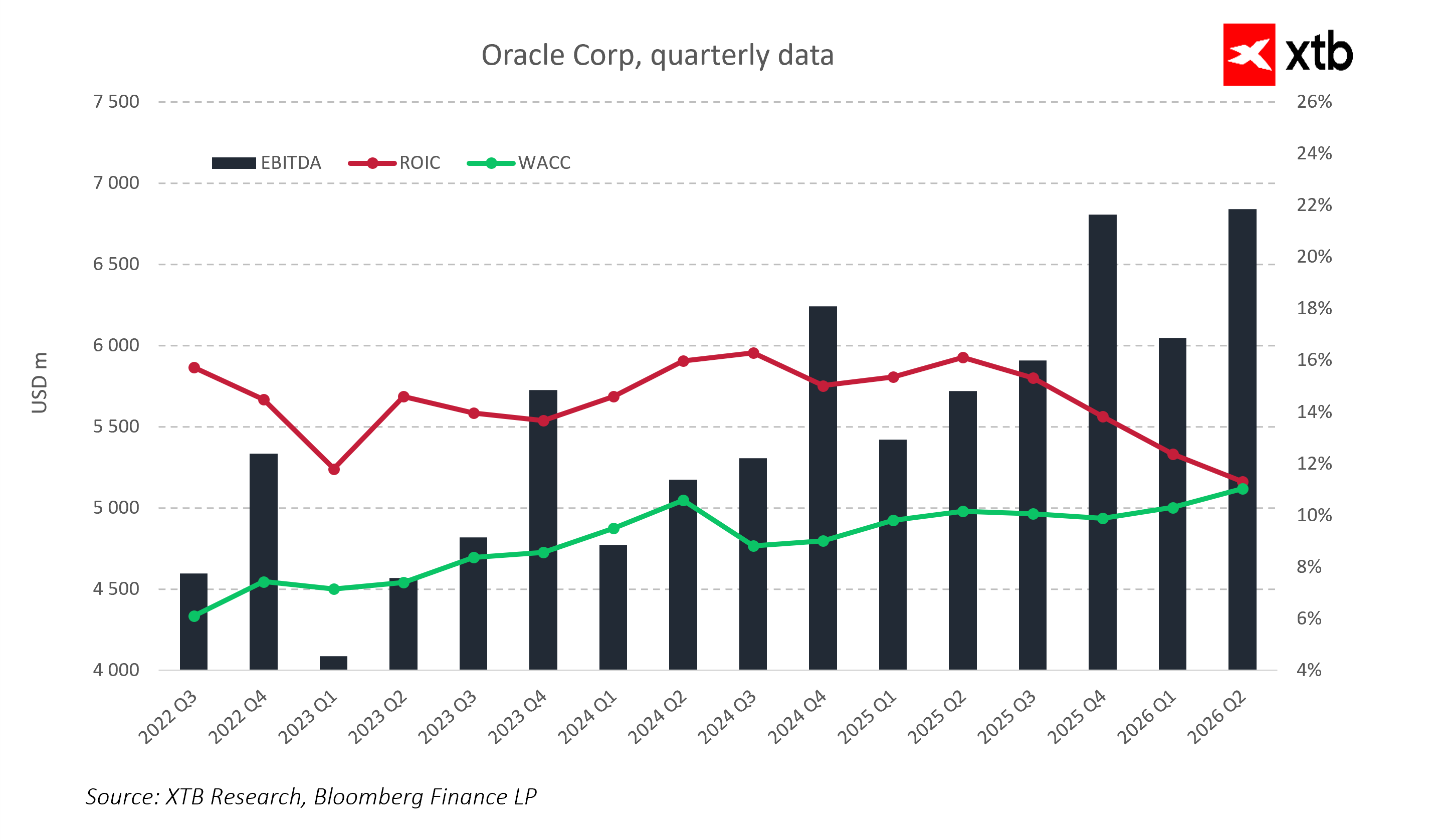

The data show a systematic increase in EBITDA, confirming the growing scale of Oracle’s operating activities. At the same time, ROIC has been gradually converging toward WACC, suggesting a narrowing spread between returns on invested capital and the cost of capital. This dynamic increases the company’s sensitivity to further debt growth and rising financing costs, despite improving operating performance.

Oracle already carries a high level of debt, with debt servicing costs amounting to approximately 4–5% annually of total debt. With total debt in the range of USD 40–50 billion, this translates into USD 1.6–2.5 billion per year in interest expenses. As a result, even with an assumed 15–20% annual revenue growth, net margins may be materially compressed.

In addition, the planned issuance of new shares of up to USD 20 billion implies dilution of existing shareholders, potentially reducing the value of current holdings by approximately 15–20% in the short term, before the market fully assesses the long-term value of the investments. In effect, Oracle is balancing between the need for capital and mounting pressure on profitability.

Credit Risk and Financial Stability

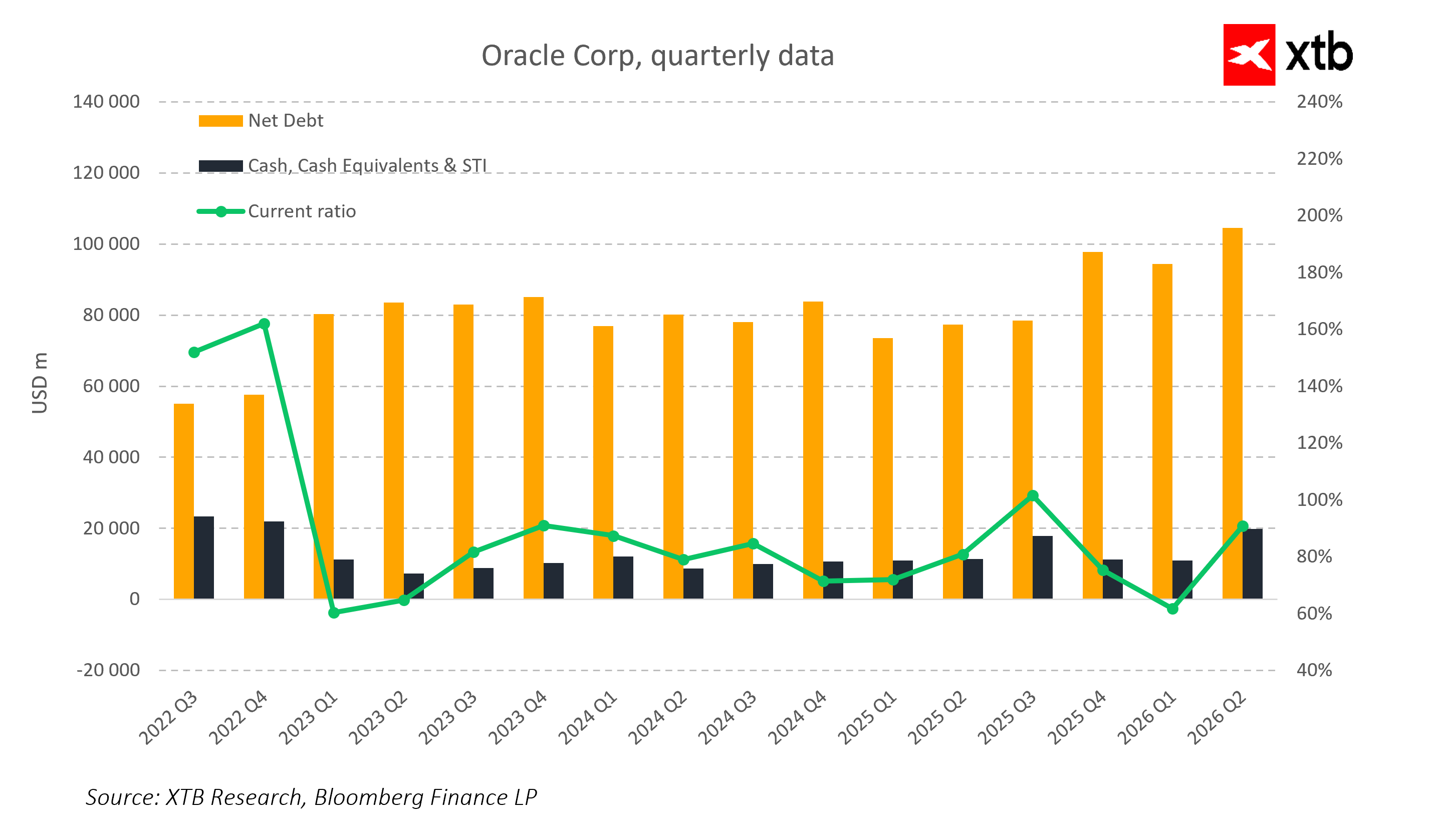

The balance sheet structure points to a clear increase in net debt while cash levels remain relatively stable. The current ratio remains volatile and periodically approaches the lower bound of comfort, suggesting limited liquidity flexibility. Further increases in debt financing could therefore materially elevate the company’s credit risk.

Source: Bloomberg

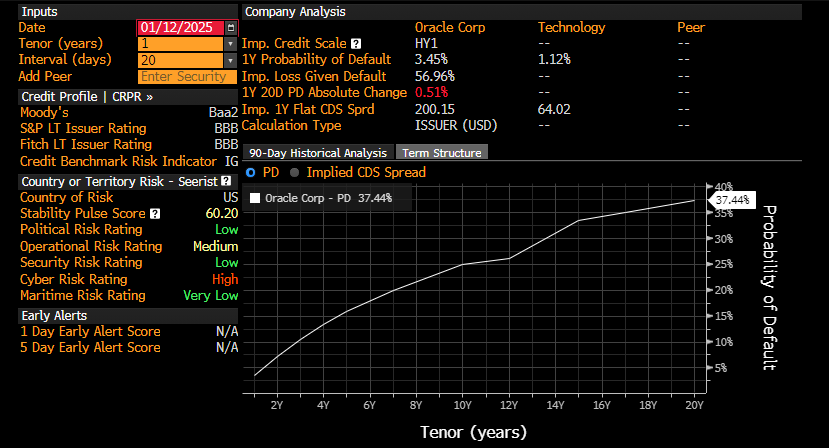

Oracle’s current credit ratings (BBB / Baa2) place the company at the lower end of the investment-grade spectrum. The projected 20-year probability of default of approximately 37% indicates that the risk of financial distress in the event of further debt accumulation is relatively high.

Strategic Dilemma – A Financial Trap

Oracle faces a serious strategic dilemma. If the company does not increase investment spending, revenues could decline by 10–15% over the next 2–3 years due to contract losses and a deterioration in competitive positioning.

Conversely, if Oracle chooses aggressive debt-financed expansion, debt servicing costs could absorb 15–20% of annual revenues. Under such a scenario, despite 15–20% annual revenue growth driven by AI and cloud projects, free cash flow may increase insufficiently, significantly constraining Oracle’s ability to pursue further investments and reinvestment in growth.

This highlights that Oracle has entered a “financial trap”, where each strategic choice entails tangible risk—either declining revenues or excessive balance-sheet strain.

Strategic Opportunities and Risks

Over the long term, Oracle faces both substantial opportunities and significant risks. Infrastructure expansion and AI development could drive 15–20% annual revenue growth, enabling the execution of multi-billion-dollar contracts with global technology leaders.

At the same time, high debt servicing costs may consume 15–20% of annual revenues, and free cash flow must at minimum cover debt servicing requirements to maintain financial stability. The risk of losing investment-grade status or the need for rapid infrastructure scaling could further intensify cost pressures and reduce profitability.

Key Conclusions

Oracle stands at a strategic crossroads. Cost-intensive investments in AI and cloud infrastructure are essential to maintaining market position, but they simultaneously and materially increase financial risk and balance-sheet pressure.

In an optimistic scenario, Oracle’s shares could stabilize and grow by 5–10% annually, supported by 15–20% revenue growth and controlled debt costs. In a pessimistic scenario, the stock could experience a sharp short-term correction if financing costs rise and revenues fail to keep pace with the scale and speed of investment execution. The coming years will determine Oracle’s position in the global technology race and its ability to manage finances effectively under conditions of elevated leverage.

Palantir Preview: Perfection already priced in?

US Open: America rises, precious metals fall!

US500 rebounds after the sell-off📈Wall Street earnings season analysis🗽

Gaming companies with huge discounts 🚨 Will Project Genie end the traditional era of gaming ❓

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.