-

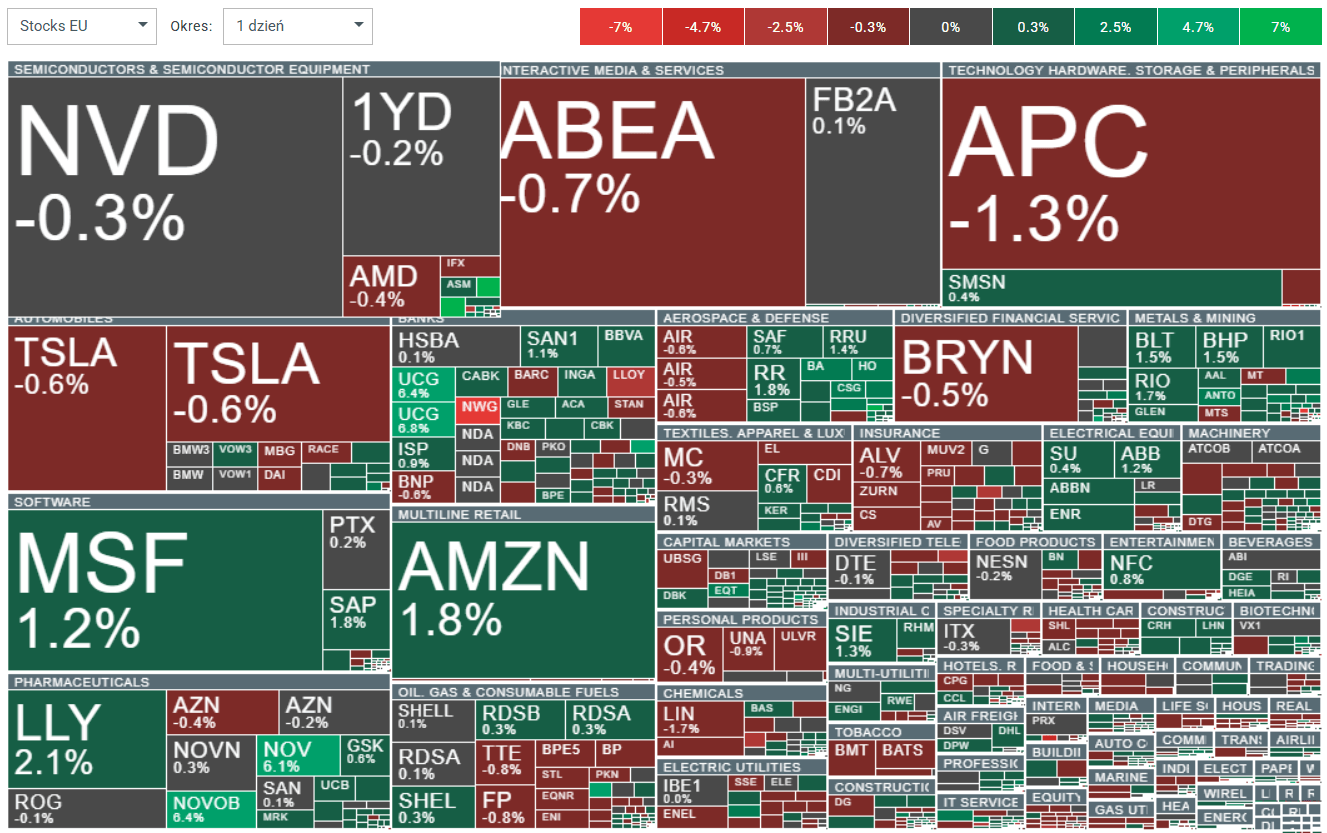

European equities held on to modest gains, but market tone remained selective and highly differentiated. Quarterly earnings are generally solid, yet investors are reacting critically even to small deviations from guidance, highlighting a still demanding market environment compared with US equities.

-

At the time of writing, the Stoxx 600 is up 0.25%, remaining near record-high levels. Germany’s DAX gains 0.23%, Italy’s ITA40 rises 0.98%, Spain’s SPA 35 adds 0.35%, while the UK’s UK100 declines 0.60%.

-

Companies in the Stoxx 600 are on track for roughly 8% EPS growth in 4Q; 61% have beaten EPS expectations and 58% have exceeded revenue forecasts. Despite this, upside potential for the index remains limited, as market reactions are often negative and 2026 guidance has failed to meet elevated expectations.

-

Tariff-sensitive companies delivered the strongest earnings beats in a year, while China-exposed names and purely EU-focused companies underperformed. Value, growth, and quality stocks beat expectations more consistently than momentum and small caps.

-

AI-risk niches under pressure: software, data services, publishers, financial information providers, alternative asset managers, and gaming stocks declined as markets priced in medium-term margin risks from AI-related disruption.

Key single-stock moves (Europe)

-

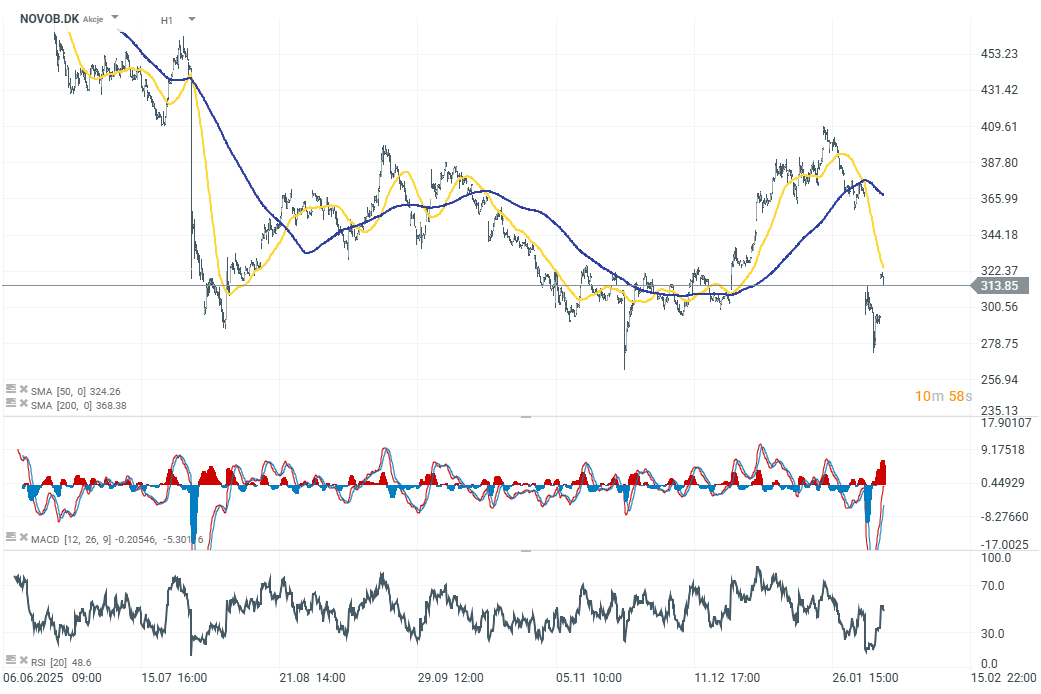

Novo Nordisk rebounds +7% after last week’s nearly 25% correction, following Hims & Hers’ announcement that it will stop selling Wegovy copies after the FDA tightened enforcement.

-

UniCredit rises +4% after presenting strong outlooks through 2030 and plans to return around €50bn to shareholders by 2030.

-

InPost surges +13% on takeover interest valuing the company at €7.8bn.

Global macro

-

Japan’s ruling LDP secured a supermajority, keeping the Takaichi trade in focus and reinforcing expectations of fiscal expansion.

-

The proposed two-year suspension of the food sales tax is seen as highly likely and is estimated to create a ~¥5trn annual fiscal gap, with key implications for bonds and FX.

-

The yen strengthened following verbal intervention by Japanese authorities. USDJPY is down 0.50%, and the yen is among the stronger G10 currencies despite Takaichi’s decisive victory.

-

Precious metals remain strong: gold is testing the $5,000 level, up 1.0% on the day, while silver gains 2.40% to $97.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

BREAKING: US jobless claims slightly higher than expected

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.