- US2000 is the top gainer among U.S. indices today, up 0.9%.

- Trump is considering three more candidates for the position of Federal Reserve Chair.

- Scott Bessent says U.S. interest rates should fall by as much as 175 basis points.

- The U.S. dollar is losing ground, while precious metals futures are rising; in the large-cap market, AMD stands out with a 6% gain, along with fashion company Capri Holdings.

US2000 (D1 chart)

Russell 2000 futures (US2000) are climbing to 3,313 USD, a level last seen in February 2025. The index is currently testing key resistance zones linked to supply concentration and price reactions. EMA50 (orange line) remains the key support level.

Source: xStation5

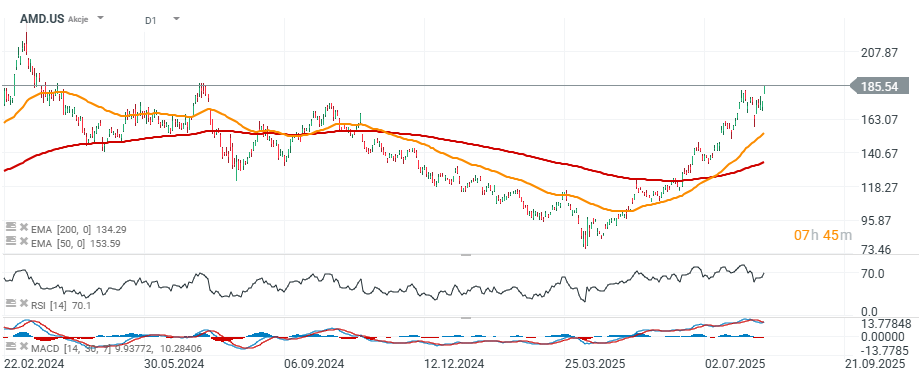

AMD (AMD.US) shares are up nearly 6% to 185 USD, matching local highs from July 2024. Citi analysts today maintained a ‘neutral’ rating on the stock.

Source: xStation5

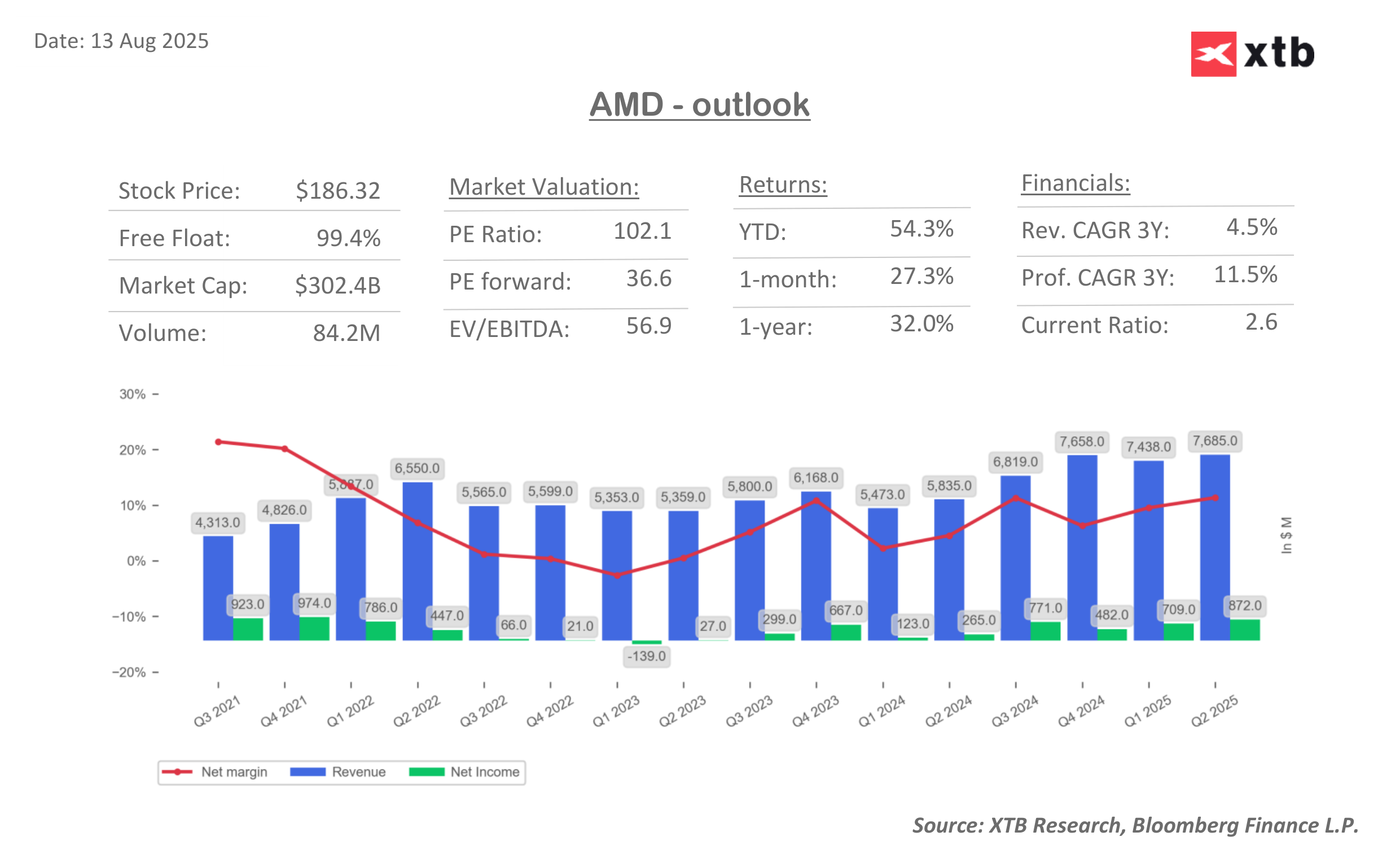

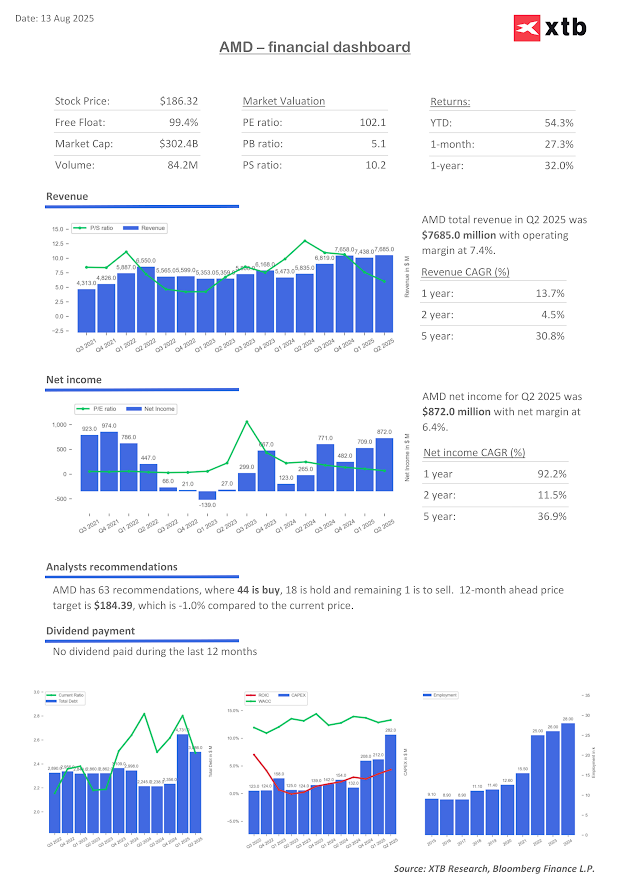

While AMD was relatively attractively valued six months ago, today the stock is approaching all-time highs, with investors paying a massive premium—100 times annual earnings and 37 times expected 12-month profits. The market, however, believes the company will capture a significant share of the AI chip market, which could materially and sustainably improve profitability.

Source: XTB Research, Bloomberg Finance L.P.

Company News

-

C3.ai Inc. (AI.US) slips after Oppenheimer downgraded the stock from “outperform” to “market perform,” following recent preliminary results viewed as weak.

-

Cadre Holdings Inc. (CDRE.US) falls after BofA Global Research cut its rating on the safety equipment maker from “neutral” to “underperform,” citing concerns about “slow growth and the current M&A environment.”

-

Capri Holdings (CPRI.US) gains 7% after JPMorgan upgraded the Michael Kors owner from “neutral” to “overweight,” noting that fewer markdowns and tariff mitigation measures should boost earnings.

-

HanesBrands (HBI.US) drops nearly 6% after Gildan Activewear agreed to acquire the company in a deal with an implied equity value of about $2.2 billion. Gildan shares see slight gains.

-

Intapp Inc. (INTA.US) jumps over 20% after the software services company reported fourth-quarter results beating expectations and issued a well-received outlook.

-

KinderCare (KLC.US) plunges 20% after the childhood education company reported disappointing Q2 results, citing lower-than-expected enrollment and cutting its full-year forecast.

-

Lumentum (LITE.US) rises 4% after the optical and photonic products maker posted better-than-expected Q4 results, prompting an analyst upgrade.

-

Palo Alto Networks (PANW.US) gains nearly 2% after Deutsche Bank upgraded the cybersecurity firm from “hold” to “buy.”

-

SimilarWeb (SMWB.US) surges over 20% after the web services company reported Q2 revenue above expectations and raised its full-year adjusted operating profit forecast.

-

Webtoon (WBTN.US) soars over 30% in premarket trading after the digital comics platform announced a deal with Disney (DIS.US) to bring around 100 series to its English-language app.