- Wall Street traded lower ahead of the FOMC minutes

- Weak Chinese data deteriorate market sentiment

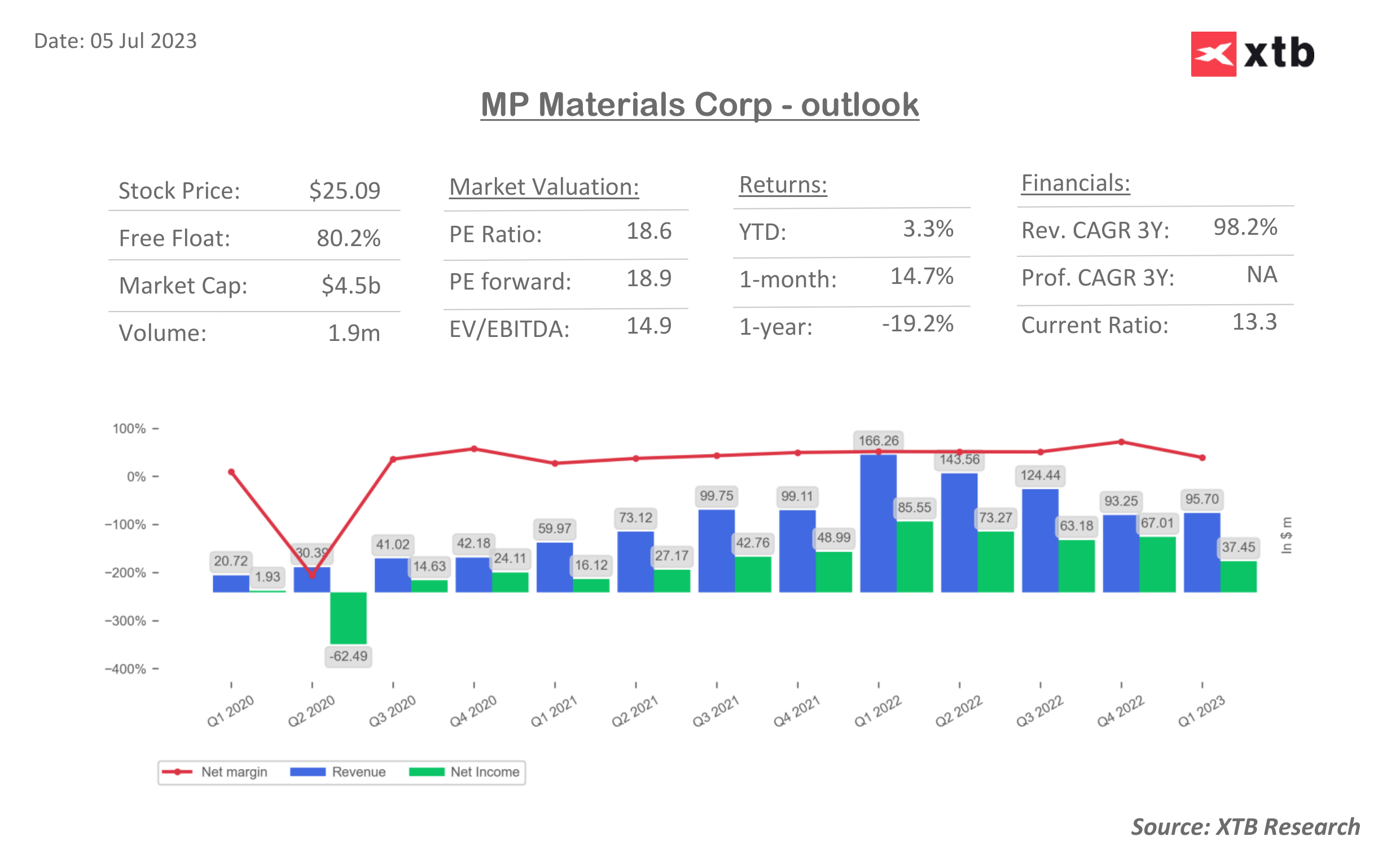

- MP Materials (MP.US) gains after China’s move to restrict export of critical minerals

Wall Street indices launched today's trading slightly lower. Nasdaq and SPX were almost 0.2% lower at the opening while Dow Jones dropped 0.4%.

Market sentiment deteriorated after disappointing data from China undermined risk appetite, leading to a decrease in market confidence. China witnessed a slower growth rate in its services sector last month, surpassing expectations and reaching its lowest level since January. This decline in growth was attributed to reduced consumer spending.

Investors have tempered their expectations for gains in Asian equities this year due to diminishing optimism surrounding the possibility of looser monetary policy and concerns about China's economic outlook. A survey conducted by Bloomberg suggests that the MSCI Asia Pacific Index is projected to reach 174 points by the end of the year, reflecting a 5% increase from its closing level on Tuesday. This forecast is lower than the prediction of 178.5 from a similar survey conducted three months prior.

A struggling Chinese economy could potentially worsen conditions in the US. However, on the other hand, it also exerts downward pressure on global prices of various commodities and weighs down inflation figures.

US equities categorised by sector and industry. Size represents market capitalisation, the leaders among large-cap companies are Google (GOOGL.US), Tesla (TSLA.US), and Meta (META.US). Source: xStation5

US equities categorised by sector and industry. Size represents market capitalisation, the leaders among large-cap companies are Google (GOOGL.US), Tesla (TSLA.US), and Meta (META.US). Source: xStation5

US500 is currently consolidating near a resistance level at 4485 points. If it breaks above this level, the next resistance zone is anticipated around 4550 points. Alternatively, if the resistance holds, the price may decline towards the 4300 level. With the upcoming release of the FOMC minutes, higher volatility on indices should be expected.

Company News:

- Netflix (NFLX.US) gains 1.2% as Goldman upgrades the streaming service to neutral, saying management has executed its password sharing crackdown more effectively than expected.

- Rivian (RIVN.US) rises as much as 2.2% after the company started delivering the electric vans it makes for Amazon.com Inc. to Europe — its first commercial shipments outside the US.

- Wolfspeed (WOLF.US) jumps 13% after Renesas Electronics makes a $2 billion deposit to secure a 10-year supply commitment of silicon carbide bare and epitaxial wafers from the chipmaker.

- MP Materials (MP.US) gains 8% after China’s move to restrict exports of rare earth specialty materials germanium and gallium.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.