Key Takeaways

- E-commerce and advertising account for the majority of Amazon’s revenue, making the company sensitive to consumer health and economic cycles.

- Amazon’s shares have recently underperformed other members of the Magnificent Seven, as investors view the company’s “classic” businesses as a relative weakness amid the AI frenzy.

- The high-margin Amazon Web Services unit is growing at roughly 20% year over year, and the company remains a leader in infrastructure-level AI services.

- AWS’s growth pace still trails rivals such as Google Cloud and Azure. Margins are compressing due to heavy investment in AI data centres and logistics.

- In Q2, North America grew more slowly than other regions, and recent U.S. data point to a cooling labour market.

- Amazon’s share price may be more sensitive to softer macro data; on the other hand, expected Fed rate cuts could more than offset that effect.

- Since the April 2025 sell-off, Amazon is up 35% vs. 26.5% for the S&P 500, but year-to-date performance remains soft (3% vs. nearly 15% for the S&P 500).

- Over the past five years, Amazon shares have risen 41% versus a 95% increase in the S&P 500.

- The company will report third-quarter results on Thursday, 30 October 2025. Fed rate cuts could bolster U.S. consumer spending and support Amazon’s business.

Key Takeaways

- E-commerce and advertising account for the majority of Amazon’s revenue, making the company sensitive to consumer health and economic cycles.

- Amazon’s shares have recently underperformed other members of the Magnificent Seven, as investors view the company’s “classic” businesses as a relative weakness amid the AI frenzy.

- The high-margin Amazon Web Services unit is growing at roughly 20% year over year, and the company remains a leader in infrastructure-level AI services.

- AWS’s growth pace still trails rivals such as Google Cloud and Azure. Margins are compressing due to heavy investment in AI data centres and logistics.

- In Q2, North America grew more slowly than other regions, and recent U.S. data point to a cooling labour market.

- Amazon’s share price may be more sensitive to softer macro data; on the other hand, expected Fed rate cuts could more than offset that effect.

- Since the April 2025 sell-off, Amazon is up 35% vs. 26.5% for the S&P 500, but year-to-date performance remains soft (3% vs. nearly 15% for the S&P 500).

- Over the past five years, Amazon shares have risen 41% versus a 95% increase in the S&P 500.

- The company will report third-quarter results on Thursday, 30 October 2025. Fed rate cuts could bolster U.S. consumer spending and support Amazon’s business.

Amazon shares rose more than 1.5% on the first day of Prime Big Deal Day, versus a 1.1% gain for the Nasdaq 100 and 0.5% for the S&P 500. That may reflect growing optimism about a potential improvement in the e-commerce business heading into the company’s seasonally crucial holiday fourth quarter. In recent months, the stock has traded in a relatively narrow range, almost ignoring the S&P 500’s best second quarter in decades.

Year to date, Amazon shares are up just under 3%, compared with a 15% rise for the S&P 500 and nearly 20% for the Nasdaq 100. Is the company approaching a turning point that could regain investor attention and push the share price higher? Will heavy AI investments start to pay off in the form of higher volumes and stronger advertising revenue?

A Time for Growth—and a Test

Amazon is investing heavily in artificial intelligence and has forged a strategic partnership with Anthropic. Investors now want to see tangible impact from these investments on the operating business. Events like Prime Big Deal Day, the upcoming Black Friday, and the broader holiday season will serve as a real-world test of whether AI is materially improving performance (comparable to Meta Platforms) and whether it can support margins in the lower-margin, traditional retail segment.

We may only know how well Amazon passed this test in early 2026. That said, the Santa rally and the historically strong fourth quarter for U.S. indices could already boost interest in e-commerce and advertising profitability at Amazon this quarter.

Such momentum could help offset concerns about AWS margins and support the shares. The impact would likely be stronger if the Fed continues to push monetary easing, leaving more cash in consumers’ pockets. Along the way, Amazon could also benefit from potential tariff-related cash distributions to Americans; Donald Trump has recently reiterated that a one-off ~$2,000 per person could be possible. Why has Amazon underperformed lately? Here’s what the last quarter revealed.

What Did the Latest AMZN Report Show?

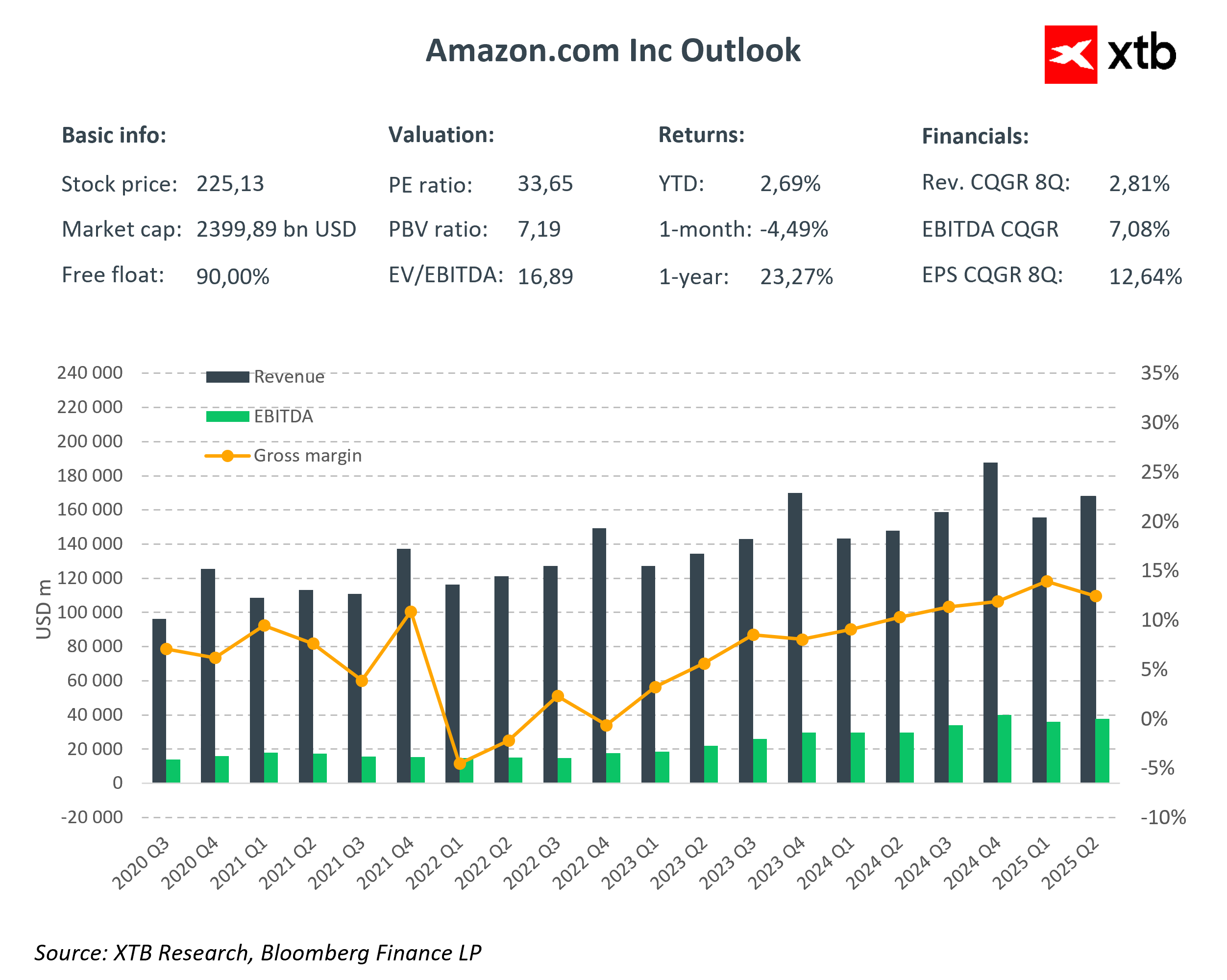

Amazon delivered second-quarter results above expectations. EPS came in at $1.68 versus $1.33 expected, and revenue reached $167.7 billion versus a $162.09 billion consensus. Notably, sales growth accelerated to 13% year over year (from 10% a year earlier), signalling improving demand and execution. By segment:

- AWS: $30.87 billion (+18% YoY), broadly in line with expectations and a small beat versus $30.8 billion.

- Advertising: $15.69 billion (+23% YoY) — clearly above the $14.99 billion estimate; this remains a key high-margin driver lifting the revenue mix.

- Online Stores: $61.5 billion (+11% YoY) versus $59 billion consensus — a sign the core retail engine is regaining momentum.

- Seller Services: $40.3 billion (+11% YoY) versus $38.7 billion expected — confirming the strength of the marketplace ecosystem.

In short, Amazon not only delivered a beat, but did so in higher-margin segments (advertising, cloud), which supports medium-term margin quality.

Cautious Guidance

Despite a solid print, the shares fell after the report. The main reason was conservative operating-income guidance for the current quarter: $15.5–$20.5 billion versus market expectations of around $19.48 billion. While Q3 revenue guidance of $174–$179.5 billion (+10–13% YoY) was above the $173.1 billion consensus, investors focused on the lower end of the operating-income range.

In the background sits an unprecedented capex plan — up to $100 billion in 2025, primarily for data centres and AI-related software. The market recognises the strategic importance, but near term worries about margin pressure and the timing of returns persist.

On the call, CEO Andy Jassy sought to calm nerves, stressing that AWS maintains a “very significant” competitive lead, and that AI progress is improving customer experience, innovation speed, and operational efficiency. The company still cites recession fears and tariff/trade policy among risk factors.

So far, tariffs haven’t dented demand or pushed prices higher this year, and Amazon is prepared to absorb any cost increases. It’s clear investors want to see AI spending translate into margins and cash flow; until then, guidance will likely drive the stock’s short-term path.

Competition Is Intensifying

AWS remains the cloud-infrastructure leader, but competition is rising. In the quarter, AWS grew about 18% YoY, while Microsoft Azure and Google Cloud reported approximately 39% and 32% growth, respectively. The gap doesn’t imply AWS is losing its top spot, but it does highlight greater competitive pressure in the AI investment cycle. Providers are boosting capex, competing for compute capacity and gen-AI talent. For Amazon, the key will be proving that infrastructure expansion (including the Anthropic partnership) converts quickly into healthy-margin revenue.

On the advertising side, the picture is unequivocally positive: +23% YoY to $15.69 billion — making Amazon the third-largest digital ad platform after Meta and Google — and growing faster than core retail. Advertising leverages shopping-data targeting and streaming formats (Prime Video/CTV). By nature, it’s a high-margin segment that can stabilise group profitability during a period of elevated capex.

Strategically, Amazon currently rests on two pillars of growth:

- Cloud (AWS) — must sustain bread-and-butter core-cloud leadership and accelerate AI monetisation to improve the margin trajectory.

- Advertising — should continue to lift the margin mix, supporting the group while capex remains high.

If guidance begins to reflect stabilising AWS margins and sustained double-digit ad growth, the market narrative could turn quickly. Until then, short-term sentiment will remain sensitive to any signals on AWS performance, ad-revenue momentum, and AI ROI.

Key Catalysts

As outlined, Amazon runs a diversified business, with e-commerce and related logistics currently the lower-margin leg. Over the next few quarters, the keys will be a soft landing in the U.S. economy, a consumer rebound, and proof that large AI investments are translating into sales and profitability.

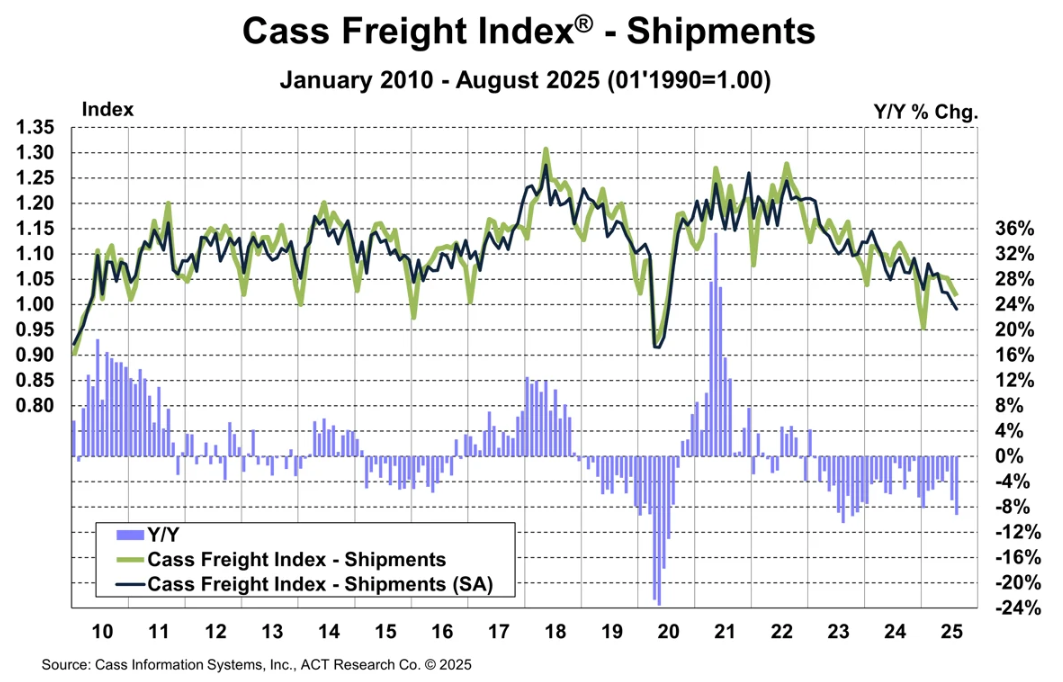

Prime Big Deal Day is an ideal moment to show investors how existing AI solutions have improved ad monetisation and shipping volumes. Strong metrics from this event could also ease concerns about competition, not only from U.S. rivals but also Chinese platforms like Temu and Alibaba. Despite the Cass Freight Index sliding back toward 2020 lows (freight softness), AMZN has held up—pointing to company-specific resilience versus the logistics cycle

Source: Cass

If upcoming results show improving margins in online retail and advertising, investor optimism could build. In that scenario, Amazon shares could climb toward ~$245 this year. On the other hand, traditional valuation metrics are demanding: P/E ~33 and forward P/E ~29. The forward multiple is nearly 20% above the S&P 500 average, while market cap stands at $2.4 trillion. Even so, thanks to the interplay of AI and macro, Amazon can still prove it’s a growth business deserving of attention — which it has recently received far less of compared with the Magnificent 7.

Source: XTB Research, Bloomberg Finance LP

Source: XTB Research, Bloomberg Finance LP

Amazon Stock Chart

On the daily chart, Amazon shares are trying to break above the 50-day EMA (EMA50) (orange line), aiming to maintain the upward trend. Since July, the price has consolidated near local highs in the $210–$240 range. RSI at 50 suggests ample room for a sharp move in either direction.

We can cautiously assume that a solid Q2 report combined with Fed rate cuts could push the shares toward all-time highs around $245 this quarter. In a downside scenario, the first key support is near $215 per share, defined by the 200-day EMA (EMA200) (red line). A potential risk remains an intensifying “trade-war” narrative with China.

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.