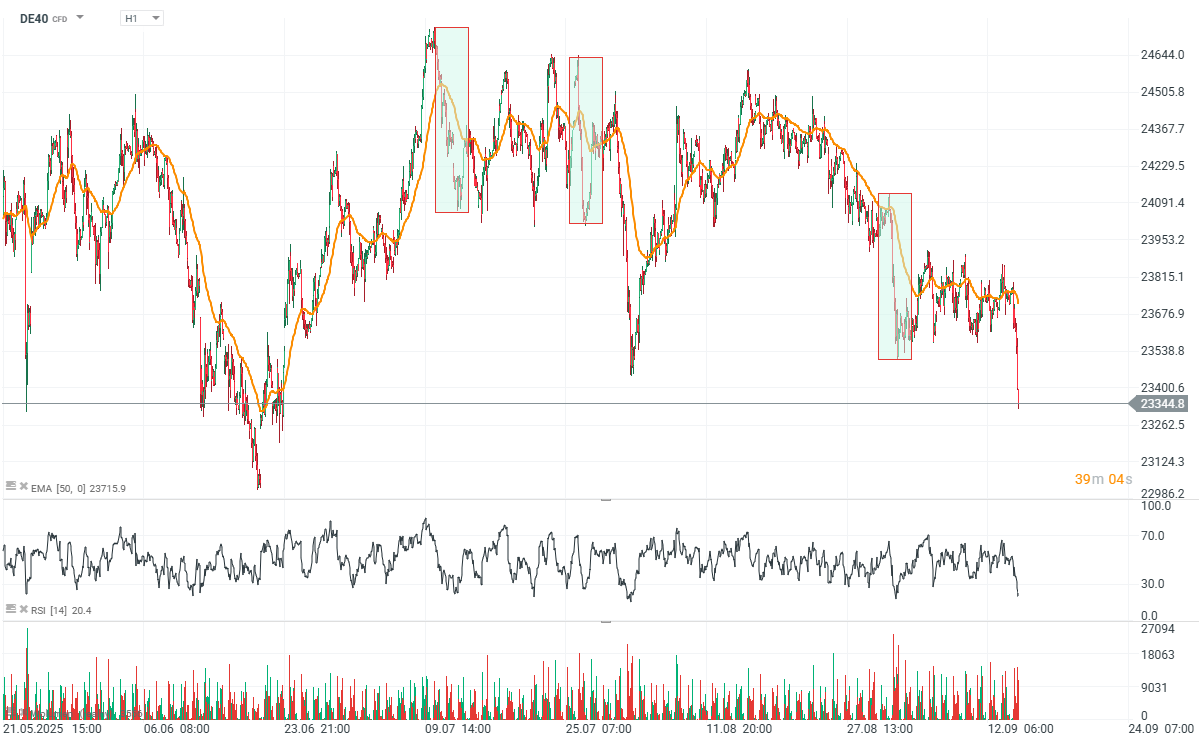

Futures on German stock index DAX (DE40) loses more than 1.8% today falling to the levels last seen in the second half of June 2025. The RSI signals capitulation, falling below 20 level. The sell-off is driven by German insurers and banks. Even Rheinmetall (RHM.DE) dropped almost 1% today, despite BofA 'Buy' recommendation, citing naval acquisition with price target at 2225 EUR per share.

As we can see below, sentiments around German stock market are pressured by the sell-off on quite large volume. From the price action analysis the 1:1 correction may be expected from the 23250 level. As for now we can see that also other futures on European indices are falling with EU50, FRA40 and SUI20 down almost 1.2%. Sentiments across the US equities are much more positive, with US100 down only -0.05%.

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.