While a market consensus had coalesced around the possibility of an RBA hike, several major investment banks remained outliers, betting on a hold. Consequently, the Reserve Bank of Australia has delivered a modest surprise to the upside—not merely through the move itself, but via its forward-looking stance. The RBA distinguishes itself as the first major central bank to pivot toward tightening in 2026, defying a global monetary landscape where many peers are still unwinding the post-2022 inflationary spike.

The RBA’s Gambit

The Reserve Bank of Australia raised its cash rate by 25 basis points, lifting the benchmark to 3.85% from 3.6%. This marks the first hike since February 2024. Only months ago, the prevailing narrative suggested further easing; however, a sharp hawkish pivot in late 2025, coupled with persistent price pressures, saw the probability of today’s move surge to 80%. The Board cited three primary catalysts:

-

Stubborn Inflation: Price growth accelerated faster than anticipated in H2 2025. Core inflation (trimmed mean) currently sits at 3.4%, remaining uncomfortably above the 2-3% target band.

-

Resilient Consumption: Household spending has gained momentum, a trend mirrored by robust business activity. Economic growth remains solid with signs of further acceleration.

-

Tight Labour Market: The unemployment rate has hit a seven-month low of 4.1%, while labour supply remains constrained.

While the RBA noted that some inflationary components may be transitory, it warned that the primary risk stems from supply-side pressures and a rapid recovery in private demand.

Macro Forecasts: A Significant Inflation Revision

The central bank’s updated economic projections reveal a more aggressive outlook:

-

GDP Growth: Forecast to remain near-trend this year before dipping more than a percentage point below trend in H2 2026.

-

Inflation (Trimmed Mean): Expected to hover around 0.9% q/q for the next two quarters (up from the typical 0.7%), ending 2026 at 3.2% y/y—still above the upper limit of the target range.

-

Unemployment: Projected to rise gradually as the tightening cycle takes hold.

Governor Michele Bullock noted that inflation is likely to remain above target for a "protracted period." While she remained non-committal on whether this marks the start of a sustained cycle or a one-off adjustment, institutional analysts are more hawkish. CBA anticipates another hike as early as May, while Westpac suggests the "bar for further tightening remains very low."

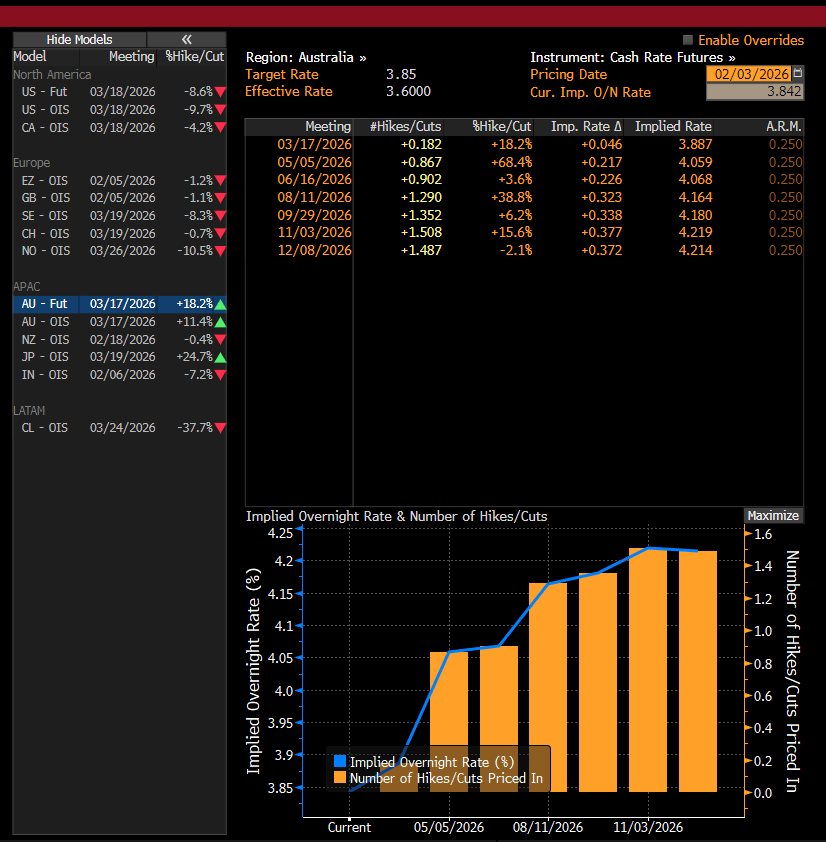

Market pricing currently implies a full hike may not arrive until August, though the probability for a May move has already climbed to 87%. Source: Bloomberg Finance LP

Technical Analysis

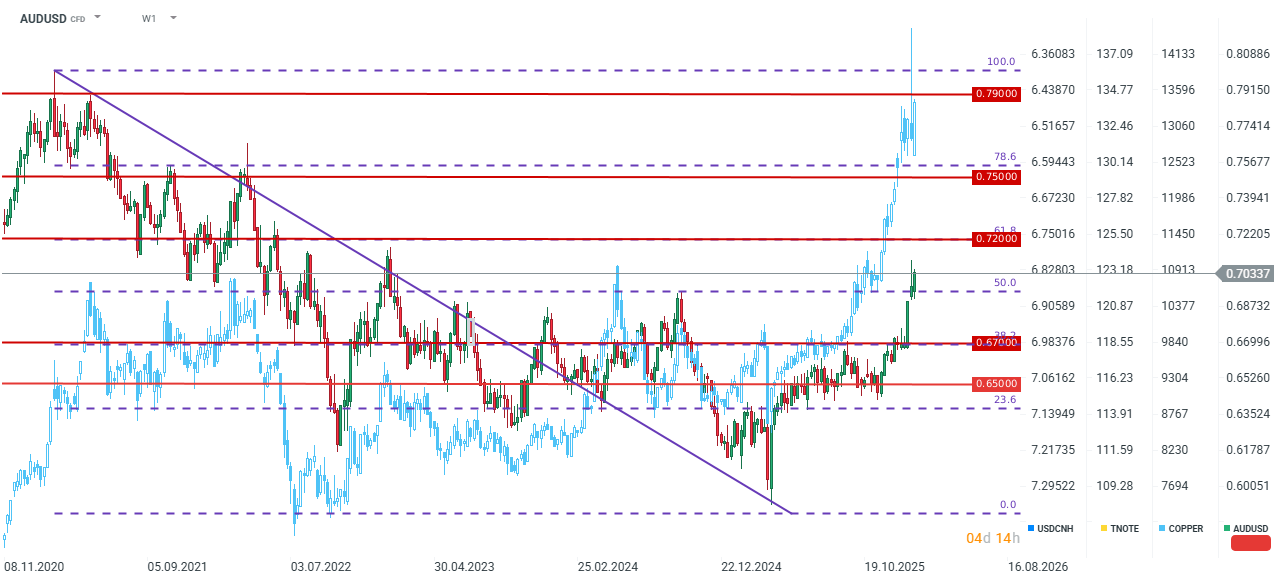

The AUD/USD pair has enjoyed a strong multi-week rally, currently testing the 0.70 handle. While the recent sell-off in commodities threatened a deeper correction, metals are rebounding: Copper is back near $13,000, Silver is approaching $90, and Gold has reclaimed $4,900. A daily close above this level for Gold could signal a "bullish engulfing" pattern, suggesting the end of the recent correction.

Trading at its highest level since February 2023, the "Aussie" appears well-positioned. A widening yield spread between Australia and the US, combined with the commodity super-cycle, could propel the pair toward the 61.8% Fibonacci retracement at 0.7200, with a medium-term target in the 0.74–0.75 range.

Dailu summary: Sell-off on Wall street 📉 Bitcoin and Ethereum extend downfall in panic

BREAKING: US Navy shot down Iranian drone approaching USS Abraham Lincon carrier🗽OIL reacts

🚨Bitcoin and Ethereum lose amid weakening sentiments on Wall Street

Gold and silver surge again 📈Will bull market come back?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.