Metal prices have quickly returned to gains after a historic crash, with “dip buyers” stepping back into the market. Gold is up 5% to $4,950 per ounce, while silver is rebounding 8% to $88 per ounce, recouping part of the steepest selloff since 2013.

- Recall that in January, precious metals surged on a wave of speculation, geopolitical tensions and concerns over the Federal Reserve’s independence. That rally was cut short brutally at the end of last week. Today, the rebound is being fueled by still-large and rising positions held by Chinese funds and Western retail investors, a renewed wave of call-option activity, and fresh inflows into leveraged ETFs.

- Metals are also benefiting from a “risk-on” tone across markets and a U.S. dollar that is stabilizing after its recent rise. At the same time, Chinese state-owned banks are reportedly trying to curb volatility in precious metals — so far with limited effect. UBS said the correction could be “healthy” in the long run and offers investors an opportunity to build positions at more attractive levels.

- Some banks still expect the uptrend to resume: Deutsche Bank reiterated its forecast for gold to reach as high as $6,000 per ounce. The bank argues that history more often points to short-term catalysts, and that investor intentions and sentiment toward precious metals have not structurally deteriorated despite the sharp drop. Deutsche Bank also noted that the selloff was larger than the underlying triggers would suggest, and that speculation alone does not fully explain the violence of the move. Deutsche Bank and Barclays both maintain that gold’s fundamentals remain strong: geopolitics, policy uncertainty and reserve-diversification themes may continue to support demand.

- Silver remains more “twitchy” than gold because it is a smaller market — which typically means higher volatility and a larger share of retail participation. Current forecasts see global silver demand rising sharply by 2030 (to 48,000–54,000 tonnes per year), while supply is projected to increase only to around 34,000 tonnes, implying a potentially widening supply gap. Solar photovoltaics alone could consume 10,000–14,000 tonnes annually (up to roughly 41% of global supply). That underscores that the longer-term bullish fundamentals are still in play.

- A key question now is how strongly Chinese investors will drive the Shanghai market, especially ahead of the Lunar New Year, with reports of increased jewelry and bullion purchases in Shenzhen. Markets are also watching geopolitics: rising U.S.–Iran tensions and talk of possible negotiations on a new nuclear deal — any breakthrough could reduce safe-haven demand and weigh on gold.

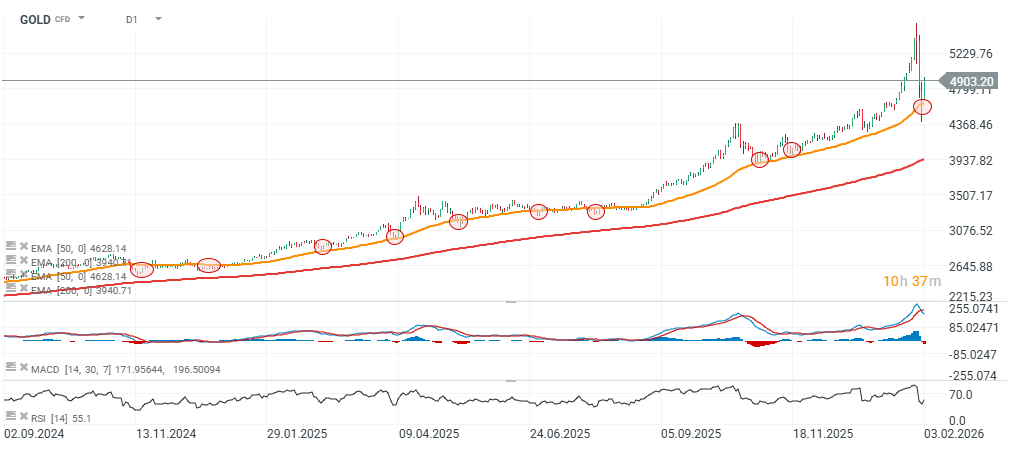

GOLD and SILVER (D1 timeframe)

Gold rebounded quickly after dipping below the 50-day EMA on the daily chart. Since the start of 2025, the 50-day EMA has repeatedly acted as strong trend support.

Source: xStation5

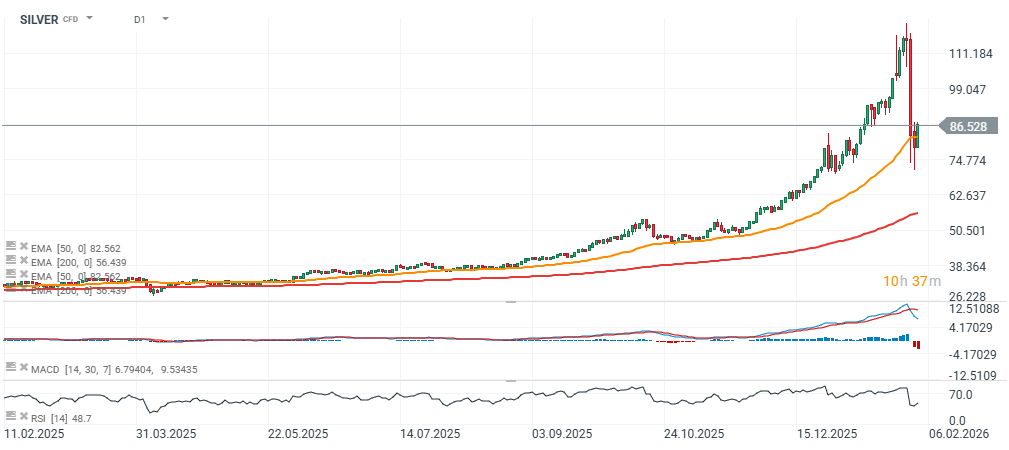

Silver has also rebounded after a drop below the 50-day EMA (similar in magnitude to March 2025). However, RSI has not yet managed to climb back above 50 following the latest sharp decline.

Source: xStation5

Riding gold and silver’s recovery, mining stocks and related funds are also advancing: in Europe, the Stoxx 600 Basic Resources index is up more than 2%. In London, shares such as Rio Tinto, Anglo American, Antofagasta and Fresnillo are higher. In the U.S., silver ETFs have rebounded sharply. Also, silver-focused miners are gaining including shares of Endeavour Silver, Coeur Mining, Hecla Mining and First Majestic Silver.

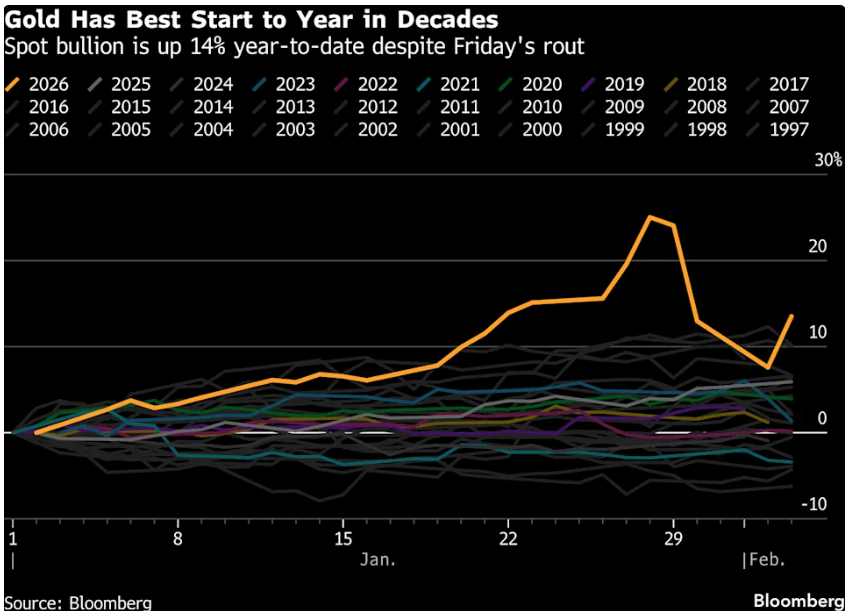

Gold is posting its strongest start to the year in decades — even after Friday’s panic selloff. Source: Bloomberg Finance L.P.

Dailu summary: Sell-off on Wall street 📉 Bitcoin and Ethereum extend downfall in panic

BREAKING: US Navy shot down Iranian drone approaching USS Abraham Lincon carrier🗽OIL reacts

🚨Bitcoin and Ethereum lose amid weakening sentiments on Wall Street

US Open: US100 slides 0.5% under pressure from IT sector 📉ServiceNow drops 6%

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.