Cocoa futures on ICE (COCOA) are down almost 3.5% today amid markets focusing on 2025/2026 season, expecting strong supply improvement. The start of the crop season in the Ivory Coast scheduled at October 1 (world’s largest cocoa producer), brought the prospect of fresh supply to the market. In the effect, cocoa prices are down more than 50% from the ATH.

Now markets await grinding data from key cocoa markets, scheduled next week. In the data will be lower than expected, which is a probable scenario, we may expect the head and shoulders technical pattern confirmation, and increase sell-side pressure on cocoa futures amid speculators and market participant focus shifting from tight supply to low demand environment, and a significant improvement of cocoa production, next year.

Source: xStation5

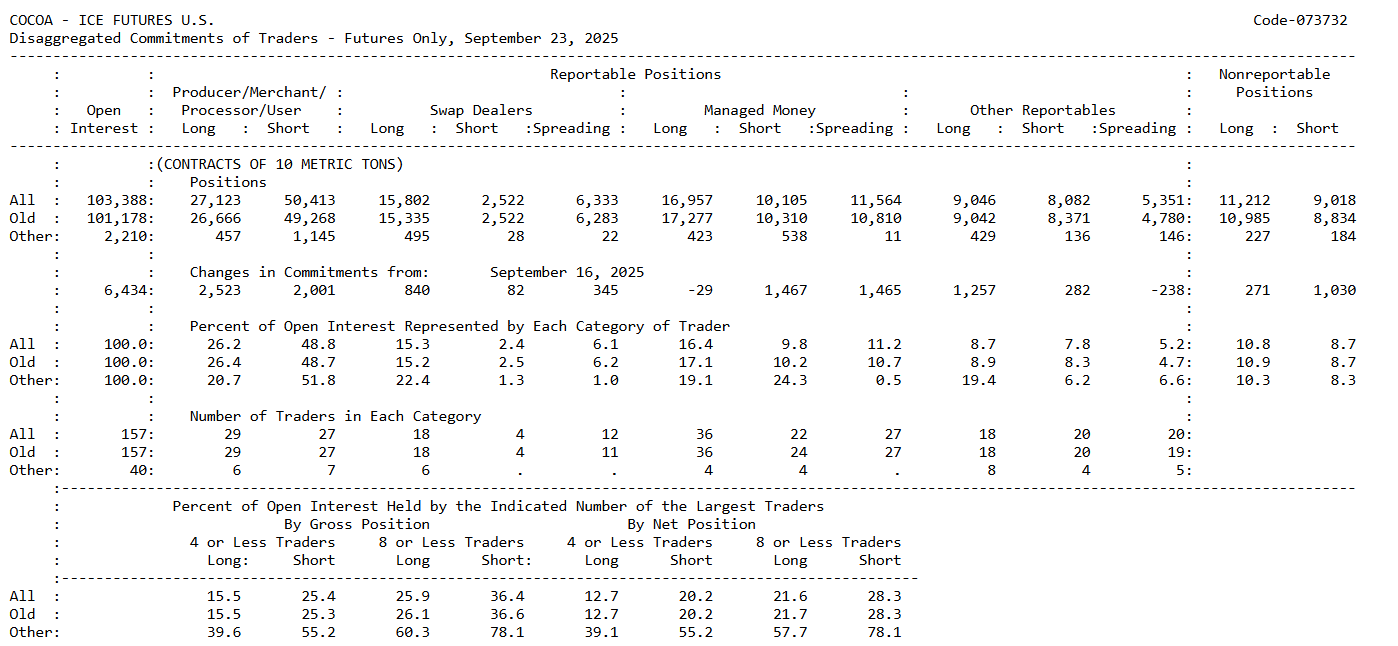

Cocoa Market Outlook (CoT – September 23, 2025)

Commercials (Producers/Merchants/Processors/Users)

-

Positioned strongly on the short side: about 50.4k short contracts vs. 27.1k long.

-

This is a classic hedging stance – producers and processors are protecting themselves against the risk of further price increases by selling futures.

-

The rise in commercial short positions suggests the supply side of the market expects high prices and is actively hedging.

Managed Money (Speculative Funds)

-

Clearly on the long side: 16.9k long vs. 10.1k short.

-

This indicates speculative capital is still betting on higher cocoa prices, despite heavy commercial shorting.

-

Over the past week, speculative funds added around +1.5k new short contracts, hinting at growing caution.

Takeaways from the Positioning

-

A classic clash of roles is visible: producers remain defensive (short), while funds maintain the upper hand on the long side.

-

Such a setup often means the market stays under supply pressure, but speculative money still supports the upside.

-

With commercials increasing shorts and funds cautiously adding to shorts as well, the market may enter a consolidation phase, with some risk of profit-taking after recent gains.

Commercials are heavily hedging against high prices, while managed money continues to bet on further upside – though with slightly more caution than before. This points to a potentially more pressure on managed money (large speculators) positioning, if the grinding data would signal slowing processing demand on chocolate and other cocoa-related products.

Source:CFTC

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.