-

European indices open Friday with cautious gains; DE40 up 0.05%.

-

Siemens and MTU Aero Engines are the weakest DAX names; Mercedes-Benz and Continental lead the advance.

-

Brenntag shares come under pressure after a UBS downgrade; ArcelorMittal falls following a rating change and commentary from Goldman Sachs.

-

European indices open Friday with cautious gains; DE40 up 0.05%.

-

Siemens and MTU Aero Engines are the weakest DAX names; Mercedes-Benz and Continental lead the advance.

-

Brenntag shares come under pressure after a UBS downgrade; ArcelorMittal falls following a rating change and commentary from Goldman Sachs.

European indices opened with cautious gains, locally partly supported by hopes of an easing in France’s political crisis. Volatility may pick up around 16:00 when U.S. University of Michigan data on consumer sentiment and inflation expectations are released.

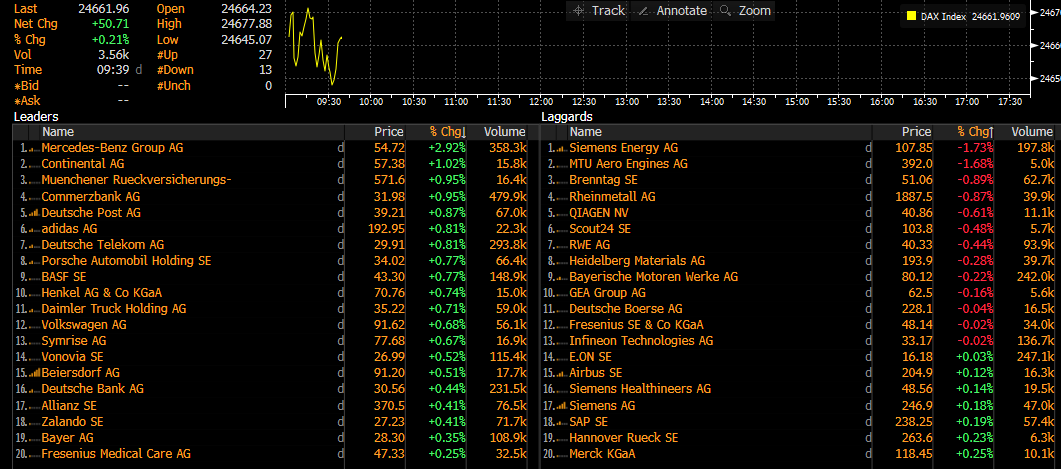

DE40 (H1 interval)

The German DAX (DE40) futures contract is oscillating around 24,750 points and testing the 50-period EMA (orange line) on the hourly chart, additionally supported by prior price reactions from early July.

Source: xStation5

Most active stocks in the German DAX. Source: Bloomberg Finance L.P.

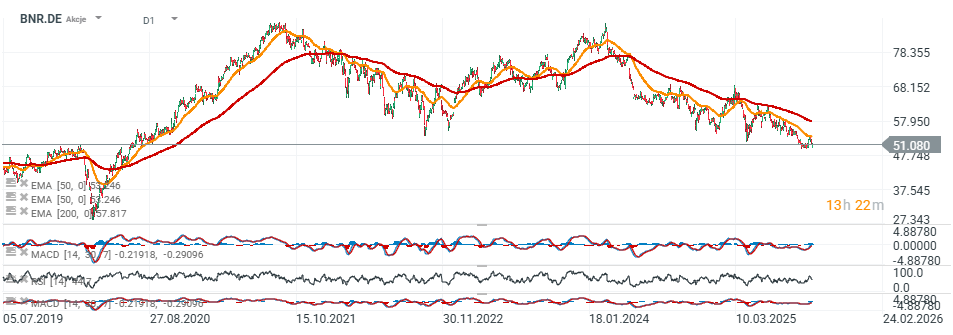

Brenntag cut by UBS

UBS downgrades Brenntag to “Sell” and cuts the target price to €45 (from €56), citing a deterioration in the outlook. Shares are down almost 4% today.

- Weak end-market demand and overcapacity in the chemical industry are expected to pressure volumes and margins for chemical distributors at least through H1 2026, wrote analyst Nicole Manion.

- Earnings forecasts for 2025–2027 have been lowered well below consensus, as UBS sees heightened risk to sales and profitability; the call suggests a longer downcycle than the market is currently pricing in.

Brenntag (D1)

Brenntag shares have been falling for some time and are hovering near levels last seen in August 2020. Even so, the chemical group’s P/E valuation remains in the high double digits.

Source: xStation5

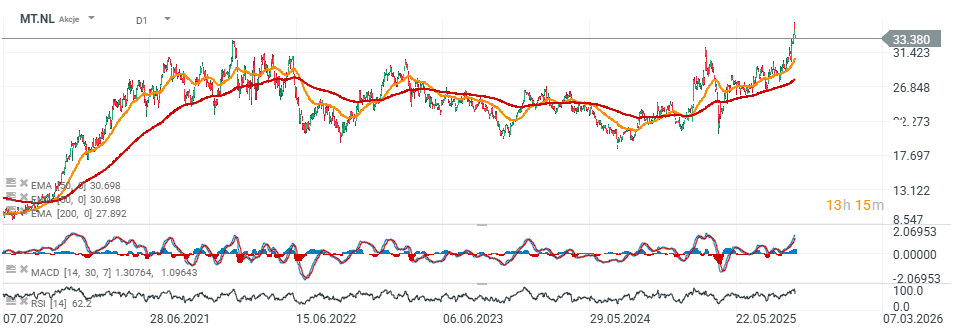

Steel giant under pressure

Goldman Sachs downgrades ArcelorMittal (MT) to “Neutral” from “Buy”, while raising the target price to €30 (from €29). As a result, the shares are down over 2% today, extending a pullback from multi-year highs.

- According to GS, the bullish thesis has largely played out: raw-material deflation supported margins and prospects for effective safeguards in key markets buoyed sentiment. After a ~55% gain since being added to the Buy list, the stock now looks fully valued.

- Risk-reward is balanced: upside depends on sustained cost tailwinds and consistent EU policy implementation; downside risks include a reversal in iron-ore/met coal or higher energy costs compressing spreads, weaker safeguard enforcement, tariff uncertainty, and risks to India JV profitability.

Arcelor Mittal (D1)

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.