- Fed's Williams gave dovish remarks to NYT

- NY Fed governor signals further rate cuts amid weakening US labor market

- Soft landing is still possible according to his remarks

- Fed's Williams gave dovish remarks to NYT

- NY Fed governor signals further rate cuts amid weakening US labor market

- Soft landing is still possible according to his remarks

New York Federal Reserve governor, John Williams commented today the US monetary policy giving an interview to New York Times. Here is the breakdown: Williams doesn't think the US economy is on the verge of recession, supporting further interest rates cuts in the US amid a weakening labor market.

- I don't see any signs of second-round effects or factors that could be amplifying the effects of tariffs on inflation

- It is appropriate for rates back to neutral setting

- Softening labor market would help limit inflation.

- The inflation outlook not as dire as earlier in the year. The slowdown in jobs is worth attention.

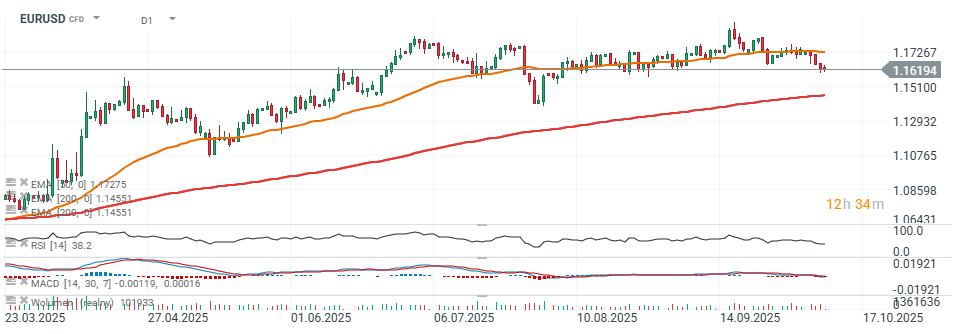

EURUSD dropped to 1.16 level again, however looking back on the chart we saw two similar corrections since April 2025.

Source: xStation5

Stock of the Week - Super Micro Computer (09.10.2025)

US OPEN: Pepsico and Delta reporting, S&P500 hanging on the top ↔️

Ferrari disappoints investors as shares drop 16%

Chinese Gambit: Raw Materials as a Weapon in the Tech War

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.