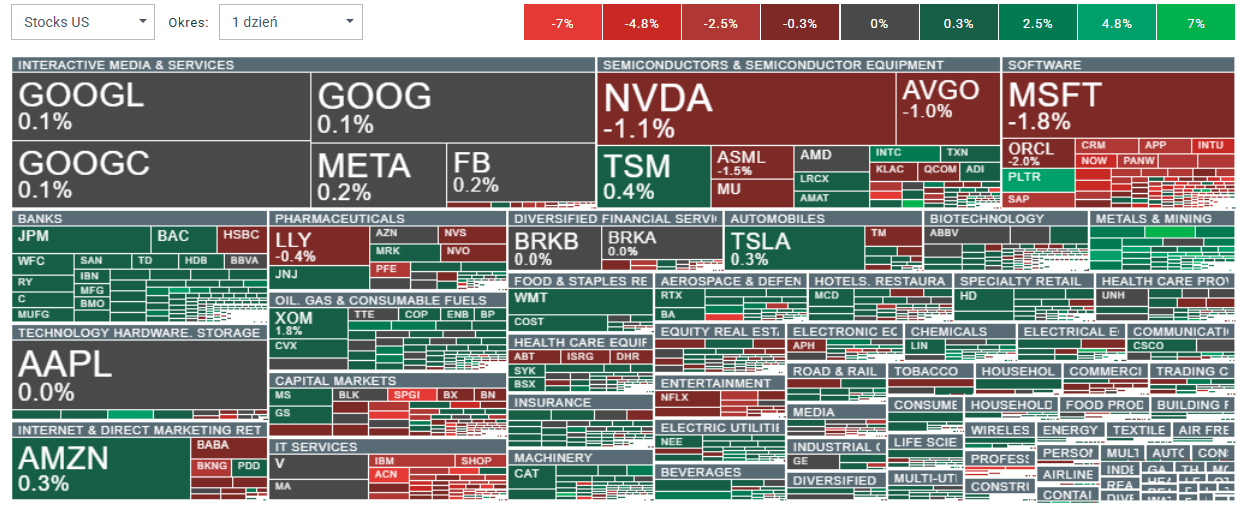

Wall Street sentiment is deteriorating today amid declines in the software sector, where shares of companies such as Intuit, ServiceNow, and Accenture are falling sharply. The market appears concerned about a slowdown in the sector’s growth rate and the accelerating adoption of AI, which may weigh on the long-term growth outlook and business models of many firms.

-

Nasdaq 100 futures (US100) are down 0.5%, while S&P 500 futures (US500) are slightly lower. Dow Jones futures (US30) are posting modest gains.

-

ServiceNow (NOW.US) is down 6%, hitting its lowest level since spring 2024, despite solid results and nearly 20% year-over-year revenue growth.

-

Accenture (ACN.US) is sliding more than 7%. The scale of the decline is raising concerns about the health of the broader consulting and IT services industry.

-

Walmart (WMT.US) surpassed $1 trillion in market capitalization for the first time in its history today. Piper Sandler raised its price target to $130 per share.

US100 (D1 timeframe)

Source: xStation5

Sentiment in the software and IT services sector is very weak today. Shares of Accenture, IBM, Shopify, Salesforce, and ServiceNow are falling sharply.

Source: xStation5

ServiceNow under pressure

ServiceNow delivered a strong Q4 2025 report “on the numbers,” but the market still reacted with a sharp sell-off. The company posted EPS of $0.92 (consensus $0.89) and revenue of $3.57bn (consensus $3.53bn). Despite the beat, the share price fell to around $110.

- The strongest part of the report was subscriptions. Subscription revenue reached $3.466bn, representing +19.5% YoY growth in constant currency. ServiceNow also ended the year with free cash flow (FCF) of $4.6bn, up 34% YoY. In addition, the company announced a $5bn share repurchase authorization.

- For 2026, ServiceNow is guiding subscription revenue to $15.53bn to $15.57bn, implying 19.5% to 20% growth. It also targets a 32% operating margin (an improvement of 100 bps) and an FCF margin of 36%. Management is strongly emphasizing the “enterprise AI platform” narrative, highlighting partnerships with OpenAI and Microsoft. CEO Bill McDermott described ServiceNow as a “semantic layer” designed to help make AI broadly usable across organizations.

- The market, however, seems to be signaling that strong results alone are not enough. Investors are focusing primarily on growth momentum in the coming quarters and the resilience of demand. The material also flagged risks including market volatility, the challenge of scaling AI across large enterprises, competitive pressure in software and AI, and the impact of macro conditions on customer budgets.

Source: xStation5

Western Digital (WD.US) shares gain today after the company posted $3.0B in revenue, up 25% YoY, beating expectations and reinforcing the idea that it is becoming more than a “legacy drive maker.” Management is leaning hard into an AI data center infrastructure narrative, highlighting accelerating hyperscaler demand for high-capacity HDDs. Profitability also looked strong with Non-GAAP EPS $2.13 and GAAP diluted EPS $4.73.

Cash generation stood out: $745M operating cash flow and $653M free cash flow, with WD returning over 100% of FCF via buybacks and dividends. The quarter’s mix was heavily cloud-driven: $2.7B from Cloud (89% of total revenue). Operationally, WD delivered 215 exabytes (+22% YoY), including 3.5M drives (103 exabytes) of its latest ePMR generation (up to 32TB). Shareholder returns included a $0.125 dividend (payable March 18, record date March 5) plus $615M spent repurchasing 3.8M shares.

Source: xStation5

Dailu summary: Sell-off on Wall street 📉 Bitcoin and Ethereum extend downfall in panic

Software stocks in panic mode 📉Will Anthropic AI disrupt tech valuations?

US100 loses 2% 📉

BREAKING: US Navy shot down Iranian drone approaching USS Abraham Lincon carrier🗽OIL reacts

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.