Gold is down more than 1% today, but after mixed U.S. data, the metal initially reacted with a rise despite higher-than-expected ISM Services readings and mixed JOLTS data (quits fell from 1.2% to 1.1%, while total separations were 2% versus the previous 1.9% revision). The U.S. dollar is trading flat, but other metals, including silver, are also declining, with silver down 5%.

Published data, along with the latest final manufacturing PMI, support the narrative suggested by Trump that the U.S. is not currently facing a significant inflation risk, and the Federal Reserve may adopt a slightly more “aggressive” stance in the second half of the year.

Gold entered 2026 on a strong note, suggesting that investors still see potential for further gains amid expectations of Fed rate cuts (Stephen Miran has even suggested up to 100 bps this year), rising deficits, and geopolitical tensions that may accelerate gold purchases and reduce dollar exposure as a diversification strategy.

Gold CoT Analysis (CFTC) – December 30, 2025

By the end of December 2025, the structure of gold futures positions shows a clear contrast between Commercials and Managed Money (large speculators). Speculative capital remains bullish, while producers and direct market participants hedge deliveries at current prices, maintaining a net short position.

-

Commercials (Producer/Merchant/Processor/User):

-

Total short positions ≈ 67,000 contracts, representing ~14% of open interest.

-

Long positions decreased by 4,200 contracts last week, while shorts remained elevated, signaling moderate short-term pessimism.

-

-

Managed Money:

-

Long ≈ 149,000 contracts vs. 44,000 short, with longs representing ~31% of OI.

-

Last week, longs decreased slightly (-1,709 contracts) while shorts increased (+4,313 contracts).

-

The contrast between bearish Commercials and bullish Managed Money often drives dynamic price moves. Commercial positions can act as natural support, while speculative pressure supports upside potential. Recently, both groups appeared to align, using record gains to hedge deliveries or reduce bullish exposure.

Outlook

-

Gold remains in short-term consolidation, with the potential to break higher if Managed Money maintains or increases long positions. A sudden reduction in Commercial short positions could signal a bullish impulse.

-

Current CoT structure suggests a potential for short-term correction, while additional long accumulation by Managed Money could provide an upward push.

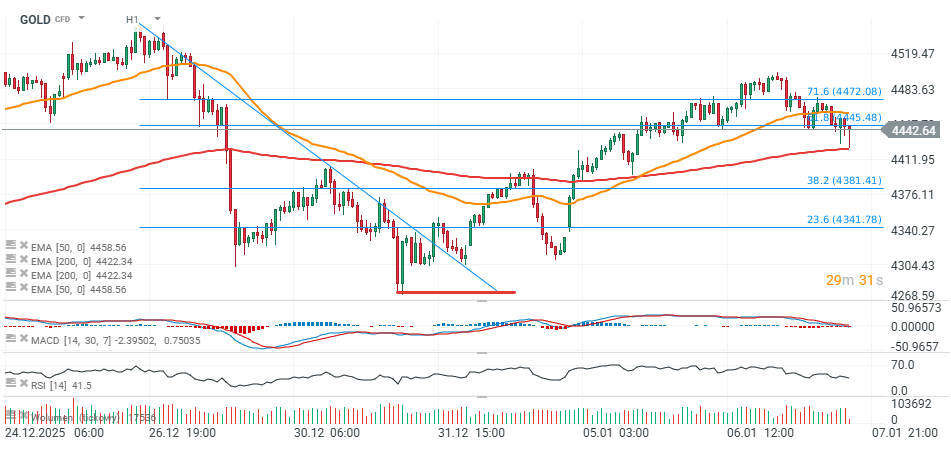

Technical Analysis (H1)

On the hourly chart, declines have halted around $4,420 (EMA200, red line), but prices remain below the 71.6% and 61.8% Fibonacci retracements of the late December down move. Immediate resistance appears near the EMA50 (orange line) at $4,460 per ounce.

Source: xStation5

Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.