Cold weather and winter demand surge, supporting futures on natural gas (NATGAS) on ICE which are up more than 5% today. As temperatures across the US drop, demand for heating rises sharply. That seasonal boost increases demand for natural gas for both residential heating and power generation.

-

Strong LNG exports from the U.S. The U.S. continues to export a large volume of liquefied natural gas globally. That export demand drains domestic supply and pushes U.S. gas benchmark prices higher.

-

Tight supply & storage drawdowns. With inventories lower and global LNG demand high, the supply-demand balance has tightened. That scarcity pushes prices upward.

-

Competition from data centers and energy-intensive industries. The expanding infrastructure for data centers (especially AI-driven data centers) and increasing electricity demand in such sectors adds further pressure on gas demand — especially for U.S. producers

-

Natural gas futures reportedly climbed to over $5 per million British thermal units (MMBtu) a level not seen since 2022.

-

The recent rally in prices has been steep: year-on-year increases are significant, reflecting both seasonality and structural demand shifts.

The surge looks like a blend of seasonal, structural, and global-market drivers, not just a short-lasting winter effect. As of now, US gas storage levels are 5% above the seasonal average, but this doesn't stop the market.

Source: xStation5

Despite the correction from 5.50 USD level, NATGAS still gains more than 5% today.

Source: xStation5

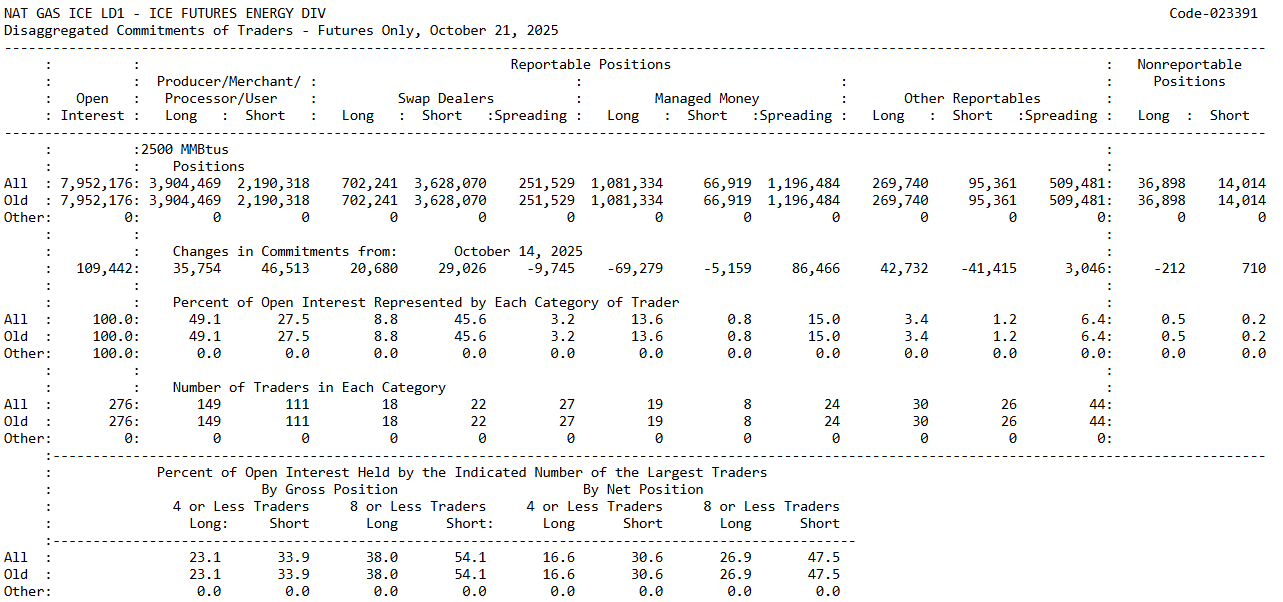

Natural Gas CoT Interpretation (Oct 21, 2025)

• Producers/Merchants added aggressively to both sides, with a larger increase in shorts than longs. This signals rising hedging activity into higher prices and a market where physical players expect volatility or downside risk.

• Swap dealers expanded both long and short exposure, maintaining large gross positions. Their posture indicates active risk transfer rather than a directional view. This may align with a market where end-users and producers are locking in risk simultaneously.

• Managed Money reduced long exposure sharply while increasing spreads and keeping shorts relatively small. The key signal is the 69k drop in MM longs, which reflects profit-taking and reduced conviction in further upside near term.

• Other Reportables increased longs strongly, suggesting that smaller institutional participants are positioning for continued strength or volatility. Their long build stands in contrast to managed money unwinding.

• Spreading positions surged across categories, especially MM and Other Reportables, pointing to heightened uncertainty and a market expecting wide ranges rather than a clean directional trend.

• Concentration on the short side is high, with the top traders controlling 54 percent of total shorts (gross) and nearly 48 percent on a net basis. This indicates large players hold dominant short exposure, raising the risk of sharp short-covering spikes if fundamentals tighten.

• Total open interest continues to climb, reinforcing that the move is supported by increasing participation rather than short-term noise.

The CoT structure shows a market entering a late-stage rally: commercial hedgers are selling into strength, managed money is reducing long exposure, and smaller institutions are stepping in on the long side. Elevated spreads and high concentration of shorts imply elevated volatility potential, with room for sharp upside swings if weather or supply catalysts materialize.

Source: CoT, CFTC, ICE

Daily Summary: Wall Street ends the week with a calm gain 🗽 Cryptocurrencies slide

Bitcoin loses 3% 📉Technical bearish flag pattern?

3 markets to watch next week (05.12.2025)

US100 gains after PCE data 📈

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.