Nasdaq has gained over 30% since the beginning of the year, despite the Fed's tightening cycle and record-high financing costs. The race is led by the largest US technology companies. The trend of artificial intelligence was initiated by ChatGPT - fueled by a massive amount of data and gaining popularity at a record pace. It is in the field of AI technology that financial markets have begun to recognize the potential for another technological boom.

Which companies can benefit from it? We have selected 8 companies whose valuations may largely result from the growing speculation around AI applications and real revenue growth through this new technology.

Looking at the cumulative returns since 2020, Nvidia (NVDA.US) and Arista Networks (ANET.US) emerge as the leaders among the selected AI companies. The comparison also shows that small-cap AI companies appear to be marauders over a multi-year time horizon. However, since the beginning of 2023, C3.ai, BigBear AI, and Soundhound AI have gained 260%, 202%, and 132%, respectively. Highly indebted companies may face difficulties in accessing financing and burning cash in a demanding macro environment.

The fundamental PE, PS, and PB ratios for the selected eight AI companies show that Nvidia is traded at a significant premium, with its valuation nearly 40 times higher than its book value.

Microsoft (MSFT.US), a giant formerly known primarily for selling Windows software, is competing with Google as both companies work on creating optimal, most efficient generative artificial intelligence. Microsoft is also a major shareholder in OpenAI (valued by the company at $29 billion), providing competitive solutions to Google: a browser and cloud services for businesses.

- Microsoft will collect 75% of all OpenAI's profits until the complete return of its investment ($10 billion). Once OpenAI repays the debt, Microsoft will acquire a huge stake of 49% in the company.

- Microsoft's Microsoft365 services are gaining broader AI-related possibilities. The Bing browser is positioned as the biggest competitor to Google's current dominance.

- The company generates a significant portion of its revenue from software sales (Windows) and hardware sales. It is also the second-largest cloud services provider in the world after AWS (Azure). AI can provide significant added value to its proven business model.

Alphabet (GOOGL.US) is improving and designing its own AI tools and language models (laMDA). It has a full infrastructure of its own products and applications to apply them. Therefore, it is not dependent on external clients in this regard. Most of its revenue comes from advertising, making its business somewhat dependent on the economic climate.

- Google benefits from its dominant position in the browser market (close to an 80% market share) and the growing Google Cloud business.

- For many years, Alphabet (Google) has been the company that spent the most on AI development among all the Big Tech companies.

- Google wants the implementation of AI into its search engine to help maintain its dominance in the increasingly demanding browser sector, which is favored by network effects.

- The company is improving its own chatbot, Bard. Its unsuccessful presentation in Q1 2023 triggered a massive sell-off of the company's shares, but the stock made up for the losses and more.

Among AI companies, Nvidia (NVDA.US) had the lowest annual revenue growth. However, the market did not concern itself with this fact, as it sees the company as a beneficiary of the "next chapter" of the bull market.

Nvidia (NVDA.US) thanks to AI euphoria, the company has become the 5th largest company in the USA and the 9th company ever to exceed a market capitalization of 1 trillion. It started production of data center chips (GPUs) as early as August 2022, ahead of the competition. This solidified its short-term advantage and allowed it to meet the emerging demand for AI first.

- In the latest results for Q1 2023, Nvidia raised its forecast for the current quarter by 50% and indicated "surging demand" related to AI applications. It benefits from growing demand and limited global GPU supply.

- Data center revenues are increasingly important for Nvidia's results, and the market views AI as a growing positive lever for the company's business. The latest report also showed improved gaming and automotive revenues.

- Nvidia is increasing its production capacity to meet the demand that exceeds supply, and its chips are known as some of the most efficient in the world. The company plans to start production of AI-focused supercomputers for large firms.

Arista Networks (ANET.PL) designs and sells high-performance, multi-layer network switches used in large data centers, cloud computing, and high-frequency trading (HFT). Importantly, the company has literally no debt (short-term 0, long-term 55.3 million USD) and a market capitalization almost 20 times smaller than Nvidia's.

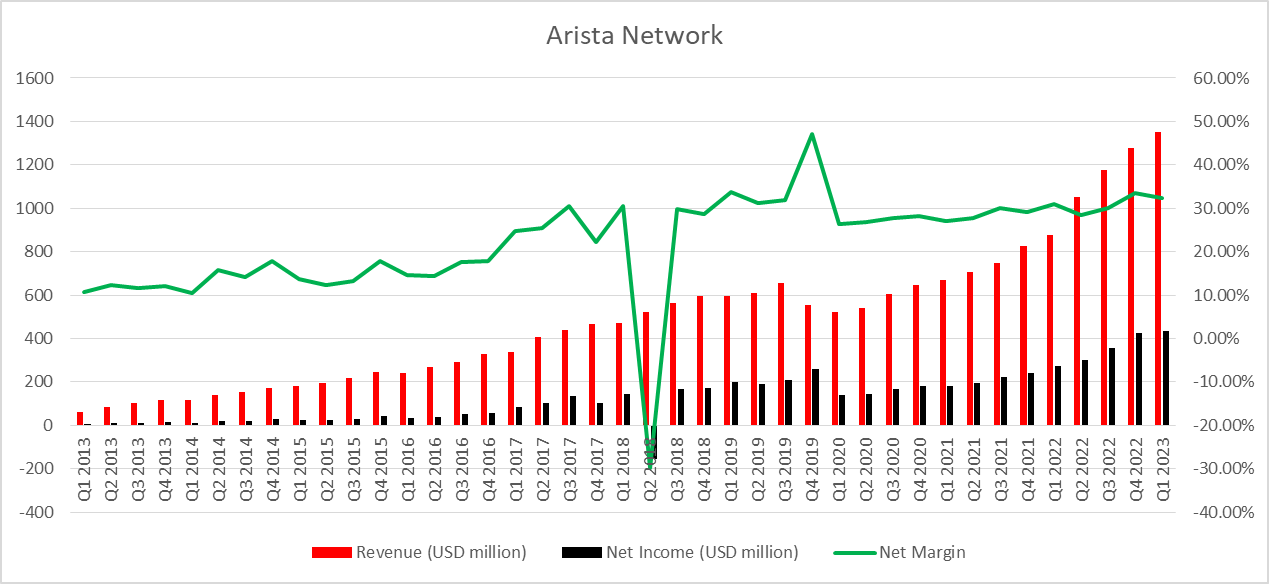

The company's revenues are growing almost exponentially along with net income. Arista maintains margins above 30%. The recent reaction to financial results was mainly due to slightly lower year-on-year net profit growth and slightly lower margins, but the company's growth metrics remain at more than satisfactory levels. Source: Bloomberg, XTB Research

The company's revenues are growing almost exponentially along with net income. Arista maintains margins above 30%. The recent reaction to financial results was mainly due to slightly lower year-on-year net profit growth and slightly lower margins, but the company's growth metrics remain at more than satisfactory levels. Source: Bloomberg, XTB Research

- Arista does not have factories in China or Taiwan, which are currently considered potentially geopolitically risky areas. Its manufacturing facilities are located in the USA, Canada, India, and Malaysia.

- Apart from network switches, the company provides its own software such as AVA (cybersecurity and decision support system), EOS (cloud APIs and integration with major company applications), and CloudVision (workflow automation).

Considering the EBITDA measures, Arista Networks looks very similar to the largest tech companies. Palantir is also similar, with one difference being that the company had negative EBITDA last year.

Considering the EBITDA measures, Arista Networks looks very similar to the largest tech companies. Palantir is also similar, with one difference being that the company had negative EBITDA last year.AMD (AMD.US) sets the bar high and aims to become a major player in the market for AI computing devices, expanding its offering of integrated circuits from Edge AI to the cloud. Despite Nvidia's dominance and increasing competition from Intel, AMD has the necessary resources and competitive advantages to become a significant supplier in this market.

- AMD has about 30% market share in processors and slightly below 20% in the discrete GPU market. AMD's strong presence in the chip market should provide broad exposure to the demand growth that artificial intelligence will create for chips.

- Over a year ago, AMD acquired the highly specialized semiconductor manufacturer Xilinx for $49 billion. The current potential of Xilinx seems enormous in the context of designing niche products for AI.

- AMD's direct competitor is Nvidia, which also specializes in discrete graphics processors and has about 80% market share.

Palantir (PLTR.US) focuses on big data analysis, originally serving the US intelligence and Defense Department. The market perceived this as evidence of the company's software and tools' quality. Until recently, the company's profitability seemed distant. Thanks to the demand for AI tools, Palantir expects to achieve profitability in every quarter of the current year. In 2021, Palantir's shares experienced euphoria, which turned into a significant downward trend in 2022.

- Palantir has opened up to private clients and serves companies from various industries, including medical, financial, and industrial conglomerates. Investors see potential primarily in the private sector, and broad interest from external companies can be a catalyst for future growth.

- The company's tools enable deep analysis of intelligence data and modern management of the military based on AI. Palantir refers to the necessary revolution in the field of battle as a conclusion from the war in Ukraine. The market is confident that demand from government agencies and intelligence will also continue.

C3.ai (AI.US) attracts a lot of speculative interest due to its low market capitalization and contracts with major clients such as Google, Amazon, Baker Hughes, and the US Department of Defense. Before its IPO in 2020, the company tried its hand in the energy industry and the Internet of Things (IoT) as C3 Energy and C3 IoT, respectively.

- Although C3.ai exceeded analysts' forecasts in its Q1 results, the business growth it achieved in terms of revenue and profits seems relatively modest compared to the level of speculative interest.

- The company may face a significant challenge in competing with major technology firms due to its ongoing cash burn (around $800 million).

- The market estimates that the company will reach profitability around 2024. So far, the AI frenzy has not resulted in a significant surge in its profits and margins. However, real contracts with large companies may eventually help generate positive cash flows, as the company is currently in the process of modifying its existing business model.

SoundHound (SOUN.US) has been developing voice recognition tools for 18 years and currently sees an opportunity in the development of conversational AI (Houndify, Voice AI).

- Due to its technology, the company could be a potential acquisition target. Its revenues in Q1 2023 increased by 56% year-over-year with a gross margin of 71% (compared to 59% in Q1 2022). The quarterly EBITDA loss decreased by 21% quarter-over-quarter and 13% year-over-year. The company is experiencing significant financial improvement but is still not profitable.

- The CEO of the company and a veteran of dot-com ventures, Keyvan Mohajer, emphasized the "surging demand" for conversational AI. Companies such as Meta Platforms (META.US), which plans to implement "virtual agents" in the metaverse on a broader scale, could potentially be interested in such solutions. SoundHound's technology could also be useful in terms of AI regulation, specifically voice identification.

The AI euphoria has led analysts to raise recommendations for many companies benefiting from this trend. Despite a significant premium in relation to fundamental valuation, Wall Street still sees considerable potential for Nvidia. The Oppenheimer fund indicated a record premium to the current valuation by raising the target price for Big Bear AI from $10 to $15 per share. The company's shares currently cost $2. It is worth noting that no recommendation is synonymous with achieving the forecasted price target.

BigBear AI (BBAI.US) focuses on AI tools primarily for the military, with L3 Harris and the US Air Force as its biggest clients. At the beginning of January, a contract with the US Air Force worth $900 million was a catalyst for growth.

- However, a 10-year contract with the US Air Force does not guarantee $900 million in revenue; it represents the upper limit. The Army will decide the exact scope and value of orders from BigBear AI. With the current market capitalization of $300 million, there are significant opportunities arising from these orders.

- While the company is not profitable, the market positively responds to new contracts from the defense industry. BigBear AI signed a contract with L3Harris in May.

- The company will provide advanced AI systems that enable autonomous operations of vessels (ASV), drones, and other unmanned vehicles. L3Harris' ASView system will be integrated with BigBear.ai's predictive vision to enhance situational awareness, identification, and battlefield reconnaissance.

Microsoft's stocks (MSFT.US) have erased all the declines from 2022 and are testing new historical highs, thanks to the AI euphoria and its involvement in the OpenAI business. Source: xStation5.

Microsoft's stocks (MSFT.US) have erased all the declines from 2022 and are testing new historical highs, thanks to the AI euphoria and its involvement in the OpenAI business. Source: xStation5.Eryk Szmyd and Bartłomiej Mętrak, XTB Analysis Department.

A Wall Street hangulata romlik 📉 Az S&P 500 eredményjelentéseinek legfontosabb eseményei

Reggeli összefoglaló: Az Nvidia ragyogó eredményei lehúzzák a piacot

Gyorsjelentési szezon az XTB-vel

Live Trading - 2026.02.24.

Ezen tartalmat az XTB S.A. készítette, amelynek székhelye Varsóban található a következő címen, Prosta 67, 00-838 Varsó, Lengyelország (KRS szám: 0000217580), és a lengyel pénzügyi hatóság (KNF) felügyeli (sz. DDM-M-4021-57-1/2005). Ezen tartalom a 2014/65/EU irányelvének, ami az Európai Parlament és a Tanács 2014. május 15-i határozata a pénzügyi eszközök piacairól , 24. cikkének (3) bekezdése , valamint a 2002/92 / EK irányelv és a 2011/61 / EU irányelv (MiFID II) szerint marketingkommunikációnak minősül, továbbá nem minősül befektetési tanácsadásnak vagy befektetési kutatásnak. A marketingkommunikáció nem befektetési ajánlás vagy információ, amely befektetési stratégiát javasol a következő rendeleteknek megfelelően, Az Európai Parlament és a Tanács 596/2014 / EU rendelete (2014. április 16.) a piaci visszaélésekről (a piaci visszaélésekről szóló rendelet), valamint a 2003/6 / EK európai parlamenti és tanácsi irányelv és a 2003/124 / EK bizottsági irányelvek hatályon kívül helyezéséről / EK, 2003/125 / EK és 2004/72 / EK, valamint az (EU) 2016/958 bizottsági felhatalmazáson alapuló rendelet (2016. március 9.) az 596/2014 / EU európai parlamenti és tanácsi rendeletnek a szabályozási technikai szabályozás tekintetében történő kiegészítéséről a befektetési ajánlások vagy a befektetési stratégiát javasló vagy javasló egyéb információk objektív bemutatására, valamint az egyes érdekek vagy összeférhetetlenség utáni jelek nyilvánosságra hozatalának technikai szabályaira vonatkozó szabványok vagy egyéb tanácsadás, ideértve a befektetési tanácsadást is, az A pénzügyi eszközök kereskedelméről szóló, 2005. július 29-i törvény (azaz a 2019. évi Lap, módosított 875 tétel). Ezen marketingkommunikáció a legnagyobb gondossággal, tárgyilagossággal készült, bemutatja azokat a tényeket, amelyek a szerző számára a készítés időpontjában ismertek voltak , valamint mindenféle értékelési elemtől mentes. A marketingkommunikáció az Ügyfél igényeinek, az egyéni pénzügyi helyzetének figyelembevétele nélkül készül, és semmilyen módon nem terjeszt elő befektetési stratégiát. A marketingkommunikáció nem minősül semmilyen pénzügyi eszköz eladási, felajánlási, feliratkozási, vásárlási felhívásának, hirdetésének vagy promóciójának. Az XTB S.A. nem vállal felelősséget az Ügyfél ezen marketingkommunikációban foglalt információk alapján tett cselekedeteiért vagy mulasztásaiért, különösen a pénzügyi eszközök megszerzéséért vagy elidegenítéséért. Abban az esetben, ha a marketingkommunikáció bármilyen információt tartalmaz az abban megjelölt pénzügyi eszközökkel kapcsolatos eredményekről, azok nem jelentenek garanciát vagy előrejelzést a jövőbeli eredményekkel kapcsolatban.