Summary:

-

BoE keep base rate at 0.75% as expected

-

Two dovish dissenters cause GBP to dip

-

FTSE lifted by US-China trade news

As was widely expected the Bank of England has decided to keep the base rate unchanged at 0.75% but there was some dissent amongst ratesetters. Two of the nine MPC members voted for a cut with Haskel and Saunders the dovish dissenters. Both these called for stimulus now as they believe that “data suggests labour market turning and see downside risks from the global economy.”

Inflation forecast were revised lower with the latest shown against the previous in parenthesis:

-

2020: 1.51% (vs 1.90%)

-

2021: 2.03% (vs 2.23%)

-

2022: 2.25% (vs 2.37%)

Downward revisions seen across the board here and also providing some negative news for the pound.

This has caused a quick slide lower in the pound with the GBP/USD dropping around 40 pips towards the $1.28 level. Governor Carney’s press conference set to start son at 12:30 GMT. Source: xStation

Given the political uncertainty ahead of next month’s election it is not at all surprising that the central bank have decided to refrain from any change in policy but the calls for rate cuts come as something of a surprise and have caused an adverse reaction in the pound.

The pound remains range bound on the whole and moves in pairs such as GBP/USD or GBP/EUR are being driven more by the other side of the cross. This week has been eventful in terms of political news as the election campaigns begin but it will probably be a while yet until we get any clearer indication as to what the outcome will be. Until that transpires any major moves in the currency are unlikely.

Trade headlines driving risk sentiment

While there are a myriad of factors that could be seen to be impacting global markets, the recent trade has boiled down to little more than sharp short-term reactions to the latest headlines on US-China trade. This morning comments from the Chinese Ministry of Commerce that the world’s two largest economies have agreed to lift tariffs on each other in phases caused a flurry of activity ahead of the European open.

The FTSE has gained this morning after positive news on the US-China trade front and could receive another boost if the drop in the pound takes hold. 7460 seen as the next level of swing resistance. Source: xStation

Equities in London and on the continent rallied out of the gate with the Eurostoxx 50 hitting its highest level since July 2015 and the FTSE 100 breaking up through the 7400 mark to trade at levels not seen since the end of September. US futures are pointing to a record open on Wall Street, with gains of around 0.5% seen in the major stock benchmarks across the pond. The moves have not been confined to just stocks, with the yield on the US 10-year rising to an 8-week high and weighing further on precious metals with Gold once more threatening to turn lower. In the FX space the US Dollar is trading lower against most of its peers while currencies that typically thrive in risk-off environments such as the Japanese Yen and Swiss Franc are both losing ground.

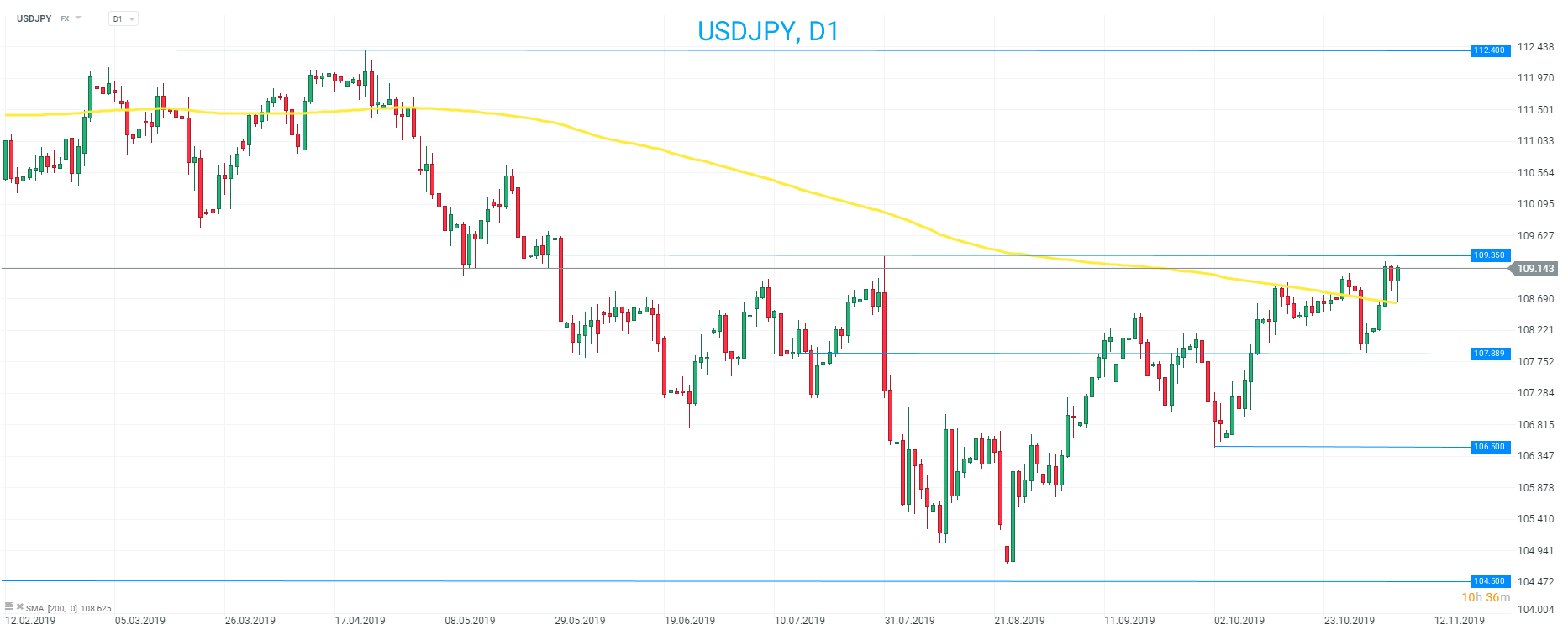

The USD/JPY cross is at a particularly interesting level as it moves back above the 109 handle and probes potential technical resistance near 109.35 once more. The pair has recently moved back above the 200 day SMA and if the market can get above the 109.35 level again then you have to go back to May to find a higher price. Source: xStation

The USD/JPY cross is at a particularly interesting level as it moves back above the 109 handle and probes potential technical resistance near 109.35 once more. The pair has recently moved back above the 200 day SMA and if the market can get above the 109.35 level again then you have to go back to May to find a higher price. Source: xStation