📆 The FOMC decision will be published at 6pm GMT and is the key event of the week!

Over the past weeks, the number one topic has undoubtedly been central banks. Investors are now wondering whether, after a cycle of interest rate hikes around the world, the markets are approaching the so-called Pivot, i.e. a slowdown in the pace of such rapid tightening and a turnaround in the rhetoric of central bankers. Today it's time for the Fed. The FOMC will decide on rates at 6pm GMT, and the decisions and comments from this event will project market sentiment over the next few weeks. Let's look at the key points to better prepare for the event.

FOMC will raise rates

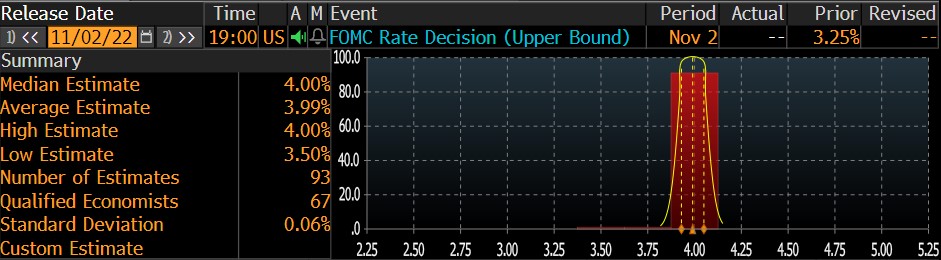

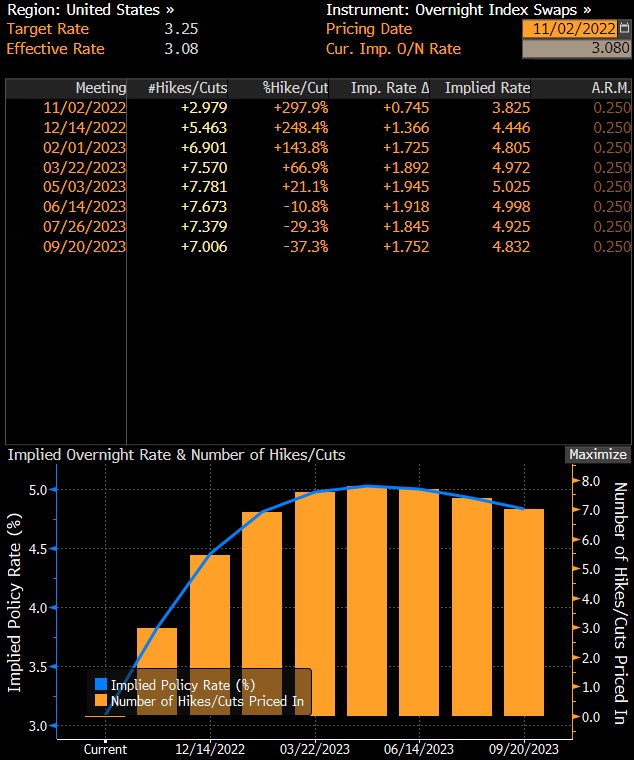

A hike at today's meeting is more than certain. The market is currently discounting a 75 basis point hike at today's FOMC meeting. This path also seems to be confirmed by swaps, which indicate a near 100% chance of a 75 basis point hike. What does this mean? The market is set for a decisive Fed action, with little chance of a sudden turnaround.

Analyst consensus. Source: Bloomberg

Current valuation of the future path of interest rates in the US. Source: Bloomberg

The market seems convinced that a 75 bps hike is already fully priced in, so investors' attention will mainly focus on Powell's conference at 7:30 p.m. Analysts assume that today's potential 75 bps hike will be the last of this magnitude, so the number one topic when it comes to interpreting today's decision will be hints about the December FOMC meeting. Keep in mind that any mention of an actual slowdown in the pace of hikes could spawn speculation about a lower target rate (terminal rate).

How will the market react?

Looking at the way the S&P500 index traded 1 hour after the decision, we note that the index seems to confirm that Powell's comments are the most significant for the market.

Source: Bloomberg

A look at the markets before the decision

US500 futures are posting moderate gains this morning and are trying to make up for yesterday's session losses. We are seeing a slight increase in US 10-year yields, although for now it is still too small to indicate a definite trend. Of course, it is worth remembering that statistically the US500 gained during the month in which the US midterm elections took place. On the other hand, if the Fed stays with its current rhetoric and does not change its stance on further balance sheet reduction, it could mean that the current rebound is another correction in the main downtrend. Source: xStation 5