The launch of the new Intel Xeon 600 line is primarily a strategic event, which the market interprets as a signal that Intel wants to be an active player in the professional computing solutions segment again. Although the announcement of the new processors will not immediately translate into revenue, it reinforces the narrative of rebuilding the company's position in areas key to the development of the technology market, including infrastructure for artificial intelligence.

This positive product narrative has been further reinforced by the latest collaboration with Japan's SoftBank and its subsidiary SAIMEMORY on the development of a new generation of Z-Angle Memory, designed for data centers supporting artificial intelligence. The partners aim to create high-capacity, high-bandwidth, and lower-power solutions to meet the growing demand for efficient memory in AI and professional computing environments. Although commercialization is not planned until 2029, the markets reacted positively, with Intel shares rising at the opening of trading.

From an investor perspective, it is important that Intel is no longer seen solely through the prism of the personal computer market, which remains weaker and more cyclical. The return to the professional and corporate segments is an attempt to diversify revenue sources and improve the margin structure in the longer term. The market interprets this as a step in the right direction, although with the caveat that the real effects of projects such as Z-Angle Memory will only be seen in a few years' time, and memory remains an area of strong competition from the current leaders.

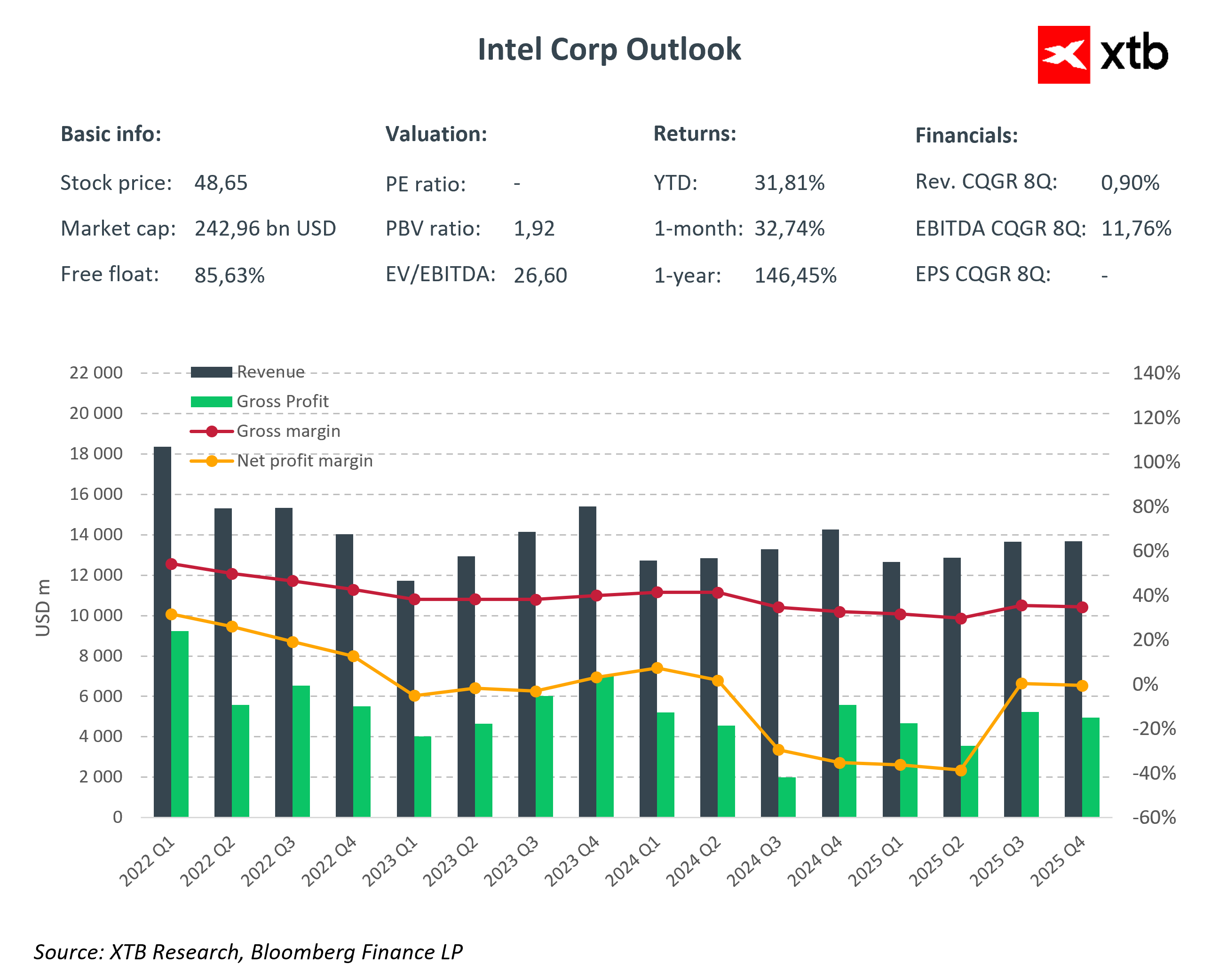

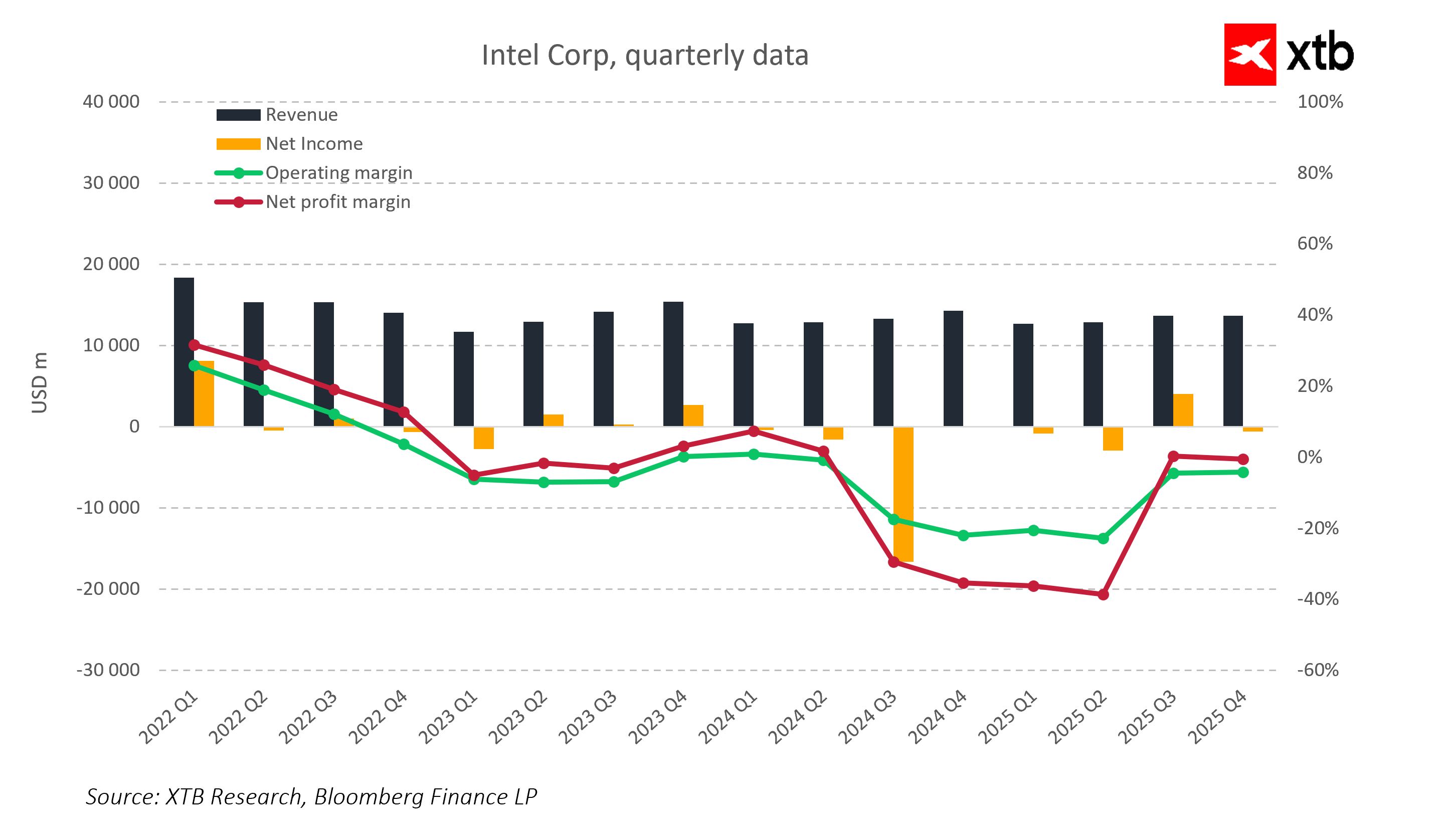

Nevertheless, Intel's latest quarterly results paint a mixed picture of the company's condition. On the one hand, the company surprised positively, exceeding analysts' expectations in terms of both revenue and profits, which suggests operational improvement in selected segments and the effectiveness of restructuring measures. On the other hand, management decided to lower its full-year forecasts, indicating that competitive pressure and demand uncertainty remain a serious challenge. It is the lowered guidance, rather than the results themselves, that is dampening investor enthusiasm and limiting short-term optimism about the stock.

Current events show the company undergoing a phase of thorough restructuring and strategic investments. On the one hand, there are positive signs in the form of new products and better-than-expected quarterly results, but on the other hand, lowered forecasts and the long-term nature of key initiatives, such as the partnership with SoftBank, clearly indicate that Intel is still struggling with market uncertainty. For investors, this means a period requiring careful observation. The key will be the pace at which the company manages to translate new product initiatives and strategic partnerships into sustainable revenue growth and improved margins, which could ultimately translate into a more stable stock valuation.

Dailu summary: Sell-off on Wall street 📉 Bitcoin and Ethereum extend downfall in panic

Software stocks in panic mode 📉Will Anthropic AI disrupt tech valuations?

US100 loses 2% 📉

US Open: US100 slides 0.5% under pressure from IT sector 📉ServiceNow drops 6%

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.