Picking a winning stock is not an easy task. It requires multiple steps to do, from downloading data to analysing it. As the investing universe gets bigger, the amount of work can become overwhelming at some point. Moreover, it’s worth remembering that psychological bias is always a significant factor in such analyses. We took a different approach and used an algorithm that is completely emotion-free and based only on historical data.

We collected data for over 700 S&P 500 members from the past 30 years and for every stock we calculated over 80 fundamental indicators such as P/E, Dividend Yield, P/B etc. Then, we selected the winners from the past and took a closer look at them – our goal was to find a common pattern, features of a potential winner. To achieve this, our model analysed stocks with the highest rates of return from the past and eventually gave us 10 indicators that we should look at while picking a potential winner.

Kezdjen befektetni még ma, vagy próbálja ki ingyenes demónkat

SZÁMLANYITÁS Mobil app letöltése Mobil app letöltéseAmong these indicators, the ones that stand out the most are dividend yield and net debt to equity ratio, which were below average in case of winners. There was another strong trend - winners appeared to have much better results when it comes to revenue growth, 3-year compound annual growth rate and cash coverage ratio compared to the index average.

This set of indicators seems to reflect a “common-sense approach”, where winners should be characterized by high sales and revenue growth, as well should have low debt levels, which reduces the risk of investment.

This analysis led us to picking 10 companies that may turn out to be winners within the near future. Below we briefly present each of the stocks selected by the model.

Fortinet (FTNT.US) - Cybersecurity

Fortinet is one of the global leaders in cybersecurity industry. The company not only designs and produces software solutions, but also manufactures hardware products and provides cybersecurity services. COVID-19 pandemic turned out to be a great opportunity for Fortinet as a lot of employees switched to home office and demand for company's products increased. Revenue increased 20% in 2020, to $2.6 billion while net income increased almost 50% compared to the previous year. In late-2020 Fortinet acquired Panopta, a company offering automated management of an enterprise network, including servers, devices and databases among others. Thanks to that, Fortinet will be able to provide new, better solutions for their clients.

Source: xStation5

Source: xStation5

Apple (AAPL.US) – Computer hardware and software

Apple needs no introduction. It is one of the most valuable businesses in the world. The company has released multiple successful, cutting – edge products last year, which can be a great sign for investors. In late 2020, Apple released the first Macbook with their own M1 chip. It performs surprisingly good compared benchmarks, and has a scope to change the entire market of consumer electronics. Apple’s net revenue has been stable for the last five years, with some slight fluctuations, and the net income has increased by $2.2 billion to $57.4 billion in 2020. The company constantly tries to be ahead of the competition and R&D spending increased in 2020 to help secure leader position.

Source: xStation5

Source: xStation5

Autodesk (ADSK.US) - Software

Autodesk is a global leader in 3D Design and engineering software and services, and among its product portfolio one can find applications such as AutoCAD, 3ds Max or Maya. In fiscal 2021, Autodesk acquired Spacemaker, provider of cloud – based software supported by AI, which goal is to help architects and urban designers make faster design decisions. What’s more, the company has recently acquired Innovyze, producer of innovative software for designing water infrastructure, which will help Autodesk enhance its product portfolio. Architecture, Engineering and Construction segment is generating more than 40% of Autodesk’s revenue, which has increased by 86% over the past few years. Elevated demand for real estate is a promising sign for Autodesk as its software plays a crucial role in construction process.

Source: xStation5

Source: xStation5

NVIDIA Corporation (NVDA.US) - Graphics Processors and Chips

NVIDIA Corp. designs and develops graphics processors and related software. Over 60% of sales comes from its Graphics segments, which includes GeForce GPUs for gaming. The other 40% of sales is from the Compute & Networking segment, which includes Data Center platforms and systems for AI and accelerated computing. Recently, NVIDIA has launched GeForce NOW – game streaming service, which has the potential to significantly increase the company's revenue. Due to increased demand for graphics cards resulting from crypto mining, their prices have skyrocketed. New CMP Chips from NVIDIA, designed exclusively for mining, could become a new source of profit and help settle down the prices. Over the past year the company’s revenue has increased 53% to $16.7 billion, and the net income increased to $4.3 billion.

Source: xStation5

Source: xStation5

Advanced Micro Devices (AMD.US) - Graphics Processors and Chips

AMD is widely known for designing and producing highly reliable processors and graphics cards, but just a few years ago the company was on the edge of bankruptcy. Change of CEO and introduction of new Ryzen products have caused enormous stock price growth and strengthened the company's position compared to Intel. The stock price has exploded from 2015-2016 levels. Company revenue grows successively and it seems that this trend can be maintained. AMD's revenue in 2020 has grown by 45% compared to 2019 and their net income increased by more than 150%. Gaming market is continuing to grow and AMD is a big part of it.

Source: xStation5

Source: xStation5

Adobe (ADBE.US) - Software

Adobe is one of the top providers of computer software products and technologies. It’s known for a wide variety of brands, but the most recognized ones are Acrobat, Photoshop, Illustrator and Premiere. The financial data for Q1 2021 and the previous quarters shows steady and sustainable growth of revenue, which is not a surprise given that Adobe products are being constantly improved and don’t have any significant competitors. The stock is setting new all time highs, which also shows the confidence that investors place in the company.

Source: xStation5

Source: xStation5

Home Depot (HD.US) - Retailing

Home Depot is a home improvement retailer that sells building materials and home improvement products. It owns over 2,200 stores across North America. Multiple lockdowns didn’t have a significant impact on Home Depot. Company set up its own e-commerce platform to adapt to difficult pandemic period. Nevertheless, lifting of Covid-19 restrictions may have a positive impact on the company as a lot of customers prefer to see and judge home improvement products before buying them (what is not the case for e-commerce sales. Home Depot looks to remain one of the leading home material retailers in the US. The company has been experiencing a steady growth in revenue as well as earnings per share during the past 5 years.

Source: xStation5

Source: xStation5

Teradyne (TER.US) – Automated Test Equipment

Teradyne designs and manufactures automated test equipment, systems for semiconductors and industrial robots. Their customers are mostly equipment manufacturers. The semiconductor test equipment industry is expected to grow at a compound annual rate of over 3% during the next 5 years. Teradyne is one of two companies that dominate this industry and has a high growth potential. The company has also targeted another market – Collaborative Robots, or Cobots, that are robots intended to facilitate human – robot interaction. This market is expected to grow rapidly within the coming years due to increased automation in companies, and it may turn out to be another great opportunity for Teradyne.

Source: xStation5

Source: xStation5

ServiceNOW (NOW.US) - Software

ServiceNOW provides a platform for automating IT, employee and customer workflows. It delivers its software via the internet, using easy to use interfaces. Just as it is the case with other software providers, ServiceNOW benefitted from pandemic restrictions and increase in work-from-home The company has been experiencing a steady growth of revenue over the past couple of quarters and it looks like there is a potential for this trend to continue. Company continuously increases its R&D spending to remain competitive. Moreover, ServiceNOW has recently acquired Lightstep, a startup that provides software for application performance monitoring.

Source: xStation5

Source: xStation5

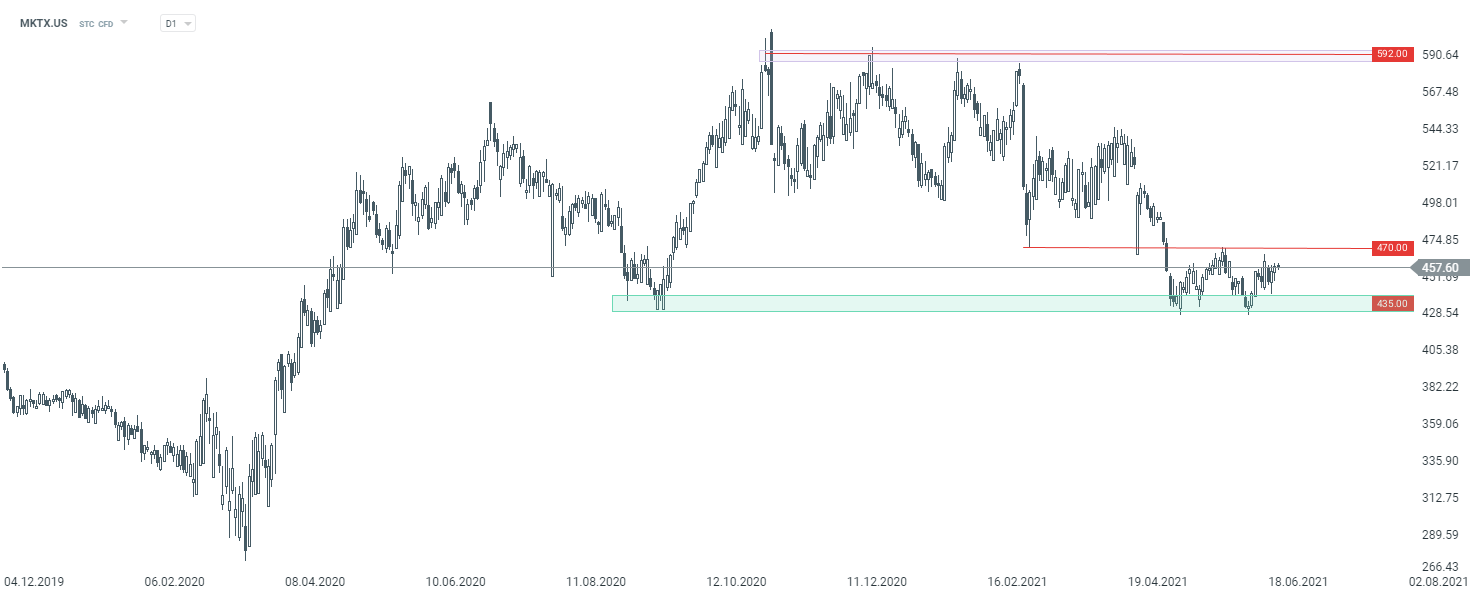

MarketAxess (MKTX.US) – Financial Services

MarketAxess offers an electronic platform for institutional clients trading US corporate, high-yield and emerging market bonds. Over 90% of the company’s revenue comes from commissions. The company has been experiencing a steady year-over-year growth of revenue over the past couple of years. Its strategy is to broaden the client base in its existing markets and increase its presence outside of the United States. There is progress in the latter as MarketAxess completed acquisition of Regulatory Reporting Hub in 2020. Regulatory Reporting Hub was the regulatory reporting business of Deutsche Börse Group and the acquisition will help strengthen and expand MarketAxess' position in Europe.

Source: xStation5

Source: xStation5

Ezen tartalmat az XTB S.A. készítette, amelynek székhelye Varsóban található a következő címen, Prosta 67, 00-838 Varsó, Lengyelország (KRS szám: 0000217580), és a lengyel pénzügyi hatóság (KNF) felügyeli (sz. DDM-M-4021-57-1/2005). Ezen tartalom a 2014/65/EU irányelvének, ami az Európai Parlament és a Tanács 2014. május 15-i határozata a pénzügyi eszközök piacairól , 24. cikkének (3) bekezdése , valamint a 2002/92 / EK irányelv és a 2011/61 / EU irányelv (MiFID II) szerint marketingkommunikációnak minősül, továbbá nem minősül befektetési tanácsadásnak vagy befektetési kutatásnak. A marketingkommunikáció nem befektetési ajánlás vagy információ, amely befektetési stratégiát javasol a következő rendeleteknek megfelelően, Az Európai Parlament és a Tanács 596/2014 / EU rendelete (2014. április 16.) a piaci visszaélésekről (a piaci visszaélésekről szóló rendelet), valamint a 2003/6 / EK európai parlamenti és tanácsi irányelv és a 2003/124 / EK bizottsági irányelvek hatályon kívül helyezéséről / EK, 2003/125 / EK és 2004/72 / EK, valamint az (EU) 2016/958 bizottsági felhatalmazáson alapuló rendelet (2016. március 9.) az 596/2014 / EU európai parlamenti és tanácsi rendeletnek a szabályozási technikai szabályozás tekintetében történő kiegészítéséről a befektetési ajánlások vagy a befektetési stratégiát javasló vagy javasló egyéb információk objektív bemutatására, valamint az egyes érdekek vagy összeférhetetlenség utáni jelek nyilvánosságra hozatalának technikai szabályaira vonatkozó szabványok vagy egyéb tanácsadás, ideértve a befektetési tanácsadást is, az A pénzügyi eszközök kereskedelméről szóló, 2005. július 29-i törvény (azaz a 2019. évi Lap, módosított 875 tétel). Ezen marketingkommunikáció a legnagyobb gondossággal, tárgyilagossággal készült, bemutatja azokat a tényeket, amelyek a szerző számára a készítés időpontjában ismertek voltak , valamint mindenféle értékelési elemtől mentes. A marketingkommunikáció az Ügyfél igényeinek, az egyéni pénzügyi helyzetének figyelembevétele nélkül készül, és semmilyen módon nem terjeszt elő befektetési stratégiát. A marketingkommunikáció nem minősül semmilyen pénzügyi eszköz eladási, felajánlási, feliratkozási, vásárlási felhívásának, hirdetésének vagy promóciójának. Az XTB S.A. nem vállal felelősséget az Ügyfél ezen marketingkommunikációban foglalt információk alapján tett cselekedeteiért vagy mulasztásaiért, különösen a pénzügyi eszközök megszerzéséért vagy elidegenítéséért. Abban az esetben, ha a marketingkommunikáció bármilyen információt tartalmaz az abban megjelölt pénzügyi eszközökkel kapcsolatos eredményekről, azok nem jelentenek garanciát vagy előrejelzést a jövőbeli eredményekkel kapcsolatban.